U.S. employers added 236,000 workers and the unemployment rate dropped a tenth of a percentage point to 3.5% last month, the Bureau of Labor Statistics announced Friday in its March employment report.

The data provide more evidence that the labor market is cooling off, even as it remains strong by pre-pandemic standards. The March results were below February’s upwardly revised level of 326,000 jobs added and January’s downwardly revised (but still enormous) level of 472,000, but still well above the 2019 average of 178,000 jobs per month.

“The great labor market machine is finally slowing down some, but it’s still got a lot of strength left,” economist Robert Frick of the Navy Federal Credit Union told The Wall Street Journal.

A remarkable recovery: The economy has now added more than 1 million jobs since the beginning of the year – and 3.2 million since February 2020, just before the pandemic began, more than making up for the millions of jobs lost in the recession. At least as far as employment is concerned, the U.S. has returned to its pre-pandemic growth trajectory.

“If an economist descended from Mars & just had access to labor data through 2019 and then the 2023 data they would find the 2023 data entirely unsurprising--and, if anything, possibly a bit pleasantly surprising,” wrote former Obama administration economist Jason Furman. “They would have no idea anything huge had happened in the interim.”

Not all sectors have recovered equally. Although employment in leisure and hospitality rose by a healthy 72,000 in March, total employment in the sector is still about 368,000 below where it was before the pandemic. Similarly, while employment in government rose by 47,000 last month, there are about 314,000 fewer jobs in the sector compared to early 2020. Over the last three years, the professional and business sector has risen the most, up by more than 1.5 million, and transportation and warehousing (up 918,000) and health care (up 391,000) have been strong, as well.

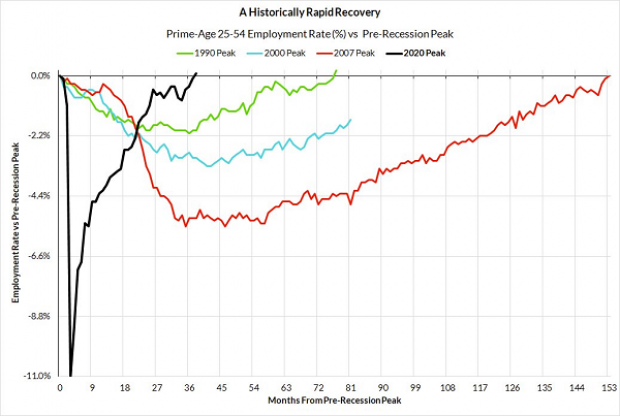

Whatever the details, one thing is clear: the pace of the recovery from the pandemic has been exceptional. As The Wall Street Journal’s Nick Timiraos noted, the share of prime-age workers (ages 25-54) who are currently employed now exceeds the pre-pandemic peak. “It took almost 13 years (Jan '07 to Dec '19) for this ratio to exceed its cyclical peak after the 07-09 recession,” Timiraos said. “It took just 3 years for this current cycle.”

Skanda Amarnath, executive director at Employ America, a research group that advocates for full employment, shared the chart below that compares the recovery time for prime-age employment in the last four recessions. “It's been a historically rapid and complete recovery,” Amarnath wrote. “Took over 12yrs to get back to pre-recession peak following the Great Recession.”

White House celebrates – and warns: President Joe Biden celebrated the strong report, saying it shows the country continues “to face economic challenges from a position of strength.” Biden noted that the economy has added 12.1 million jobs since he took office, and highlighted the fact that the unemployment rate for African Americans, which now stands at 5%, is at a record low.

Biden said there is more that he wants to do, including boosting economic growth, but warned that Republicans were risking economic catastrophe by refusing to increase the debt ceiling unless federal spending is slashed. “Extreme MAGA Republicans in Congress … are threatening to wreak havoc on our economy with debt limit brinkmanship,” Biden said. “And it’s all to pay for even more giveaways to the wealthiest Americans and largest corporations.”

What comes next: Although the labor market appears to be cooling, the continuing strength demonstrated in the report boosts the odds that the Federal Reserve will move ahead with another interest rate hike at its next meeting in early May. After the report was released, traders on Wall Street pushed the probability of a 25-basis-point increase up from 49% to 67%.

“A slower pace of hiring is clearly a relief to policymakers looking to cool an overheated economy and labor market,” wrote RSM chief economist Joseph Brusuelas. “However, neither the slower pace of hiring nor the cooling of inflation is sufficient to cause the Federal Reserve to end its efforts to restore price stability at the current time. We expect the central bank to hike its policy rate by 25 basis points to a range of 5% to 5.25% at the May meeting, and then engage in a strategic pause that will likely last until early 2024 when we see the first possibility of rate cuts being enacted.”