President Trump has claimed that tariffs will generate enormous revenues for the country, so much so that they could potentially replace the income tax and pay off the national debt. “America is going to be very rich again, very soon,” he said earlier this month as he extolled the virtues of 19th-century fiscal policies.

Economists have expressed serious doubts about the benefits of Trump’s trade war, while pointing out that tariffs are essentially a tax on imports paid for by U.S. firms and consumers, so not really a source of new wealth. But the basic idea — that higher tariff rates mean higher tariff revenues — is sound, at least up to a point, and the latest revenue data from the Treasury is starting to bear that out.

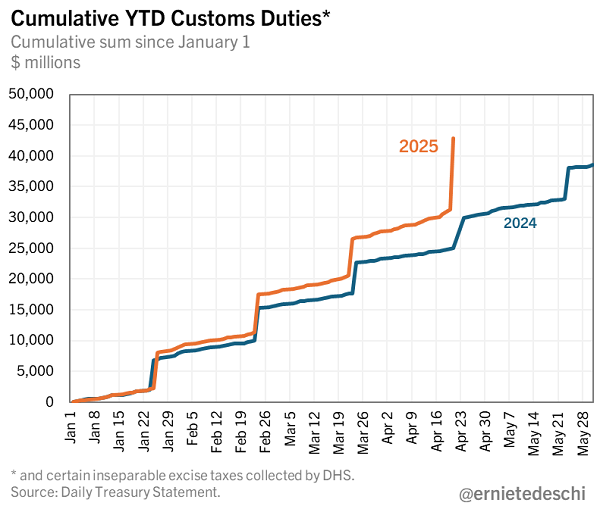

Ernie Tedeschi, director of economics at the Yale Budget Lab, shared a chart on social media Thursday that indicates that tariff revenue is starting to move noticeably higher. “Monday's custom duty deposit to Treasury from CBP was $11.7 billion, almost $7 billion higher than the April 2024 deposit,” Tedeschi wrote, referring to U.S. Customs and Border Protection, which collects tariffs at ports of entry. “Suggests that tariffs were biting in April in a way they weren't in February or March.”

We don’t know how much higher that number could go, but $7 billion more per month would translate to about $84 billion a year — far from the amount needed to replace the income tax or make a dent in the national debt. And if the trade war continues, the number could actually fall as imports drop dramatically, wiping out any revenue gains.

Based on preliminary data, Tedeschi estimated that the effective tariff rate for April would be about 5.5%. If that holds, it would be the highest tariff rate since 1972.