The roughly $2 trillion coronavirus relief package signed into law last month includes a provision that will cut the tax bills for some Americans who make more than $1 million a year, according to a new analysis from the congressional Joint Committee on Taxation.

Inserted into the legislation by Senate Republicans, the provision temporarily suspends the limits on excess business losses that can be claimed by non-corporate taxpayers, referred to as “pass-through” businesses. The primary beneficiaries of the suspension are “far and away” hedge-fund operators and real-estate owners, Steve Rosenthal of the Tax Policy Center told The Washington Post.

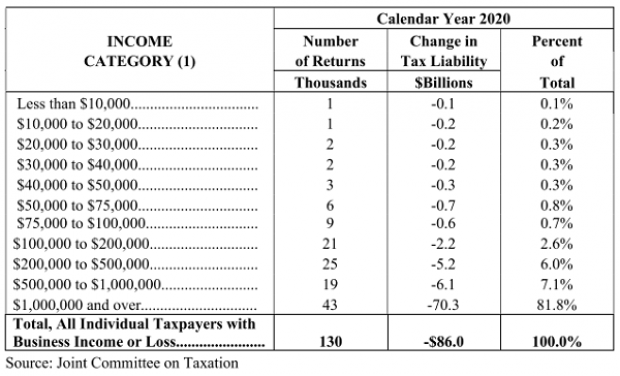

The JCT provided a distributional analysis of the tax law tweak, which applies to 2018, 2019 and 2020, with the largest effect occurring this year. In 2020, the total cost of the tax law change would be about $86 billion in lost revenue, JCT found, with more than 80% of the benefit flowing to filers with incomes of $1 million or higher. Less than 3% of the benefit accrues to taxpayers earning less than $100,000.

The analysis was performed at the request of Sen. Sheldon Whitehouse (D-RI) and Rep. Lloyd Doggett (D-TX). In a letter, Thomas Barthold of the JCT said that while there is considerable uncertainty about how the economy will perform for the rest of the year, the analysis provides a sense of the “potential scale of revenue changes associated with this provision.”

The Democratic lawmakers accused Republicans of pursuing tax cuts for the rich in the middle of a national emergency. “It’s a scandal for Republicans to loot American taxpayers in the midst of an economic and human tragedy,” Whitehouse said in a statement. “Congress should repeal this rotten, un-American giveaway and use the revenue to help workers battling through this crisis.” Doggett charged that the total cost of the provision “is more than total new funding for all hospitals in America and more than the total provided to all state and local governments.”

Defending the provision back in March when the relief bill was being written, Alan D. Viard of the right-leaning American Enterprise Institute said it corrects a flaw in the 2017 tax legislation. “The tax relief gives businesses badly needed liquidity during the coronavirus pandemic while also reducing the tax penalty on risky business investments,” Viard said.

The New York Times previously reported that the special provision could cost as much as $170 billion over 10 years, and could benefit real estate investors close to President Trump, including his son-in-law and senior adviser, Jared Kushner.