Why Prescription Drug Prices Keep Rising – and 3 Ways to Bring Them Down

Prescription drug prices have been rising at a blistering rate over the last few decades. Between 1980 and 2016, overall spending on prescription drugs rose from about $12 billion to roughly $330 billion, while its share of total health care spending doubled, from 5% to 10%.

Although lawmakers have shown renewed interest in addressing the problem, with pharmaceutical CEOs testifying before the Senate Finance Committee in February and pharmacy benefit managers (PBMS) scheduled to do so this week, no comprehensive plan to halt the relentless increase in prices has been proposed, let alone agreed upon.

Robin Feldman, a professor at the University of California Hastings College of Law, takes a look at the drug pricing system in a new book, “Drugs, Money and Secret Handshakes: The Unstoppable Growth of Prescription Drug Prices.” In a recent conversation with Bloomberg’s Joe Nocera, Feldman said that one of the key drivers of rising prices is the ongoing effort of pharmaceutical companies to maintain control of the market.

Fearing competition from lower-cost generics, drugmakers began over the last 10 or 15 years to focus on innovations “outside of the lab,” Feldman said. These innovations include paying PBMs to reduce competition from generics; creating complex systems of rebates to PBMs, hospitals and doctors to maintain high prices; and gaming the patent system to extend monopoly pricing power.

Feldman’s research on the dynamics of the drug market led her to formulate three general solutions for the problem of ever-rising prices:

1) Transparency: The current system thrives on secret deals between drug companies and middlemen. Transparency “lets competitors figure out how to compete and it lets regulators see where the bad behaviors occur,” Feldman says.

2) Patent limitations: Drugmakers have become experts at extending patents on existing drugs, often by making minor modifications in formulation, dosage or delivery. Feldman says that 78% of drugs getting new patents are actually old drugs gaining another round of protection, and thus another round of production and pricing exclusivity. A “one-and-done” patent system would eliminate this increasingly common strategy.

3) Simplification: Feldman says that “complexity breeds opportunity,” and warns that the U.S. “drug price system is so complex that the gaming opportunities are endless.” While “ruthless simplification” of regulatory rules and approval systems could help eliminate some of those opportunities, Feldman says that the U.S. doesn’t seem to be moving in this direction.

Read the full interview at Bloomberg News.

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

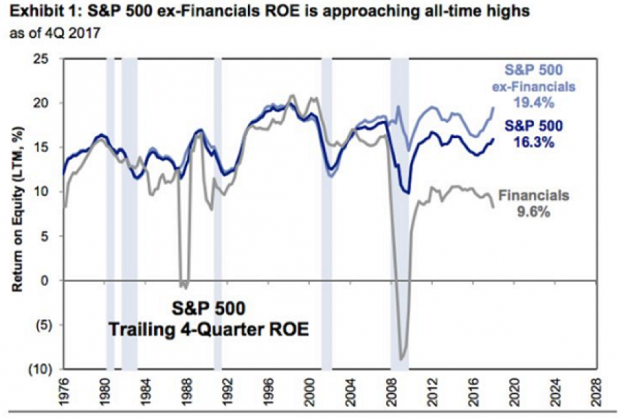

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.

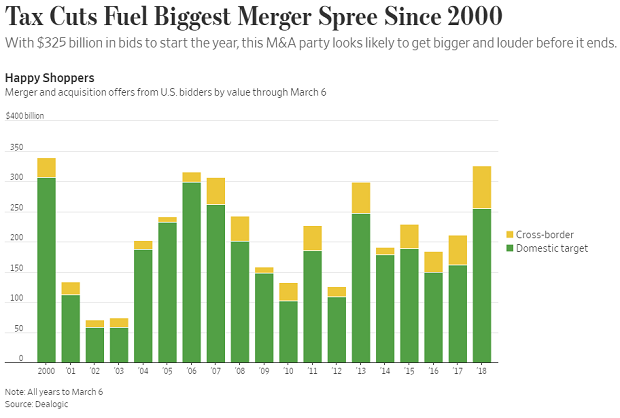

Chart of the Day: A Buying Binge Driven by Tax Cuts

The Wall Street Journal reports that the tax cuts and economic environment are prompting U.S. companies to go on a buying binge: “Mergers and acquisitions announced by U.S. acquirers so far in 2018 are running at the highest dollar volume since the first two months of 2000, according to Dealogic. Thomson Reuters, which publishes slightly different numbers, puts it at the highest since the start of 2007.”