President Trump made some big claims about the 2017 Republican tax overhaul, including a prediction that it would encourage companies to transfer trillions in profits held overseas back to the U.S.

“We expect to have in excess of $4 trillion brought back very shortly,” Trump said last August. “Over $4 [trillion], but close to $5 trillion, will be brought back into our country. This is money that would never, ever be seen again by the workers and the people of our country.”

Most economists said the Trump administration was overstating the amount held overseas, and more sober estimates pegged the figure somewhere between $1.5 trillion and $2.5 trillion. U.S. multinationals kept those funds offshore to avoid paying tax on them, but the 2017 overhaul lowered the corporate tax rate while imposing a one-time levy on foreign profits at a reduced rate, freeing companies to bring the money back home.

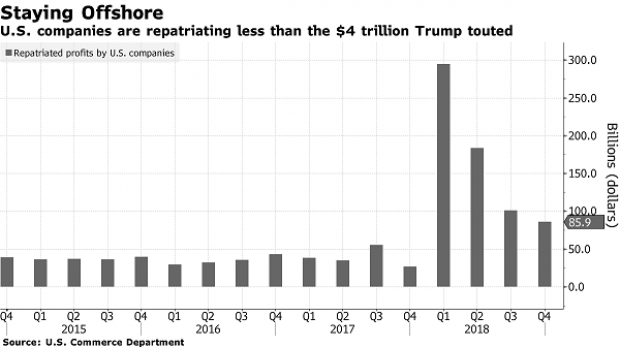

Data released by the Bureau of Economic Analysis Wednesday shows that while the repatriation of profits increased substantially last year, the total falls well short of the figures Trump cited. Corporations brought $665 billion back to the U.S. in 2018, the BEA said. By comparison, U.S. firms repatriated $155 billion the year before. The data suggest that the repatriation effect is fading, with the quarterly numbers falling back toward their pre-tax cut levels after an initial jump in the first quarter of 2018.

Critics of the GOP tax law warned that the impact from repatriation was likely exaggerated. In addition to being significantly smaller than President Trump indicated, about half of the assets held overseas by U.S. firms are illiquid and therefore hard to repatriate. And the profits that are eventually brought home are unlikely to boost investment and wages as Republicans promised; instead, the extra cash is likely to flow into dividend payouts and share buybacks. Not coincidentally, S&P recently announced that buybacks hit a record high last year.