Republicans Unveil Plan to Raise Defense Spending Over $1 Trillion

Happy Monday! Canadian voters are choosing a new government today in an election that may well be determined by ... U.S. President Donald Trump. The rising tide of Canadian anger at Trump, his trade war and his repeated insistence that Canada should become the 51st U.S. state - he said it again today -has helped Mark Carney's Liberal Party to a remarkable resurgence. Election results should be known within hours.\n\nHere's what else is going on.

Republicans Unveil Plan to Raise Defense Spending Over $1 Trillion

Congress is back from a two-week recess and Republicans will be working to pull together the details of their massive budget reconciliation bill - the "one big, beautiful bill" that includes the bulk of President Donald Trump's legislative agenda, including a permanent extension of the 2017 tax cuts set to expire at the end of the year.

Republicans on the House and Senate Armed Services Committees on Sunday unveiled details for their portion of the plan, a measure that would increase Pentagon spending by $150 billion, lifting the total defense budget to more than $1 trillion for the first time. See the full text here.

The $150 billion boost is in line with the amount sought by Senate Republicans and $50 billion more than the GOP budget resolution called for on the House side, marking a win for defense hawks. The additional funding includes:

-

$34 billion for shipbuilding and improved infrastructure in the maritime industrial base;

-

$25 billion for President Donald Trump's proposed "Golden Dome" national missile-defense shield;

-

$21 billion to restock and expand production of munitions;

-

$14 billion to scale up production of new technologies and "expedite delivery of low-cost, attritable weapons systems" to fighters;

-

$13 billion for modernization of the nuclear triad and infrastructure needed for nuclear weapons manufacturing;

-

$12 billion to "enhance military readiness," including infrastructure and military depots and shipyards;

-

$11 billion for military operations in the IndoPacific region, including improvements to Taiwan's military defense capabilities;

-

$9 billion to improve quality of life for service members, including housing, healthcare and assistance for families;

-

$7 billion to speed delivery of next-generation fighter jets and drones.

-

$5 billion for border enforcement;

-

$400 million for investments in IT and other systems to help the Defense Department pass required audits.

Republicans said the extra funding was sorely needed to reverse a decline in the U.S. defense industrial base, arguing that defense spending as a share of the economy has dropped to its lowest levels since before World War II. "America's deterrence is failing and without a generational investment in our national defense, we will lose the ability to defeat our adversaries," House Armed Services Committee Chair Mike Rogers said in a statement. "With this bill, we have the opportunity to get back on track and restore our national security and global leadership."

The House Armed Services panel is scheduled to consider the legislation tomorrow morning. The measure represents the first part of the larger bill that will be pieced together with portions from other committees. At least four other House committees are scheduled to consider their portions of the legislation this week. The House Judiciary Committee on Monday released the text of its bill, including a $175 billion funding boost and some notable immigration policy changes, ahead of a planned Wednesday markup.

House Speaker Mike Johnson wants to finalize the broader budget reconciliation bill and pass it in his chamber by Memorial Day. Senate Majority Leader John Thune told reporters Monday that the timeline in the Senate would be determined by the deadline for raising the debt ceiling, a date likely to be over the summer. Republicans plan to raise the debt limit as part of their bill. Treasury Secretary Scott Bessent told reporters that the hope is to have the tax legislation done by July 4.

Democrats have warned that the budget reconciliation bill as a whole will cut programs that Americans rely on to pay for tax cuts that overwhelmingly benefit the wealthy.

Rep. Adam Smith, the top Democrat on the Armed Services Committee, said in a statement that, while there may be bipartisan backing for some increases in defense spending and support for military members and their families, the investments should be made as part of the normal annual appropriations process. He criticized the special process Republicans are using.

"This legislation would increase defense spending by $150 billion through a partisan budget reconciliation gimmick," he said. "It will be paid for by devastating cuts that can only come from critical programs like Medicaid, the Supplemental Nutrition Assistance Program (SNAP), and student loan and grant programs at the Department of Education. And to add insult to injury, this will all be part of a legislative package that provides $4.5 trillion in tax cuts for the wealthy but does nothing to lower costs for American families."

