Three top officials who helped steer the U.S. through the financial crisis a decade ago warned Tuesday that, while the banking system has clearly been strengthened, policymakers might find it harder to deal with the next crisis.

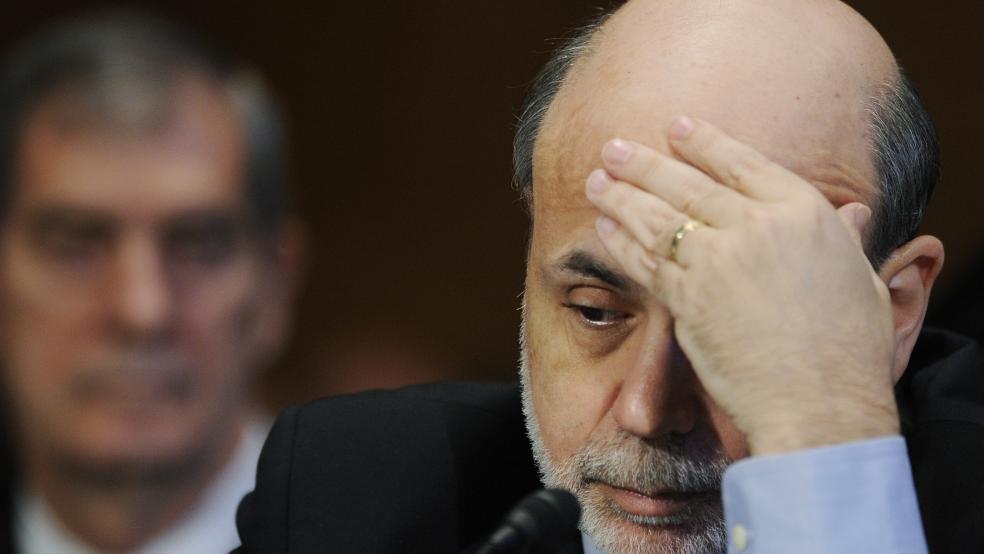

At a recent round-table discussion with reporters at the Brookings Institution, Former Fed Chair Ben Bernanke and former Treasury Secretaries Henry Paulson and Timothy Geithner expressed concern than policymakers would be more constrained, and have weaker emergency powers, in responding to the next large-scale crisis. "Better defenses, weaker arsenal," said Geithner, according to USA Today.

The three also voiced concerns about the dangers of rising deficits and mounting national debt.

Bernanke: The former Fed chair “criticized the deficit-ballooning tax cuts and spending increases agreed to by President Donald Trump and Congress as ill-timed,” Bloomberg’s Rich Miller reports. “Bernanke noted that they come as the country is at or near full employment. He also voiced concern about the longer-term consequences of rapidly rising government debt.”

Geithner: "I think the deficit fever of '09 through '13 was mistimed," the former Treasury secretary said, according to USA Today, noting that deficit concerns served to reduce stimulus spending that might have helped speed the recovery. "I say the new complacency about the larger deficits is mistimed, too."

Paulson: “If we don’t act, that is the most certain fiscal or economic crisis we will have,” the Treasury secretary under President George W. Bush said of the national debt. “It will slowly strangle us.” Paulson also said that now, when the economy is growing, is the best time to address “some of the persistent structural issues that are going to determine our long-term economic competitiveness.” Those issues, he said, include the deficit, immigration, income disparities and what automation and globalization are doing to wages.