Why Prescription Drug Prices Keep Rising – and 3 Ways to Bring Them Down

Prescription drug prices have been rising at a blistering rate over the last few decades. Between 1980 and 2016, overall spending on prescription drugs rose from about $12 billion to roughly $330 billion, while its share of total health care spending doubled, from 5% to 10%.

Although lawmakers have shown renewed interest in addressing the problem, with pharmaceutical CEOs testifying before the Senate Finance Committee in February and pharmacy benefit managers (PBMS) scheduled to do so this week, no comprehensive plan to halt the relentless increase in prices has been proposed, let alone agreed upon.

Robin Feldman, a professor at the University of California Hastings College of Law, takes a look at the drug pricing system in a new book, “Drugs, Money and Secret Handshakes: The Unstoppable Growth of Prescription Drug Prices.” In a recent conversation with Bloomberg’s Joe Nocera, Feldman said that one of the key drivers of rising prices is the ongoing effort of pharmaceutical companies to maintain control of the market.

Fearing competition from lower-cost generics, drugmakers began over the last 10 or 15 years to focus on innovations “outside of the lab,” Feldman said. These innovations include paying PBMs to reduce competition from generics; creating complex systems of rebates to PBMs, hospitals and doctors to maintain high prices; and gaming the patent system to extend monopoly pricing power.

Feldman’s research on the dynamics of the drug market led her to formulate three general solutions for the problem of ever-rising prices:

1) Transparency: The current system thrives on secret deals between drug companies and middlemen. Transparency “lets competitors figure out how to compete and it lets regulators see where the bad behaviors occur,” Feldman says.

2) Patent limitations: Drugmakers have become experts at extending patents on existing drugs, often by making minor modifications in formulation, dosage or delivery. Feldman says that 78% of drugs getting new patents are actually old drugs gaining another round of protection, and thus another round of production and pricing exclusivity. A “one-and-done” patent system would eliminate this increasingly common strategy.

3) Simplification: Feldman says that “complexity breeds opportunity,” and warns that the U.S. “drug price system is so complex that the gaming opportunities are endless.” While “ruthless simplification” of regulatory rules and approval systems could help eliminate some of those opportunities, Feldman says that the U.S. doesn’t seem to be moving in this direction.

Read the full interview at Bloomberg News.

Fitch Sends a Warning on US Credit Rating

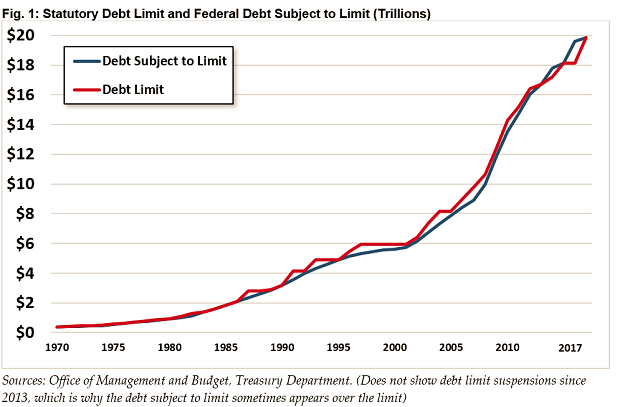

One of the three major credit ratings agencies warned Wednesday that a failure to raise the debt ceiling could result in a lower credit rating for the U.S.

Fitch Ratings currently assigns a AAA rating to U.S. debt, the highest level possible. However, a failure to raise the debt ceiling "may not be compatible with 'AAA' status," according to the agency.

If the U.S. cannot sell more debt after bumping up against the debt ceiling, it may not be able to make all of its interest payments on time and in full. The federal government could begin running out of cash as soon as October.

The debt ceiling is currently $19.9 trillion, and Treasury Secretary Steven Mnuchin has repeatedly urged Congress to raise the debt ceiling by September 29. A failure to do so could roil financial markets around the world, and ultimately increase the cost of servicing U.S. debt.

This is not the first time Congress has faced this problem. During an earlier debt ceiling showdown in 2011, Standard & Poor's reduced its rating on U.S. debt from its highest level to AA+. However, Fitch and Moody’s stuck with their top ratings.

