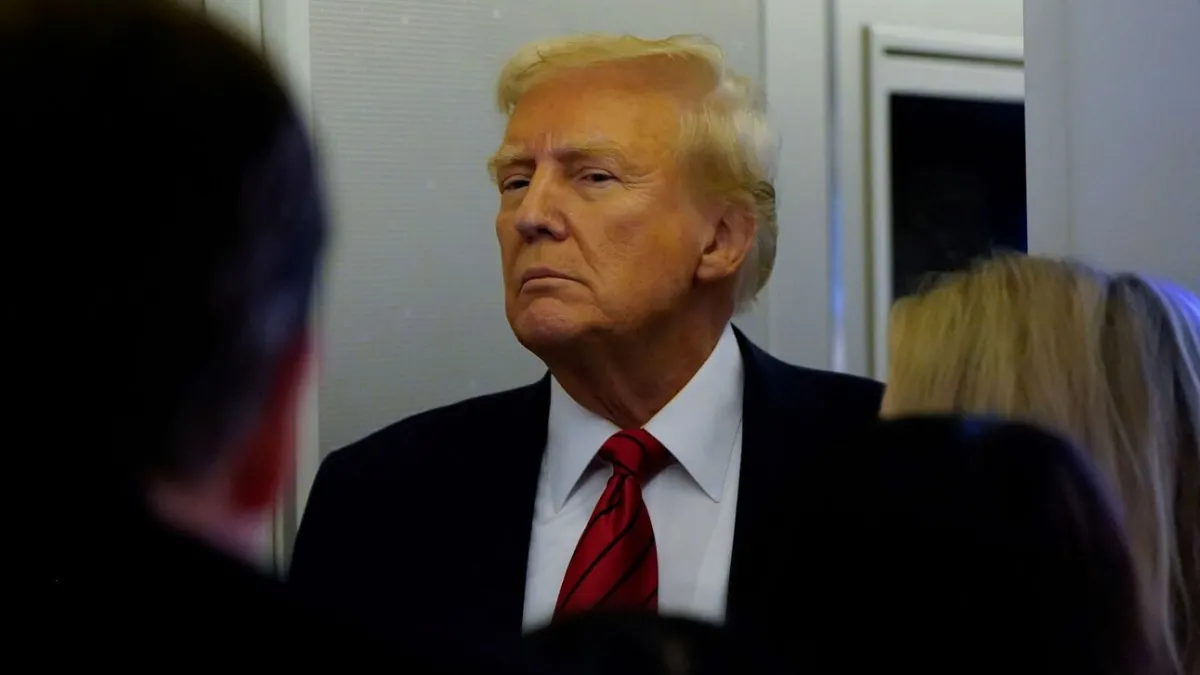

Despite a stock market reeling from a rapidly escalating trade war and growing worries about stumbling into an avoidable recession, President Trump on Tuesday threatened to impose a 50% tariff on Canadian steel and aluminum products starting Wednesday - only to back off the threat later in the day.

Following another down day for stocks, the White House said the previously announced 50% tariff on Canadian metals would instead revert to a planned 25% tariff on steel and aluminum imported from all trading partners, taking effect at midnight Wednesday. Canada is the largest supplier of foreign steel and aluminum to the U.S.

Trump's initial threat came in response to the announcement by Ontario Premier Doug Ford that would impose a 25% tax on electricity sold by Canadian producers to American consumers. However, Ford suspended the export tax after U.S. Commerce Secretary Howard Lutnick agreed to trade talks.

"With any negotiation that we have, there's a point that both parties are heated and the temperature needs to come down," Ford told reporters Tuesday afternoon.

Trump was anything but cool earlier in the day as he expressed outrage about the threatened Canadian tariff - and surprise that the nation's northern neighbor provides any power to the U.S. in the first place.

"Why would our Country allow another Country to supply us with electricity, even for a small area? Who made these decisions, and why?" he wrote on his social media platform. "And can you imagine Canada stooping so low as to use ELECTRICITY, that so affects the life of innocent people, as a bargaining chip and threat? They will pay a financial price for this so big that it will be read about in History Books for many years to come!"

Stocks plunge again: Stocks whipsawed during the day as investors contemplated the worsening trade war. The Dow Jones Industrial Average closed down 1.1%, or 478 points, and the S&P 500 was down 0.75%, or 42 points.

Speaking to reporters at midday, White House Press Secretary Karoline Leavitt dismissed the recent stock market decline - which has wiped out all gains since Trump was elected - as simply a "snapshot in time" and said any problems should be blamed on Trump's predecessor.

"We are in a period of transition from the mess that was created under Joe Biden in the previous administration," Leavitt said. Without providing a clear timeline or any details on how things might play out, Leavitt added that the economic transition will lead to "a golden age of American manufacturing under a businessman and a dealmaker-in-chief in President Donald J. Trump."

The problem for the Trump team is that most economists and investors reject the idea that high tariffs and a trade war will boost the U.S. economy. Nathan Sheets, global chief economist at Citigroup, told The New York Times that the Trump administration's talk about a painful but necessary transition is an attempt to convince Americans that Trump's policies are laying the groundwork for better times ahead. "But the bigger question is, are we really going to get to a better place?" he asked. The answer for him and for most economists is "no," at least not if a trade war is involved.

Still, there are no indications that Trump has changed his mind about the appeal of aggressive tariff use, even if he backed off a bit on Tuesday.

Marc Short, who served as chief of staff to Vice President Mike Pence in Trump's first term, told Bloomberg that the escalating trade war reflects an important change in the second Trump administration. "I think it's dramatically different than the first administration, and I think one of the biggest challenges is markets look at it and say, you know, this is just part of his bluster, right?" he said. "I think markets just assumed it would be the same, that it's just negotiation, and it's not."