Income taxes paid by individuals made up the majority of federal revenue for the first time last year, according to an analysis released Wednesday by the Joint Committee on Taxation.

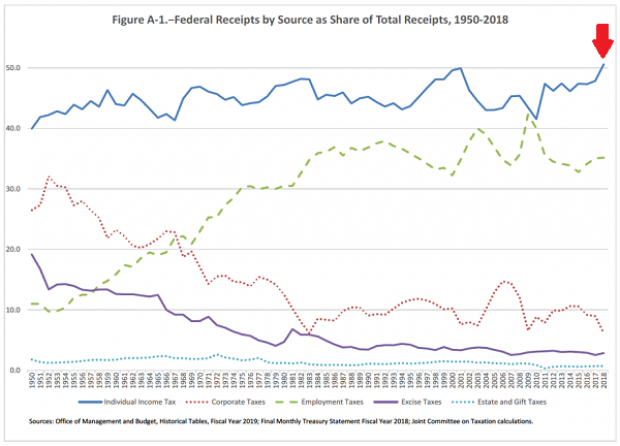

The chart below shows the upward trend for individual income taxes (blue line) as a share of federal revenue, which rose above 50 percent in fiscal year 2018.

Payroll taxes (green dotted line) have also risen as a share of federal receipts over time, from about 10 percent in 1950 to roughly 35 percent last year. More than two-thirds of U.S. households pay more in federal employment taxes (Social Security, Medicare) than they do in federal income taxes, The Wall Street Journal’s Richard Rubin noted.

Corporate taxes made up 6.2 percent of federal revenue in the 2018 fiscal year, tying 1983 for the lowest level in at least 50 years. The corporate share fell sharply from the 9.0 percent recorded in 2017 due to the Republican effort to slash business tax rates.

For 2019, JCT expects the share of corporate taxes to rise a bit to 7 percent of federal revenues and individual income taxes to come in at 50 percent.