Why Prescription Drug Prices Keep Rising – and 3 Ways to Bring Them Down

Prescription drug prices have been rising at a blistering rate over the last few decades. Between 1980 and 2016, overall spending on prescription drugs rose from about $12 billion to roughly $330 billion, while its share of total health care spending doubled, from 5% to 10%.

Although lawmakers have shown renewed interest in addressing the problem, with pharmaceutical CEOs testifying before the Senate Finance Committee in February and pharmacy benefit managers (PBMS) scheduled to do so this week, no comprehensive plan to halt the relentless increase in prices has been proposed, let alone agreed upon.

Robin Feldman, a professor at the University of California Hastings College of Law, takes a look at the drug pricing system in a new book, “Drugs, Money and Secret Handshakes: The Unstoppable Growth of Prescription Drug Prices.” In a recent conversation with Bloomberg’s Joe Nocera, Feldman said that one of the key drivers of rising prices is the ongoing effort of pharmaceutical companies to maintain control of the market.

Fearing competition from lower-cost generics, drugmakers began over the last 10 or 15 years to focus on innovations “outside of the lab,” Feldman said. These innovations include paying PBMs to reduce competition from generics; creating complex systems of rebates to PBMs, hospitals and doctors to maintain high prices; and gaming the patent system to extend monopoly pricing power.

Feldman’s research on the dynamics of the drug market led her to formulate three general solutions for the problem of ever-rising prices:

1) Transparency: The current system thrives on secret deals between drug companies and middlemen. Transparency “lets competitors figure out how to compete and it lets regulators see where the bad behaviors occur,” Feldman says.

2) Patent limitations: Drugmakers have become experts at extending patents on existing drugs, often by making minor modifications in formulation, dosage or delivery. Feldman says that 78% of drugs getting new patents are actually old drugs gaining another round of protection, and thus another round of production and pricing exclusivity. A “one-and-done” patent system would eliminate this increasingly common strategy.

3) Simplification: Feldman says that “complexity breeds opportunity,” and warns that the U.S. “drug price system is so complex that the gaming opportunities are endless.” While “ruthless simplification” of regulatory rules and approval systems could help eliminate some of those opportunities, Feldman says that the U.S. doesn’t seem to be moving in this direction.

Read the full interview at Bloomberg News.

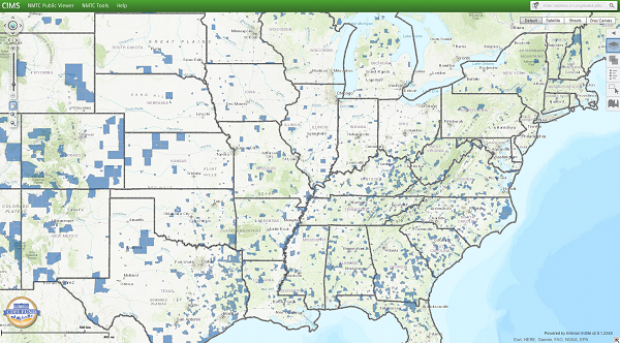

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

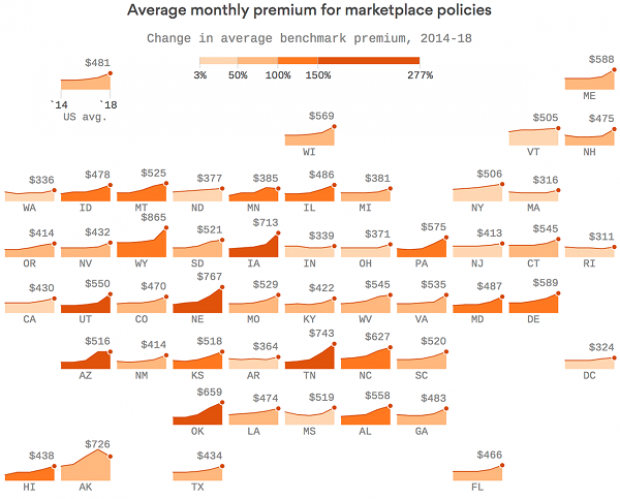

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).