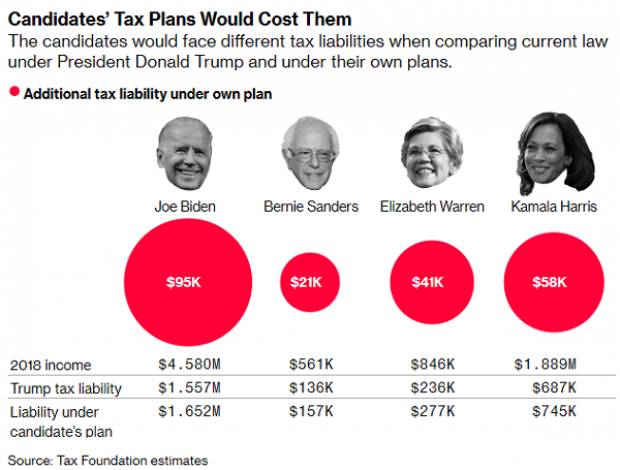

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.

Number of the Day: $1.57

A new study from the Bipartisan Policy Center says that Medicare would save $1.57 for every dollar it spends delivering healthy food to elderly beneficiaries who have recently been discharged from the hospital. The savings would come from a reduction in the rate of readmissions to the hospital for patients suffering from a wide range of common ailments, including rheumatoid arthritis, congestive heart failure, diabetes and emphysema.

“If you were going to offer meals to every Medicare beneficiary, it would be cost-prohibitive,” said BPC’s Katherine Hayes. “By targeting it to a very, very sick group of people is how we were able to show there could be savings.”

Budget Deal Moving Ahead, Despite Outrage on the Right

The bipartisan deal to suspend the debt ceiling and increase federal spending over the next two years will get a vote in the House on Thursday, House Majority Leader Steny Hoyer (D-MD) said late Tuesday. Leaders in both parties have expressed confidence that the bill will pass before lawmakers leave town for their August recess.

"We're gonna pass it," Hoyer told reporters. "I think we'll get a good number [of votes]. I don't know if it's gonna be huge, but we're gonna pass it."

President Trump announced that he backs the deal, removing one possible hurdle for the bill. “Budget Deal gives great victories to our Military and Vets, keeps out Democrat poison pill riders. Republicans and Democrats in Congress need to act ASAP and support this deal,” he tweeted Tuesday evening.

Despite widespread agreement that the bill will pass, however, not everyone is on board.

Grumbles from the left: Some progressive Democrats have been critical of the deal, portraying it as too easy on Republicans. Worried that the agreement could set up a budget crisis in 2021, Rep. Ro Khanna (D-CA) said he was “concerned that it was a two-year deal. Why not a one year deal?... It seems like it’s basically handcuffing the next president.” Other liberals, noting that Democratic leaders have agreed to avoid “poison pill” riders on controversial issues such as abortion and funding for the border wall in the funding bills that must pass this fall, lamented their loss of leverage in those negotiations.

Outrage on the right: Resistance to the deal was more pronounced on the right, with the hardline House Freedom Caucus announcing Tuesday that it would not support the bill due to concerns about the growing national debt. “Our country is undeniably headed down a path of fiscal insolvency and rapidly approaching $23 trillion in debt. … All sides should go back to the drawing board and work around the clock, canceling recess if necessary, on a responsible budget agreement that serves American taxpayers better—not a $323 billion spending frenzy with no serious offsets,” the 31-member group said in a statement.

The deficit hawks at the Committee for Responsible Federal published “Five Reasons to Oppose the Budget Deal,” which include its purported $1.7 trillion cost over 10 years. CRFB noted that the agreement would increase discretionary spending by 21 percent during President Trump’s first term, pushing such spending to near-record levels.

Sen. John Kennedy (R-LA) was more colorful in his criticism, saying, “You don’t have to be Euclid to understand the math here. We’re like Thelma and Louise in that car headed toward the cliff.” Nevertheless, Kennedy said he would consider supporting the deal.

Is the deficit hawk dead? The budget deal represents “the culmination of years of slipping fiscal discipline in Washington,” said Robert Costa and Mike DeBonis of The Washington Post, and it highlights the declining influence of fiscal conservatives in the capital, at least as far as policy is concerned. Sen. James Lankford (R-OK) said the Republican Party’s credibility on fiscal restraint is “long gone.”

Although it may be too early to declare the fiscal hawk extinct – plenty of critics say the bird will return as soon as there’s a Democratic president – it certainly seems to be in ill health. As the University of Virginia's Larry Sabato said Wednesday: “A battered bird has been named to the list of endangered species. The ‘deficit hawk’ is on the road to extinction. Rarely spotted around Washington, D.C., the deficit hawk’s last remaining habitat is found in some state capitals.”

