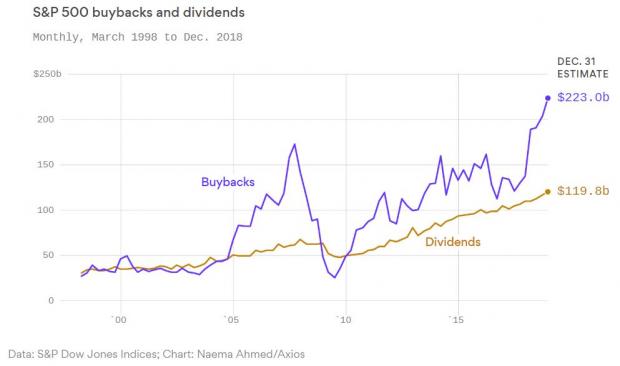

S&P Dow Jones Indices said Monday that companies in the S&P 500 index bought back a record $806.4 billion worth of their own stock in 2018, up 55.6 percent compared to 2017 — and about 37 percent higher than the previous record of $589.1 billion in 2007. (Apple alone spent $74.2 billion on buybacks for the year, by far the most of any company.)

Over the last three months of the year, companies bought back $223 billion in shares, or roughly the market size of AT&T, setting a fourth consecutive quarterly record.

“Companies continued to spend more of their tax savings on these share repurchases as they boosted earnings through significantly reduced share counts,” Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, said. The Axios chart below shows how buybacks have surged since the tax law was enacted.