Wall Street investors don’t believe that President-elect Donald Trump will fully follow through on some key campaign promises — but they are confident that he will deliver tax cuts.

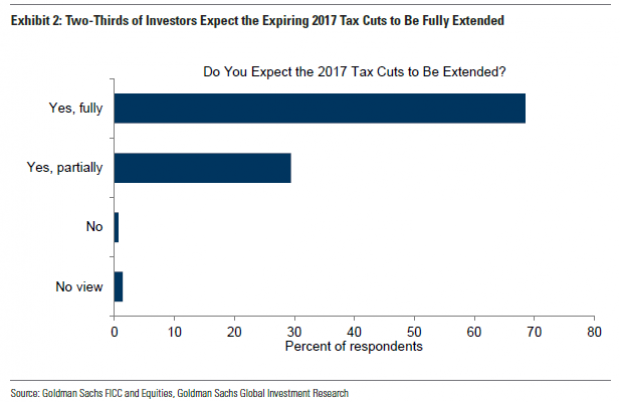

Counting on tax cuts and tariffs: Goldman Sachs’s economic team, led by Jan Hatzius, recently surveyed more than 500 investors to compare their expectations with those of the banks’ own analysts. They found that nearly all investors expect the 2017 Republican tax cuts to be extended, with roughly two-thirds forecasting that all the 2017 cuts will be kept in place and about one-third looking for at least a partial extension (see chart below).

About two-thirds of those surveyed also see some additional personal tax cuts being enacted, and about 60% expect the corporate tax rate to fall, though Goldman’s team notes that could happen in several ways. “Some investors who expect a decline might mean just for manufacturing; others might expect a broad decline in the statutory rate to 20%, which we think is possible; and others might expect a larger decline, which we think is unlikely,” Goldman economists David Mericle and Ronnie Walker wrote in a note to clients.

For their part, Goldman’s economists expect the statutory corporate rate to stay at 21%, with the rate for domestic manufacturers cut to 15%.

Investors also expect Trump to raise tariffs. About 60% say they see Trump boosting tariffs on imports from China and foreign cars, while almost 40% also forecast across-the-board tariffs of 10% or 20% paired with higher tariffs on goods from China. Goldman’s analysts expect Trump to raise tariffs on imports from China by an average of 20 percentage points, with added tariffs on imported cars. “While Trump has also proposed a universal 10-20% tariff on all imports, we see this as a serious risk—we place 40% odds on a universal tariff ultimately being implemented,” Goldman’s economists say.

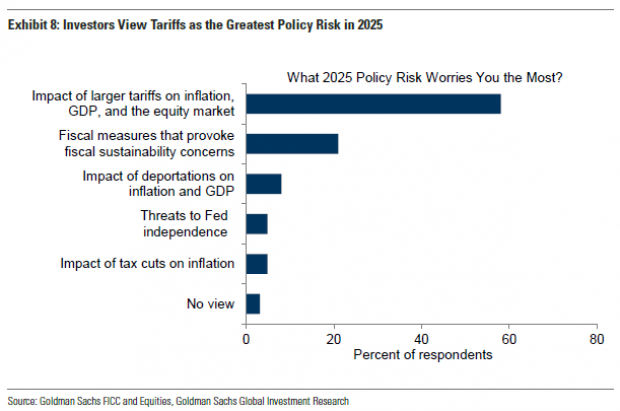

Asked what policies concern them the most, 60% of those surveyed cited larger tariffs, which investors see as spurring higher inflation. Only about 20% pointed to the possibility of policy measures that raise fiscal sustainability fears.

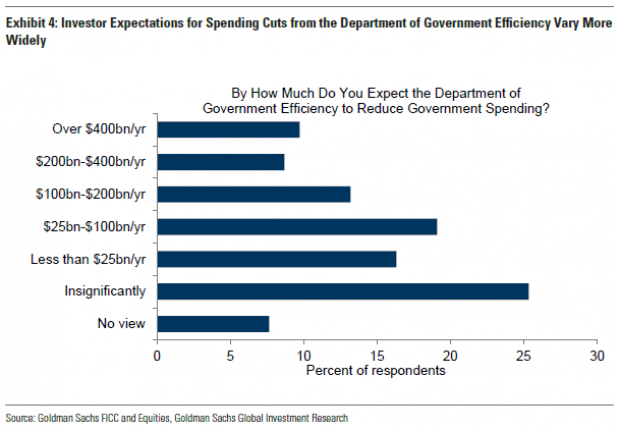

Downgraded expectations for DOGE: Investors are more skeptical about other Trump campaign promises, the survey found. While Elon Musk, as a leader of Trump’s new Department of Government Efficiency, has talked about slashing at least $2 trillion from the federal government’s annual budget of about $6.75 trillion, just 32% of those surveyed by Goldman expect spending cuts of more than $100 billion a year. Another 19% expect cuts of between $25 billion and $100 billion. More than four in 10 investors, 42%, expect cuts to be “insignificant or quite modest.”

The Goldman team still expects federal spending to grow, particularly for defense.

Immigration expected to slow but stay positive: Wall Street also doesn’t believe Trump will be able to fully carry out his promised immigration policy changes, including mass deportations of millions of undocumented immigrants. The survey finds investors still expecting more people to enter the United States than leave it.

Goldman’s analysts say that net immigration to the United States averaged about 1 million people a year before the Covid 19 pandemic and climbed to about 3 million people in 2023 before falling to a rate of roughly 1.75 million lately. About half of survey respondents predict that immigration will slow to a net gain of between half a million and 1 million people a year. And more than 20% of investors expect immigration will stay above the pre-pandemic rate.

“Perhaps surprisingly given the number of headlines and discussions in markets about potential large-scale deportations, only 6% of respondents expect net immigration to turn negative,” Goldman’s analysts write.

They project immigration to fall to about 750,000 people a year in 2025 — “only moderately below the pre-pandemic trend because there are legal and logistical limits to executive action.”