The Trump Budget's $1.2 Trillion in 'Phantom Revenues'

President Trump’s 2020 budget includes up to $1.2 trillion in “potentially phantom revenues” — money that comes from taxes the administration opposes or from tax hikes that face strong opposition from businesses, The Wall Street Journal’s Richard Rubin reports, citing data from the Committee for a Responsible Federal Budget. That total, covering 2020 through 2029, includes as much as $390 billion in taxes created under the Affordable Care Act, which the president wants to repeal.

The $1.2 trillion in questionable revenue projections is in addition to the White House budget’s projected deficits of $7.3 trillion for the 10-year period. That total is itself questionable, given that the president’s budget relies on optimistic assumptions about economic growth and some unrealistic spending cuts, meaning that the deficits could be significantly higher than projected.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

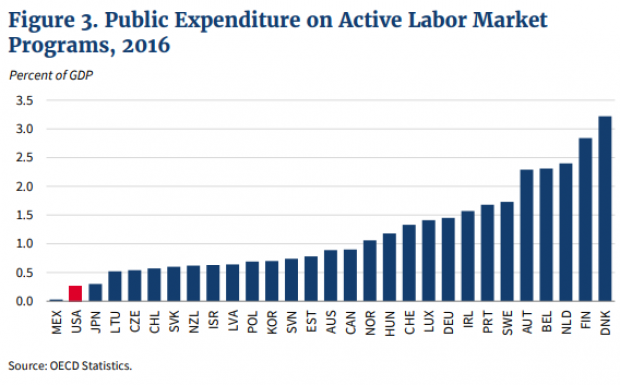

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.

Economists See More Growth Ahead

Most business economists in the U.S. expect the economy to keep chugging along over the next three months, with rising corporate sales driving additional hiring and wage increases for workers.

The tax cuts, however, don’t seem to be playing a role in hiring and investment plans. And the trade conflicts stirred up by the Trump administration are having a negative influence, with the majority of economists at goods-producing firms who replied to the most recent survey by the National Association for Business Economics saying that their companies were putting investments on hold as they wait to see how things play out.