Former President Donald Trump’s proposed tax changes would skew heavily toward the wealthy, according to a new analysis by the left-leaning Institute on Taxation and Economic Policy (ITEP).

Trump has proposed to cut a broad range of taxes while imposing steep tariffs of up to 20% on imported foreign goods — or 60% for goods from China. As we mentioned above, he’s called for extending his 2017 tax cuts, further lowering the corporate tax rate from 21% to 15% and ending taxes on tips, Social Security benefits and overtime pay. He’s also pledged to eliminate the $10,000 cap on the deductibility of state and local taxes, a measure he signed into law as part of the 2017 changes.

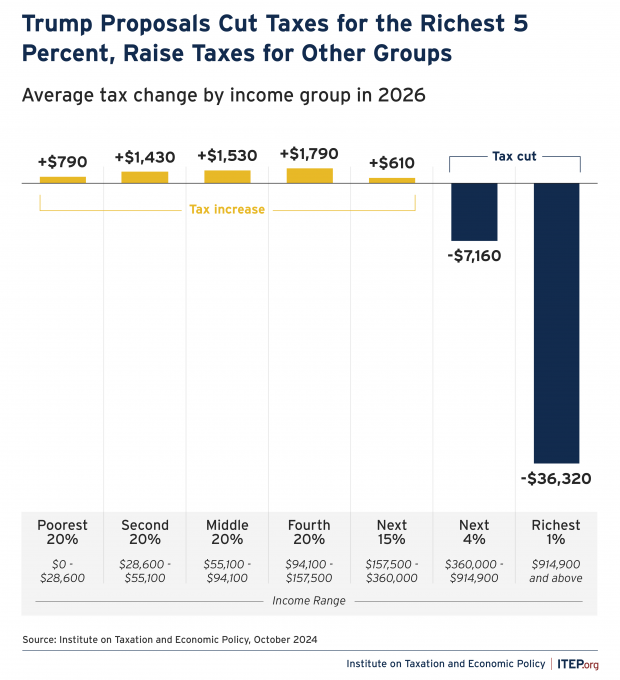

“Taken together, these proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups,” the ITEP report says. It adds: “Measured as a share of income, the tax increases faced by most Americans would fall hardest on working-class families.”

The proposed tariffs are far and away the biggest driver of increased costs for lower-income households. Those tariffs are effectively a tax increase, the report says, and it “would be paid by everyone who makes purchases in the U.S., but it would comprise a smaller share of income for the richest taxpayers than it would for everyone else.”