The $1.9 trillion Covid rescue plan passed by Democrats provides $350 billion in direct aid to states, cities and counties, but lawmakers — worried that the money might be used for matters unrelated to the pandemic — restricted states from “directly or indirectly” using the funding to cut taxes. Treasury Secretary Janet Yellen on Wednesday acknowledged in testimony before the Senate Banking Committee that the restriction raises a number of “thorny” issues for her department as it works to issue guidance on how states can use the money they receive.

“We will have to define what it means to use money from this act as an offset for tax cuts,” Yellen said, according to The New York Times. “Given the fungibility of money, it’s a hard question to answer.”

The Treasury Department has 60 days from when the law was enacted to issue its guidance on how the money can be spent.

Twenty-one Republican state attorneys general have asked for clarification and threatened legal action against the Biden administration over the restrictions, saying that the vague language in the legislation may be “an unprecedented and unconstitutional intrusion on the separate sovereignty of the States.” They argue that the restriction, if interpreted broadly, “would represent the greatest invasion of state sovereignty by Congress in the history of our Republic.”

Ohio’s attorney general sued the administration last week, arguing that the law violated the state’s constitutional right to set its own tax policies.

Yellen on Tuesday refuted those concerns. “It is well established that Congress may place such reasonable conditions on how States may use federal funding. Congress includes those sorts of reasonable funding conditions in legislation routinely, including with respect to funding for Medicaid, education, and highways,” she wrote in a letter responding to the attorneys general. “Nothing in the Act prevents States from enacting a broad variety of tax cuts. That is, the Act does not ‘deny States the ability to cut taxes in any manner whatsoever.’ It simply provides that funding received under the Act may not be used to offset a reduction in net tax revenue resulting from certain changes in state law.”

The law’s restrictions wouldn’t apply, she said, if states lower taxes but offset the lost revenue through means other than the Covid relief funds.

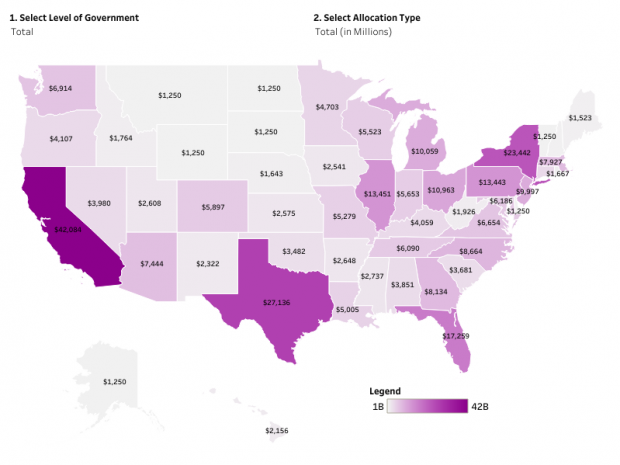

What the states get: A new visualization by the Rockefeller Institute of Government breaks down the payments to state, county, city and municipal governments.

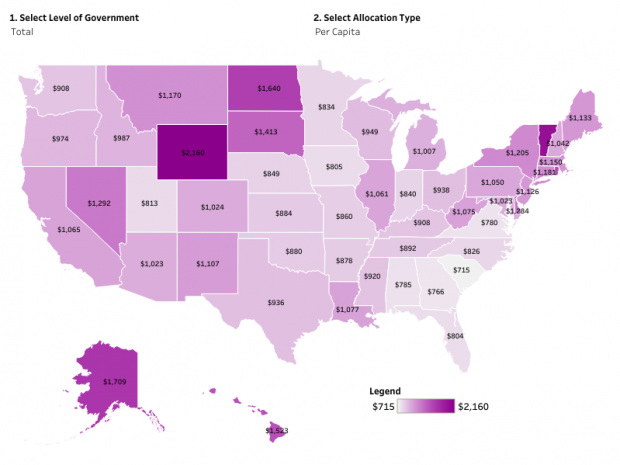

“California, Texas, New York, and Florida are expected to receive the largest total amounts of state and local funding,” Rockefeller’s Laura Schultz writes. “On average, the funds deliver $980 per resident, with Wyoming, Vermont, and Alaska projected to receive the most per resident. States in the Northeast and upper Midwest are receiving higher than average per capita funding. States in the southeast and lower Midwest appear to be getting lower than average.”

This map shows the total funds, with amounts in millions:

And here’s a look at what states get on a per capita basis:

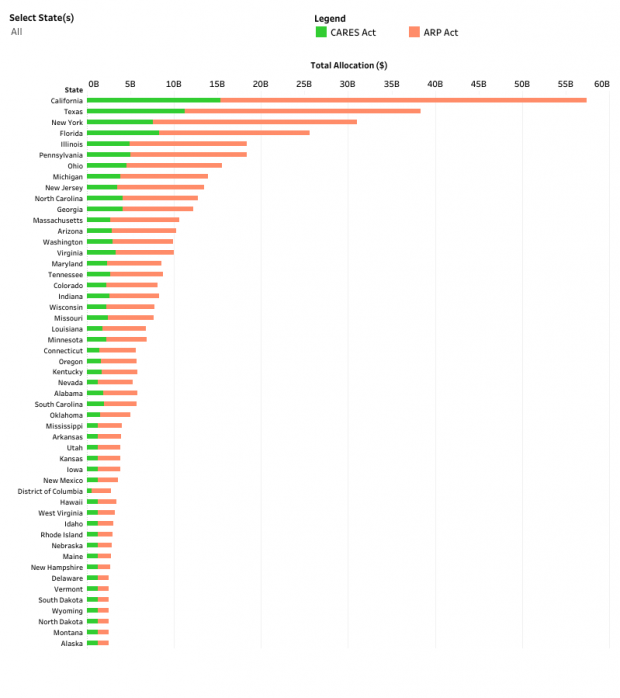

Finally, here’s a breakdown by state of the direct aid from both the CARES Act passed in March 2020, which included $150 billion for state and local governments, the American Rescue Plan.