Trump Touts ‘Inspirational’ Middle Class Tax Cut

President Trump said Thursday that he is working on a new tax cut for middle-class households, to be unveiled “sometime in the next year.”

Speaking to lawmakers at the GOP retreat in Baltimore, Trump said, “we’re working on a tax cut for the middle-income people that is going to be very, very inspirational. … it'll be a very, very substantial tax cut for middle-income folks who work so hard.”

The president, who has hinted at tax cuts several times over the last year without producing any specific proposals, provided no further details. Although House Speaker Nancy Pelosi and other Democratic lawmakers have said they are open to the idea of a middle-class tax cut, their insistence that new cuts be paid for with tax increases on the wealthy make it unlikely that the president will be able to make a deal on the issue with a divided Congress.

White House economic adviser Larry Kudlow told reporters Friday that the tax-cut plan would be made public “sometime in the middle of next year,” putting the release date close to the 2020 election.

Republican lawmakers may be more focused on making permanent their 2017 tax cuts, some of which are set to expire after 2025. “The first and most important step is we can make the cuts for families and small business permanent,” Rep. Kevin Brady, the ranking Republican on the tax-writing House Ways and Means Committee, said Friday.

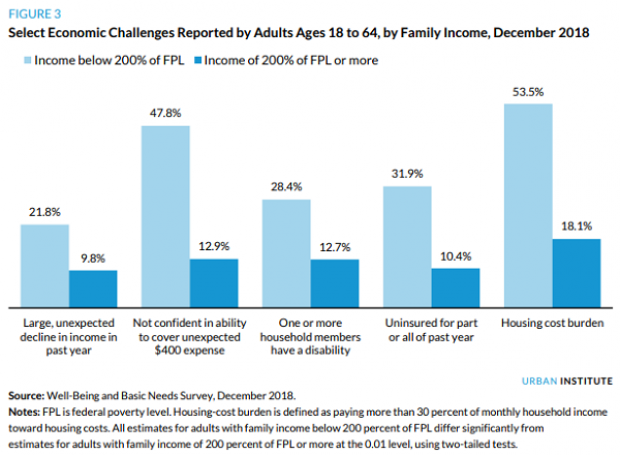

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

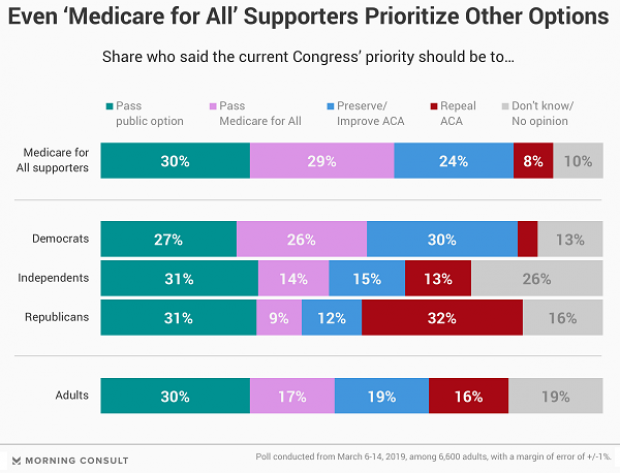

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

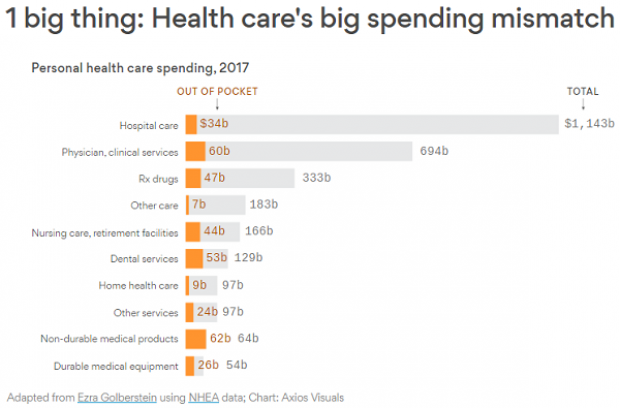

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.

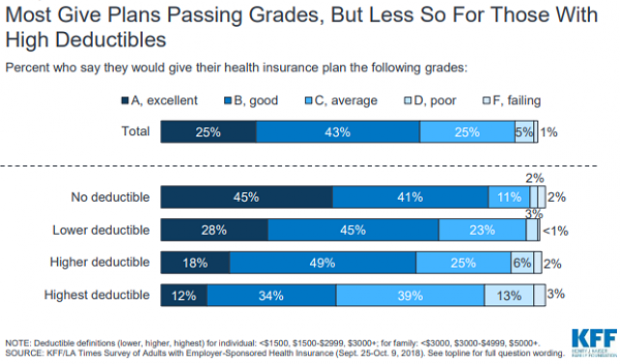

Chart of the Day: High Deductible Blues

The higher the deductible in your health insurance plan, the less happy you probably are with it. That’s according to a new report on employer-sponsored health insurance from the Kaiser Family Foundation and the Los Angeles Times.