Trump Touts ‘Inspirational’ Middle Class Tax Cut

President Trump said Thursday that he is working on a new tax cut for middle-class households, to be unveiled “sometime in the next year.”

Speaking to lawmakers at the GOP retreat in Baltimore, Trump said, “we’re working on a tax cut for the middle-income people that is going to be very, very inspirational. … it'll be a very, very substantial tax cut for middle-income folks who work so hard.”

The president, who has hinted at tax cuts several times over the last year without producing any specific proposals, provided no further details. Although House Speaker Nancy Pelosi and other Democratic lawmakers have said they are open to the idea of a middle-class tax cut, their insistence that new cuts be paid for with tax increases on the wealthy make it unlikely that the president will be able to make a deal on the issue with a divided Congress.

White House economic adviser Larry Kudlow told reporters Friday that the tax-cut plan would be made public “sometime in the middle of next year,” putting the release date close to the 2020 election.

Republican lawmakers may be more focused on making permanent their 2017 tax cuts, some of which are set to expire after 2025. “The first and most important step is we can make the cuts for families and small business permanent,” Rep. Kevin Brady, the ranking Republican on the tax-writing House Ways and Means Committee, said Friday.

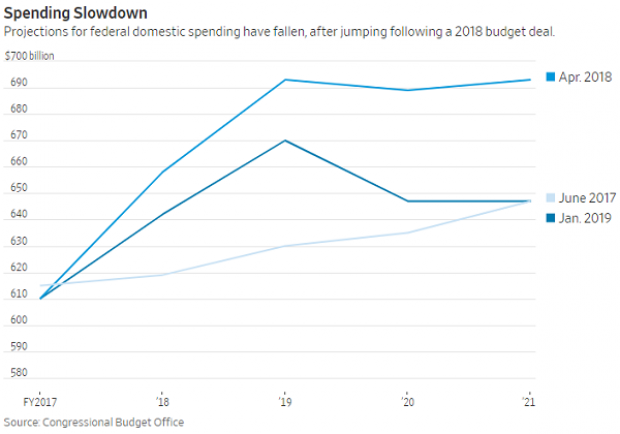

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

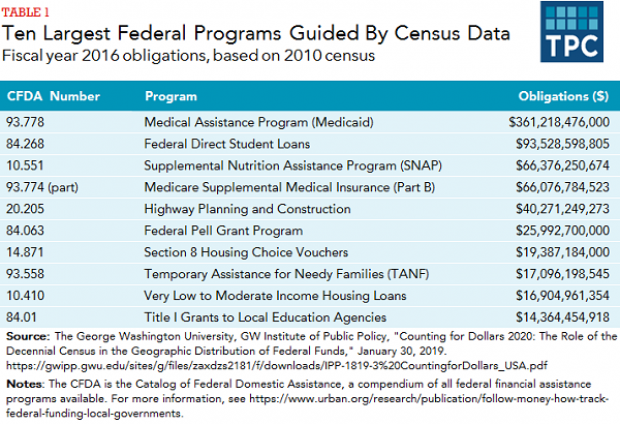

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

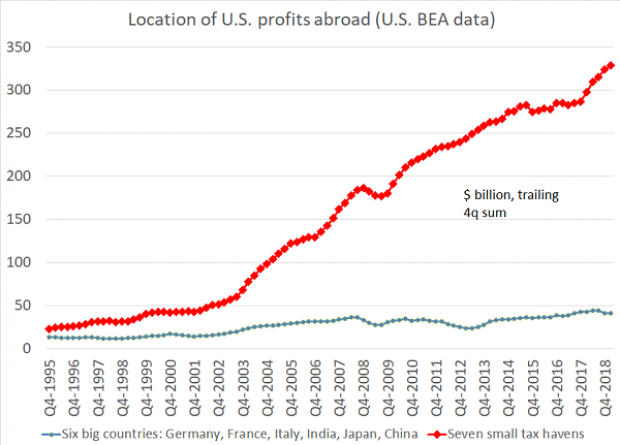

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.