The bottom line: The defense portion of the reconciliation bill is one of the easy parts. The sections that will be more contentious within the party, like the details of the tax cuts and potential healthcare spending cuts, are still ahead. The next four weeks promise to be busy, - and critical for budget watchers.

Trump Again Floats the Impossible Idea that Tariffs Could Eliminate Income Taxes

President Trump on Sunday again raised the idea that his tariffs might generate enough revenue to eventually allow income taxes to be eliminated, at least for some people. Spoiler alert: That math doesn't work.

"We're going to make a lot of money, and we're going to cut taxes for the people of this country," Trump told reporters before flying back from Pope Francis's funeral in Rome. "It'll take a little while before we do that, but we're going to be cutting taxes, and it's possible we'll do a complete tax cut, because I think the tariffs will be enough to cut all of the income tax."

Trump made a similar point in a post on his Truth Social site: "When Tariffs cut in, many people's Income Taxes will be substantially reduced, maybe even completely eliminated. Focus will be on people making less than $200,000 a year. Also, massive numbers of jobs are already being created, with new plants and factories currently being built or planned. It will be a BONANZA FOR AMERICA!!! THE EXTERNAL REVENUE SERVICE IS HAPPENING!!!"

The tariffs might be happening, but as CNN reports today, to fully replace income taxes they "may need to be set so high that they quadruple the price of everything that comes into the country from abroad." That would destroy consumer demand, wiping out much of the potential revenue.

The bottom line: Trump keeps saying this, so we'll keep pointing out that it's simply not realistic to replace roughly $2.5 trillion in annual revenues from individual income taxes with tariff revenue generated by taxing about $3.3 trillion in imported goods.

Polls of the Day: More Trouble for Trump

We told you last week that poll ratings of President Trump's performance are plunging, including on the economy, an area that had traditionally been a strength. That trend has continued, as a new CNN poll finds that Trump's approval rating is at 41% - "the lowest for any newly elected president at 100 days dating back at least to Dwight Eisenhower" and lower than Trump's first term. The results are income with the 39% approval Trump has in a poll from ABC News, The Washington Post and Ipsos. ABC News on Monday said the results are "the lowest 100-day job approval rating of any president in the past 80 years."

Particularly notable in the ABC News/Washington Post/Ipsos poll is the negative opinion of Trump's handling of the economy, an area that was seen as a strength, with 72% of respondents saying they think his policies are very or somewhat likely to cause a recession in the near term. Nearly three-quarters (73%) said the economy is in bad shape, and more than half (53%) said the economy has gotten worse since Trump took office.

Delivering more bad news for the White House, the new poll from CNN found that 59% of Americans say Trump's policies have worsened economic conditions in the country, up from 51% last month and roughly equal to the worst numbers of Joe Biden's presidency (58%) on the same question. Six in 10 Americans now say that Trump has raised the cost of living in their community, and 69% say that they see a recession in the next year as very or somewhat likely.

Nearly the same percentage says that they don't believe Trump has a clear strategy for his tariffs.

Trump lashed out at those polls on his social media platform Monday, calling them "FAKE POLLS FROM FAKE NEWS ORGANIZATIONS" and "TRULY THE ENEMY OF THE PEOPLE!"

Still, it looks like Trump's supporters are sticking with him for the most part. In the ABC News/Washington Post/Ipsos poll, 94% of those who voted for him in November said it was the right thing to do, and just 6% said they now regret their vote.

Trump Tariffs Could Trigger a 'Voluntary' Recession This Summer, Economist Warns

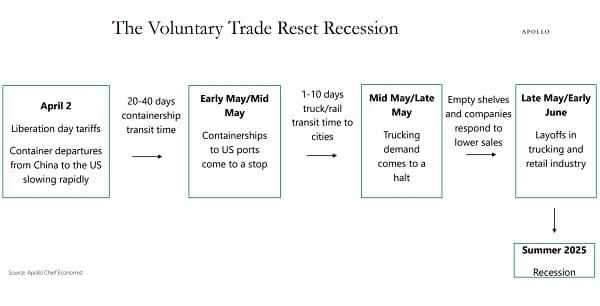

In ananalysisreleased this past weekend, Torsten Slok, chief economist at Apollo Global Management, warned that the U.S. economy could be just a few months away from a sharp slowdown caused by the trade war initiated by President Donald Trump.