Senators to Hold Hearings on a Bipartisan Fix for Health Care

Mark your calendars: Senate health committee Chairman Lamar Alexander (R-Tenn.) and Ranking Member Patty Murray (D-Wash.) announced today that they will hold bipartisan hearings on Sept. 6 and 7 focused on stabilizing premiums in the individual insurance market. The first hearing will be with state insurance commissioners; the second will be with governors.

In a statement, Alexander noted that 18 million Americans buy insurance on the individual market.

“My goal by the end of September is to give them peace of mind that they will be able to buy insurance at a reasonable price for the year 2018,” he said. “Unless Congress acts by September 27—when insurance companies must sign contracts with the federal government to sell insurance on the federal exchange in 2018— 9 million Americans in the individual market who receive no government help purchasing health insurance and whose premiums have already skyrocketed may see their premiums go up even more. Even those with subsidies in up to half our states may find themselves with zero options for buying health insurance on the Obamacare exchanges in 2018.”

McConnell: ‘Zero Chance’ the Debt Ceiling Will Be Breached

At an event in Kentucky to discuss tax reform, Senate Majority Leader Mitch McConnell and Treasury Secretary Steven Mnuchin insisted Monday that Congress will raise the debt ceiling by late next month, in time for the U.S. to avoid a default that could roil the global economy and markets.

Related: The Debt Ceiling — What It Is and Why We Should Care

The key quotes, per Roll Call:

McConnell: "There is zero chance — no chance — we won't raise the debt ceiling. No chance. America's not going to default. And we'll get the job done in conjunction with the secretary of the Treasury."

Mnuchin: “We’re going to get the debt ceiling passed. I think that everybody understands this is not a Republican issue, this is not a Democrat issue. We need to be able to pay our debts. This is about having a clean debt ceiling so that we can maintain the best credit, the reserve currency, and be focused on what we should be focusing on — so many other really important issues for the economy.”

Related: Here’s a Solution for the Annual Debt Ceiling Crisis — Get Rid of It

Mnuchin reiterated his “strong preference” for a “clean” increase to the debt limit — one without other policy proposals or spending cuts attached to it — but some House conservatives continue to press for such cuts.

Bonus McConnell quote on what tax breaks might be eliminated in tax reform: “I think there are only two things that the American people think are actually in the Constitution: The charitable deduction and the home mortgage interest deduction. So, if you’re worried about those two, you can breathe easy. For all the rest of you, there’s no point in doing tax reform unless we look at all of these preferences, and carried interest would be among them.”

Trump’s Travel and Family Size Squeeze Secret Service Budget

In an interview with USA Today, Secret Service Director Randolph "Tex" Alles said the agency is bumping up against federally mandated salary and overtime caps in executing its mission to protect the president and his family.

USA Today’s Kevin Johnson notes that 42 people in the Trump administration have Secret Service protection, including 18 of the president’s family members. Under President Obama, 31 people had such protection.

“The compensation crunch is so serious that the director has begun discussions with key lawmakers to raise the combined salary and overtime cap for agents, from $160,000 per year to $187,000 for at least the duration of Trump's first term,” Johnson reported.

Related: Which Former President Costs US the Most?

In a statement, Alles said the agency has the funding it needs for the rest of the fiscal year, which runs through Sept. 30, but estimated that 1,100 employees run into statutory pay caps as a result of overtime work during this calendar year.

“This issue is not one that can be attributed to the current Administration’s protection requirements alone, but rather has been an ongoing issue for nearly a decade due to an overall increase in operational tempo," Alles said in the statement.

Earlier: The Secret Service Won’t Get $60 Million More to Protect the Trumps

Will Trump's Tax Cuts Really Happen? Economists Are Surprisingly Optimistic

Despite all the thorny questions swirling around President Trump's nascent tax reform plan, 29 of 38 economists surveyed by Bloomberg in a monthly poll said they expect Congress to cut taxes by November of next year.

The hitch: The economists don’t expect the cuts will help the economy much. The median projection of a larger group of 71 economists is for 2018 growth of 2.3 percent, up only slightly from 2.1 percent this year — and by 2019, the economists see growth slipping back to 2 percent.