Elizabeth Warren’s proposed wealth tax seems to have unsettled some of the country’s wealthiest citizens, inspiring criticism from the likes of Bill Gates and Leon Cooperman — and maybe playing a role in Michael Bloomberg’s renewed interest in joining the 2020 presidential race.

Following an exchange with Gates earlier this week, after the Microsoft founder said, “when you say I should pay $100 billion, O.K., then I’m starting to do a little math about what I have left over,” Warren released a “calculator for the billionaires” on her campaign website to illustrate how it would work. Gates wouldn’t be faced with anything like a $100 billion annual tax bill.

“Some billionaires seem confused about how much they would pay under Elizabeth’s Ultra-Millionaire Tax. Don’t worry, now we have a calculator for that too,” the campaign said.

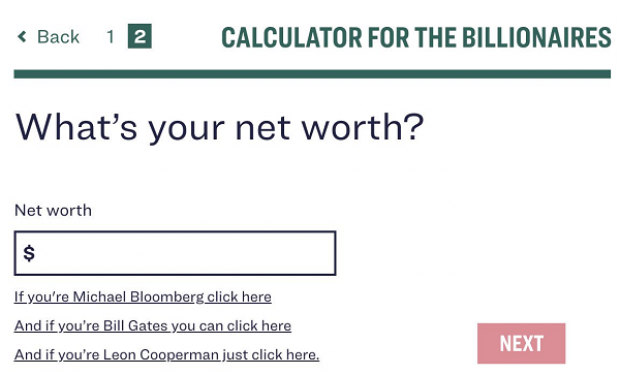

Warren’s calculator, which you can see here, asks simply, Are you a billionaire? A positive response allows users to enter their net worth for a quick calculation of taxes that would be owed under her proposals (2% on household wealth over $50 million, rising to 6% on household wealth over $1 billion). The page includes handy shortcuts (see below) for three of her billionaire critics, and elsewhere there are links to tax estimates for other well-known superrich critics, including Amazon’s Jeff Bezos, Facebook’s Mark Zuckerberg and JPMorgan Chase’s Jamie Dimon.

The calculator provides an estimate of taxes owed based on current net worth. For example, based on an estimated net worth of $107 billion, Gates would owe $6.4 billion next year. Bezos would owe $6.7 billion, Bloomberg would owe $3.1 billion, Zuckerberg would owe $4.5 billion and Dimon would owe $55 million. Those aren’t their total tax bills, just what they’d have to pay under Warren’s wealth tax.

The calculator also provides a message for critics who may have concerns about the impact of the wealth tax: “Don’t worry too much about billionaires - if history is any guide, if they do nothing other than invest their wealth in the stock market, it’s likely that their wealth will continue to grow.” Gates, for example, reportedly earned more from his investments last year than he would have had to pay under Warren’s wealth tax.

Warren’s campaign says the wealth tax would affect only 75,000 families, while generating enough revenue “to cover universal child care, quality public education, forgive student loan debt, provide free public college, and help finance Medicare for All.”