"A trade war is a stagflation shock," Slok wrote, and a recessionary shockwave is already in motion (see his chart below).

Slok said a slowdown in the flow of container ships from China - a reaction to Trump's massive increase in tariffs on goods imported from China - is already evident in shipping data and will result in a huge decrease in activity at U.S. ports. That will cause a sharp reduction in the demand for trucking and delivery services, while producing empty shelves for some items at stores around the country. That in turn will result in layoffs at both trucking firms and retailers by early summer, tipping the economy into recession.

Major corporations are already starting to trim their earnings forecasts, but it's small and medium-sized businesses that will take the brunt of the downturn. "Expect ships to sit offshore, orders to be canceled, and well-run generational retailers to file for bankruptcy," Slok said.

It's not too late to avoid a recession, Slok says, since Trump could reduce tariffs even as he negotiates new trade agreements with China, as well as Canada and Mexico. "But, the bottom line," Slok wrote, is this: "If the current level of tariffs continues, a sharp slowdown in the U.S. economy is coming."

Fiscal News Roundup

- House GOP Unveils Billions for Defense and Border Programs in First Piece of Trump Agenda – CNN

- Republicans Unveil Bill to Lift Defense by $150B – Inside Defense

- July 4 Is the GOP's New Target for Megabill, Bessent Says – Politico

- Debt Cliff Is 'Hard Deadline' for GOP Megabill, Thune Says – Politico

- Treasury Secretary Bessent Says It's Up to China to De-Escalate Trade Tensions – CNBC

- Trump Floats Income Tax Cut to Ease Tariff Impact – The Hill

- House Republicans Still Debating How to Pull Back on Medicaid Expansion – Politico

- Poll: Trump's Approval at 100 Days Lower Than Any President in at Least Seven Decades – CNN

- Trump's 'Buoyant' Trade Warrior Flexes His Power Over Global Business – New York Times

- Former Trump Economic Adviser: Tariffs Are 'Highly Regressive,' Will Impact Lower Class – The Hill

- Federal Workers in Charge of Trump Terminations Also Firing Themselves – New Republic

- Tariffs on Chinese-Made Machinery Drive Up Costs for U.S. Manufacturers – Washington Post

- Trump Lashes Out Against "Fake Polls" as His Approval Ratings Sink – Axios

- US Navy Loses $60 Million Jet at Sea After It Fell Overboard From Aircraft Carrier –

Views and Analysis

- Why Trump's Economic Disruption Will Be Hard to Reverse – Patricia Cohen, New York Times

- How to Trash an Economic Superpower in 100 Days – Allison Morrow, CNN

- Trump's 100 Days of Economic Damage – Harry J. Holzer, The Hill

- Trump Is Softening His Tariff Talk. But the Damage May Already Be Done – David L. Lynch and Jeff Stein, Washington Post

- I'm a Conservative Economist. Here Are 6 Reasons Trump's Plans Won't Work – Jessica Riedl, Politico

- Trump Says He'll Eliminate Income Taxes. There's a Problem With That – David Goldman and Matt Egan, CNN

- The US Is Already Losing the New Cold War to China – Hal Brands, Bloomberg

- Trump Is Laying a Potentially Deadly Trap for the U.S. Auto Industry – Brian Deese, New York Times

- Trump's Agenda Is Still Undecided – David Dayen, American Prospect

- White House Tech Bros Are Killing What Made Them (and America) Wealthy – David Singer, New York Times

- Dollar Collapse: The Crisis Is No Longer Just Theoretical – Vivekanand Jayakumar, The Hill

- The High Cost of the Fed's Mission Creep – Kevin Warsh, Wall Street Journal

- The Student Loan Bubble Is About to Pop – Preston Cooper, Washington Post

- The 'Generation Trump' Thesis Is Looking a Lot Shakier – David Wallace-Wells, New York Times

- Raising the Top Income Tax Rate Would Offset Economic Benefits of TCJA Individual Permanence – Garrett Watson, Tax Foundation

- Trump Is Crippling the Tax Police – Matthew Yglesias, Slow Boring

- 'I Run the Country and the World' – Ashley Parker and Michael Scherer, The Atlantic