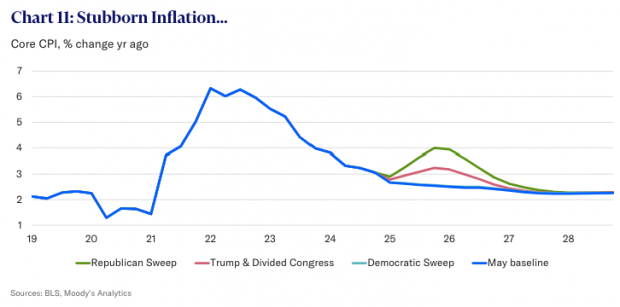

A clean sweep for Donald Trump and Republicans in this fall’s elections would result in higher inflation and weaker economic growth over the next four years relative to a baseline that maintains the status quo, according to economists at Moody’s Analytics.

Exploring the economic implications of the upcoming election, the researchers give a GOP clean sweep scenario — in which Trump wins the White House, the Senate flips to Republican control, and the House remains under Republican majority — a 35% chance of occurring. Under those conditions, Trump is expected to raise tariffs sharply on virtually all imported goods. Higher tariffs would raise costs for businesses and consumers, slowing growth while adding inflationary pressure throughout the economy. The odds of a recession would rise.

Trump is also expected to push for restrictions on immigration and efforts to deport millions of undocumented workers already in the U.S. That would tighten conditions in the labor market, raising wages while causing worker shortages in key industries including food production and housing construction.

Trump’s promised corporate tax cuts would add another inflationary factor. Reducing the top corporate tax rate would provide fiscal stimulus to an economy already at full employment. It would also increase the deficit and national debt, putting upward pressure on interest rates.

With both prices and wages rising, the Federal Reserve would likely feel pressure to raise its key interest rate, or at least delay cutting it, applying a brake to economic growth while raising the odds of a recession.

A Biden win: If Joe Biden holds the White House and Congress remains divided, with Republicans gaining control of the Senate and Democrats gaining control of the House — the scenario the researchers say is most likely, with a 40% probability — the researchers estimate that the economy remains close to the status quo baseline.

Under those conditions, lawmakers strike a last-minute deal to raise the debt ceiling and avoid a default in 2025; some of the 2017 tax cuts for individuals are allowed to expire, but those earning less than $400,000 a year maintain them; and Biden is unable to raise the corporate tax rate. The researchers also assume that Democrats win an increase in the Child Tax Credit and an extension of subsidies for Affordable Care Act, while Republicans successfully defend some business tax cuts, including more generous depreciation allowances.

Immigration would still be an issue, and Biden takes moderate steps to reduce the number of entries at the southern border, though he is unable pass any significant legislation. Biden deploys targeted tariffs against China, focused on electric vehicles and solar power, and his administration continues to push for cleaner energy.

Overall, a second Biden administration helps keep the economy near its potential growth rate, while maintaining the unemployment rate close its current low level of 4%. Inflation continues on its downward path, falling to 2% in the summer of 2025, prompting the Fed to reduce its benchmark rate to 3% by the end of 2026.

Other scenarios: The analysts note that other scenarios are possible. They give a clean Democratic sweep a 10% chance, while Trump with a divided Congress gets a 15% chance. To see how those unlikely — but not impossible — eventualities could play out, read the full Moody’s analysis.

Economy

A Trump Win Would Mean Higher Inflation, Recession Risk: Moody’s

Reuters/Carlos Barria