The Tax Cuts and Jobs Act has been on the books for two years now, prompting The Wall Street Journal’s Richard Rubin and Theo Francis over the weekend to review how the law has fared so far.

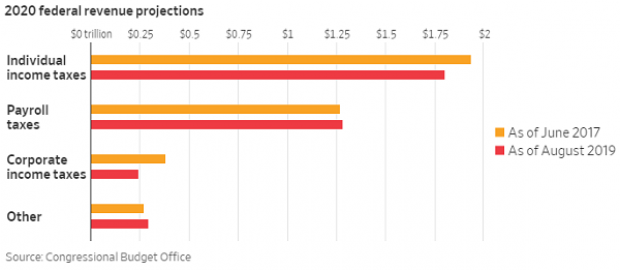

A few effects are clear, Rubin and Francis say: Most households and businesses are paying lower taxes; foreign subsidiaries have shifted more than $1 trillion to their U.S. corporate parents; federal revenue projections are lower than they would have been without the tax cuts (see the chart below); and the deficit has risen sharply, contrary to some Republicans’ claims that the cuts would pay for themselves.

In other respects, though, the picture is a lot “muddier.” While the economy is stronger today than it was projected to be back in 2017, it’s not obvious that the tax package deserves the credit. Economic indicators like employment and wages are up, but such “metrics were already on the rise before the tax law was signed by President Trump, and most economic numbers don’t show a sharp change that coincides with the tax law,” Rubin and Francis say. “Early growth in business investment seems to have faded; overall economic growth rose before pulling back again.”

The bottom line: Rubin and Francis say it “seems clear the tax cuts contributed to economic growth—but not enough to pay for themselves, as many backers promised. And even some of the intended beneficiaries say the gains haven’t been dramatic.”

Read their full analysis here (paywall).