Three years ago, Congress provided the IRS with billions in extra funding to revitalize the agency, but that vast majority of that money has either been rescinded or gone unspent, according to a new report from the Treasury Inspector General for Tax Administration, known as TIGTA.

The Inflation Reduction Act signed into law by President Joe Biden in 2022 included $79.4 billion in supplemental funding for the IRS budget over a decade — money that was intended to boost staffing by as much as 87,000 following a decade of decline, improve taxpayer service, modernize technology and foster a renewed focus on making corporations and high-income tax cheats pay what they owe.

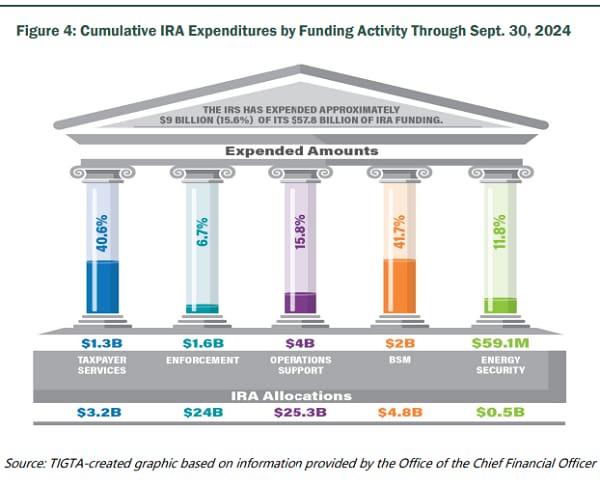

Republican lawmakers pushed back against that effort from the start and won a $21.6 billion recission as part of a deal to raise the federal debt limit, reducing funding to $57.8 billion, available through September 30, 2031. Another $20.2 billion in funding slated for enforcement was frozen as part of the government funding deal for the current fiscal year, leaving $37.6 billion, or a bit less than half of the original amount, although the fate of that frozen sum is not yet certain.

According to the TIGTA report, the IRS has spent just $9 billion of the funds Congress has made available. The chart below shows the areas in which the money has been spent. The largest amount — $4 billion — has been spent on operations support, although that number represents just 15.8% of the total Congress made available in that area. The second largest allocation area, enforcement, has seen $1.6 billion in spending — just 6.7% of the $24 billion Congress has provided, and just 3.4% of the $46 billion provided in the initial allocation.

As the report notes, not all of the $9 billion in extra funding has been used to boost the agency, as intended. Instead, some of the supplemental funds have been used for general operating expenses rather than new projects and enhancements, mainly because Congress froze appropriations at 2023 levels in 2024, failing to keep pace with inflation.

The bottom line: At its current pace, the IRS will not spend all of its funding boost by 2031, even as the future of that funding stream is threatened by Republican lawmakers seeking to reduce or eliminate it entirely. With the IRS estimating that a sustained period of investment could produce more than $850 billion in extra revenue over the next decade, that could be bad news for the budget deficit and national debt.