While the world watches markets melt down and trillions of dollars in value evaporate because of President Donald Trump’s trade war, congressional Republicans are pushing ahead with the rest of Trump’s agenda. The Senate adopted a revised budget framework in the wee hours of Saturday morning, voting 51-48 to advance the process the GOP is using to enact a package of tax and spending cuts combined with border security, defense and energy priorities.

The resolution aims to make permanent Republicans’ 2017 tax cuts and allows for $1.5 trillion in additional tax cuts. It also would raise the debt limit by $5 trillion. House GOP leaders want to vote on the measure this week — before lawmakers leave for a two-week holiday break — but the plan faces resistance from conservatives on several fronts.

Two Republican senators voted against the plan: Sen. Susan Collins of Maine, the chair of the Appropriations Committee, opposed it because of concerns about possible cuts to Medicaid, one of the ways Republicans may offset the cost of extending their 2017 tax cuts. “I’m concerned about the instruction to the House Committee for $880 billion — the Energy and Commerce Committee in the House, which has jurisdiction over Medicaid, because I don’t see how you can get to that amount without cutting Medicaid benefits,” Collins told reporters.

Some House conservatives quickly came out against the plan, concerned that it might not result in significant spending cuts. The resolution provides differing instructions for the House and Senate. It requires Senate committees to come up with just $4 billion in spending cuts, far less than the minimum of $1.5 trillion in cuts required on the House side. Senators had pushed for that lower floor, insisting that it would give them the flexibility they need to move ahead while also saying that they continue to target steeper cuts. The Senate also used an accounting tactic called a “current-policy baseline” that would zero out the official cost of some $4 trillion in renewed tax cuts.

Both chambers must adopt the same budget outline to unlock the special reconciliation process that would allow Republicans to bypass the Senate’s 60-vote threshold and enact their plan with a simple majority.

House Budget Committee Chairman Jodey Arrington, a Texas Republican, slammed the Senate resolution after the weekend vote: “The Senate response was unserious and disappointing, creating $5.8 trillion in new costs and a mere $4 billion in enforceable cuts, less than one day’s worth of borrowing by the federal government. It also sets a dangerous precedent by direct scoring tax policy without including enforceable offsets.”

Hardline Rep. Chip Roy said in posts on X that the Senate plan didn’t do enough to force spending cuts and he would vote against it. “The Senate is making very clear it has little intent to reduce spending,” he wrote.

Rep. Andy Harris of Maryland, the chairman of the House Freedom Caucus, told Fox News that he’d vote against the resolution at this point. "I still think that we should just ask the Senate to begin crafting their reconciliation bill, and then if they deliver on their promise of deficit reduction, then I'm fine with their budget resolution," he said.

Some Republicans from blue states have also rejected a proposal to raise the cap on the deductibility of state and local taxes to $25,000 from $10,000. "$25,000 is woefully insufficient and does not provide the needed tax relief our constituents deserve,” Rep. Mike Lawler of New York wrote on X. “Any tax bill that does not fix the cap on SALT will not have my vote.”

Rep. Nick LaLota, also of New York, had a similar message: “$25k is not a serious offer and would not result in a deal.”

Raising the limit would be expensive, though, reportedly costing hundreds of billions of dollars for each $10,000 increase, making it harder to find the savings that fiscal hawks demand. Critics also note that lifting the limit would primarily benefit high-income earners.

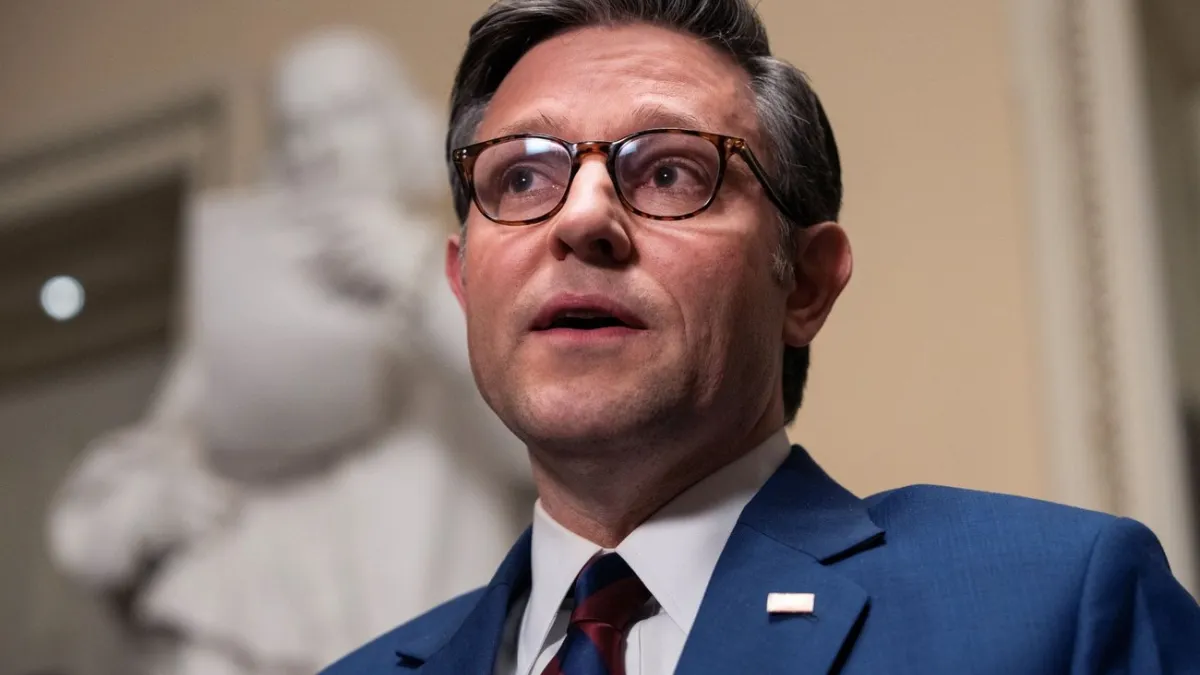

In a letter to colleagues on Saturday, House Speaker Mike Johnson kicked off what’s likely to be an intense wrangling effort. He called for unity and reminded lawmakers that the Senate-passed blueprint did not change the House reconciliation instructions that were approved in February.

“Adopting the Senate’s amendment to the House resolution will allow us to finally begin the most important phase of this process: drafting the reconciliation bill that will deliver on President Trump’s agenda and our promises to the American people,” he wrote, adding that the differences in the Senate plan would not prevent House Republicans from achieving their goals. “We have and will continue to make it clear in all discussions with the Senate and the White House that—in order to secure House passage—the final reconciliation bill must include historic spending reductions while protecting essential programs.”

Johnson said that once the House adopts the Senate’s amended budget resolution, committees will start work on the reconciliation bill, with a goal of passing the “one big, beautiful bill” by Memorial Day.

“With the debt limit X-date approaching, border security resources diminishing, markets unsettled, and the largest tax increase on working families looming, time is of the essence,” he added. “As President Trump said, ‘Every Republican, House and Senate, must UNIFY.’”

The bottom line: Republicans hold a slim 220-213 majority in the House, meaning they can only afford to lose a few votes — and that there’s likely to be plenty of arm-twisting and negotiating required before the vote, expected Wednesday. But will House conservatives really buck Trump to protest this plan at a time when they are eager to show progress and build some momentum?