Some Republicans said that fiscal conservatism was never really a core Republican value, dating back to President Reagan’s tax-cut-and-spend policies, and that Paul Ryan’s emphasis on fiscal issues was an aberration. “It was never the party of Paul Ryan,” former House Speaker Newt Gingrich told the Post. “He’s a brilliant guy, but he filled a policy gap. The reality here is that Republicans were never going to get spending cuts with Speaker Pelosi running the House, and they didn’t want an economic meltdown or shutdown this summer.”

Is the whole debate missing the point? William Gale of the Brookings Institution, who served on President George H.W. Bush’s Council of Economic Advisers, said he wasn’t sure why the budget deal was producing so much hostility, since it basically maintains the status quo and – more importantly – is focused solely on discretionary spending. “There *is* a long-term budget issue,” Gale tweeted Tuesday, “but cutting [discretionary spending] is not the way to go.”

Instead, Gale says that any serious fiscal plan must focus on the mandatory side of the ledger, where the rapidly increasing costs of health care and retirement are straining against revenues reduced by repeated rounds of tax cuts. Gale recommends a combination of entitlement reductions and revenue increases – a standard mix of policy options that faces an uncertain future, with well-entrenched interest groups standing opposed to movement in either direction.

News & Views

Here's what we have our eye on today:

- Trump Wants a ‘Phase Two’ of Tax Cuts – CNBC

- Congress Has Until March 23 to Fund the Government. Three Ways This Could Go – Vox

- The First Target on Drug Prices: Pharmacy Benefit Managers – Axios

- No One’s Sure Who Qualifies for This $415 Billion U.S. Tax Deduction – Bloomberg

- Companies Are Putting Tax Savings in the Pockets of Shareholders – CNBC

- Conservative Groups Warn Against Obamacare 'Bailout' in Spending Bill – The Hill

- Trump to Visit Boeing Plant in Missouri to Tout Impact of Tax Overhaul – Reuters

- U.S. DOT Announces TIGER Grants Totaling Nearly $500 Million – Route Fifty

- Are You Underpaid? In a First, U.S. Firms Reveal How Much They Pay Workers – Wall Street Journal

- How Much Do America’s Arms Makers Depend on Foreign Metal? No One Seems to Know – Defense One

- Fox News Launching New Ad Campaign: 'Real News. Real Honest Opinion' – The Hill

- It’s Tax Time! Here’s What to Know This Year – New York Times

VIEWS

- The G.O.P. Accidentally Replaced Obamacare Without Repealing It – Peter Suderman, New York Times

- Red-State Changes Could Strengthen ACA, Medicaid – Drew Altman, Axios

- Social Security Is Headless Because of Trump’s Inaction. Will Other Agencies Be Decapitated? – Joe Davidson, Washington Post

- Britain Has Budget Problems, and the US Can Learn from Them – Tom Rogan, Washington Examiner

- The Rich Are Happier About Their Taxes Than the Poor – Kevin Drum, Mother Jones

- Axing State Corporate Taxes Is Good Policy – Richard F. Keevey, Route Fifty

- Trump's Tariff Move Shows He Flunked Economics – Jeffrey Sachs, CNN

- Without Pressure from the Electorate, Better Infrastructure Will Just Be Talk – Mark Jamison and Jeff Lawrence, RealClear Markets

- Most Small Business Owners Say They Will Not Hire, Give Raises Because of New Tax Law – Frank Knapp, Jr. – The Hill

- Trump Administration Is Helping a Lost Generation of Workers Recover – Scott Jennings, CNN

- I Hate Trump, but I Love These Tariffs – Krystal Ball, The Hill

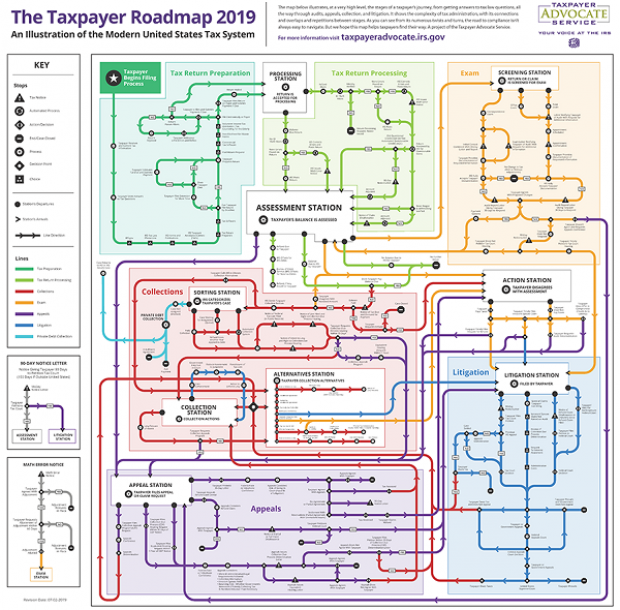

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.