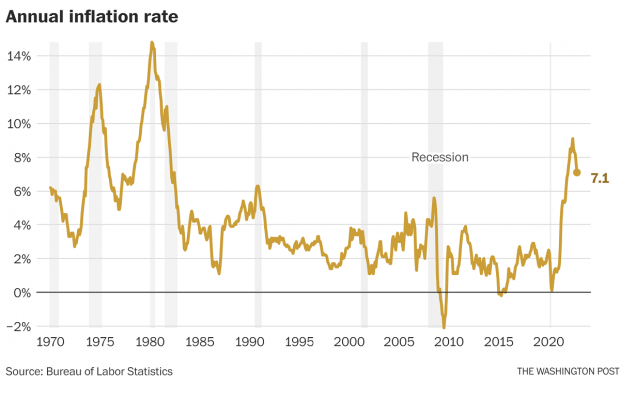

Inflation cooled a bit in November, according to data released by the Bureau of Labor Statistics Tuesday, as the Consumer Price Index for All Urban Consumers (CPI-U) rose 7.1% on an annual basis and 0.1% month over month. Both numbers were better than expected, boosting hopes that the Federal Reserve’s effort to bring down inflation is starting to have a significant effect on the economy even as supply chains recover and the shock of war in Ukraine eases in the energy markets.

The closely watched core inflation measure, which strips out volatile fuel and inflation costs, rose by 6% annually, and 0.2% on a monthly basis – down from 0.4% in October and the smallest increase since August 2021.

The increasing cost of shelter was the biggest factor in the still robust inflation topline number, and the price of food continued to rise, with grocery prices up 12% on an annual basis. Used cars, gasoline and heating fuel got cheaper, though, putting downward pressure on the overall inflation level.

President Joe Biden called the price report “welcome news for families across the country” as we head into the holiday season, and credited his economic policies for helping to reduce inflation. At the same time, Biden acknowledged that inflation may continue to be a problem into 2023, saying he hopes things are closer to normal “by the end of next year.”

The Fed persists: While the latest report indicates that inflation is moving in the right direction, it is unlikely to have much influence on the Fed as it plans its next rate hike this week. The central bank is still expected to announce a 50-basis-point increase in its key interest rate at the conclusion of its final meeting of the year on Wednesday – a smaller increase than the 75-basis-point hikes at the last four meetings, but one that was pretty well telegraphed before the latest inflation data was announced.

Still, the relatively good news on the inflation front boosts confidence that the Fed could soon ease up its tightening efforts and consider slowing if not pausing its interest rate hikes early in 2023. That in turn raises hopes that the Fed will be able to pull off a soft landing – pushing inflation down toward its target level of 2% while avoiding a recession.

Here’s what the experts are saying about the latest inflation data:

We have a trend: “What the November CPI report showed is that this is no longer a ‘one datapoint doesn’t make a trend’ story and that inflation is now on a clear disinflation trajectory,” said Eugenio Aleman, chief economist at Raymond James. “This disinflationary trajectory will probably cement itself in the coming quarters as we expect shelter prices, which represent about a third of the weight on the CPI index, to start weakening. This CPI report will not change this week’s Federal Reserve decision to increase the federal funds rate by 50 basis points, but it may help keep the Fed from overtightening monetary policy.”

But inflation is still unusually high: “While inflation is moving to a better place, it is not yet in a good place,” said Mark Hamrick, senior economic analyst at Bankrate. “The month over month changes show inflation pressures are cooling. But compared to a year earlier, prices broadly remain historically high. Consumers rejoice that the price of gasoline has dropped sharply. But rising prices for other necessities, most notably food and shelter, remain elevated and continue to strain household budgets.”

And inflation could linger: “The areas that continue to keep inflation higher now lie largely within the services component of CPI, like rent and housing prices,” said Gargi Chaudhuri of iShares Investment Strategy. “The service components within CPI tend to be stickier – price growth in services takes longer to slow because they are thought to reflect wage growth and don’t have their prices adjusted as much as goods. Because of this, the move from 5% to 2% year-over-year inflation will not be as easy as the move from 9% to 5% inflation. We continue to believe that inflation will remain stubbornly high and above the Fed’s 2% target in 2023.”