'Tax Reform Is Hard. Keeping Tax Reform Is Harder': Highlights from the House Tax Cuts Hearing

The House Ways and Means Committee held a three-hour hearing Wednesday on the effects of the Republican tax overhaul. We tuned in so you wouldn’t have to.

As you might have expected, the hearing was mostly an opportunity for Republicans and Democrats to exercise their messaging on the benefits or dangers of the new law, and for the experts testifying to disagree whether the gains from the law would outweigh the costs. But there was also some consensus that it’s still very early to try to gauge the effects of the law that was signed into effect by President Trump less than five months ago.

“I would emphasize that, despite all the high-quality economic research that’s been done, never before has the best economy on the planet moved from a worldwide system of taxation to a territorial system of taxation. There is no precedent,” said Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office. “And in that way we do not really know the magnitude and the pace at which a lot of these [effects] will occur.”

Some key quotes from the hearing:

Rep. Richard Neal (D-MA), ranking Democrat on the committee: “This was not tax reform. This was a tax cut for people at the top. The problem that Republicans hope Americans overlook is the law’s devastating impact on your health care. In search of revenue to pay for corporate cuts, the GOP upended the health care system, causing 13 million Americans to lose their coverage. For others, health insurance premiums will spike by at least 10 percent, which translates to about $2,000 a year of extra costs per year for a family of four. … These new health expenses will dwarf any tax cuts promised to American families. … The fiscal irresponsibility of their law is stunning. Over the next 10 years they add $2.3 trillion to the nation’s debt to finance tax cuts for people at the top – all borrowed money. … When the bill comes due, Republicans intend to cut funding for programs like Medicare, Medicaid and Social Security.”

David Farr, chairman and CEO of Emerson, and chairman of the National Association of Manufacturers: “We recently polled the NAM members, and the responses heard back from them on the tax reform are very significant and extremely positive: 86 percent report that they’ve already planned to increase investments, 77 percent report that they’ve already planned to increase hiring, 72 percent report that they’ve already planned to increase wages or benefits.”

Holtz-Eakin: “No, tax cuts don’t pay for themselves. If they did there would be no additional debt from the Tax Cuts and Jobs Act, and there is. The question is, is it worth it? Will the growth and the incentives that come from it be worth the additional federal debt. My judgment on that was yes. Reasonable people can disagree. … When we went into this exercise, there was $10 trillion in debt in the federal baseline, before the Tax Cuts and Jobs Act. There was a dangerous rise in the debt-to-GDP ratio. It was my belief, and continues to be my belief, that those problems would not be addressed in a stagnant, slow-growth economy. Those are enormously important problems, and we needed to get growth going so we can also take them on.”

“Quite frankly, it’s not going to be possible to hold onto this beneficial tax reform if you don’t get the spending side under control. Tax reform is hard. Keeping tax reform is harder, and the growth consequences of not fixing the debt outlook are entirely negative and will overwhelm what you’ve done so far.”

Steven Rattner: "We would probably all agree that increases in our national debt of these kinds of orders of magnitude have a number of deleterious effects. First, they push interest rates up. … That not only increases the cost of borrowing for the federal government, it increases the cost of borrowing for private corporations whose debt is priced off of government paper. Secondly, it creates additional pressure on spending inside the budget to the extent anyone is actually trying to control the deficit. … And thirdly, and in my view perhaps most importantly, it’s a terrible intergenerational transfer. We are simply leaving for our children additional trillions of dollars of debt that at some point are going to have to be dealt with, or there are going to have to be very, very substantial cuts in benefits, including programs like Social Security and Medicare, in order to reckon with that.”

Coming Soon: Deductible Relief Day!

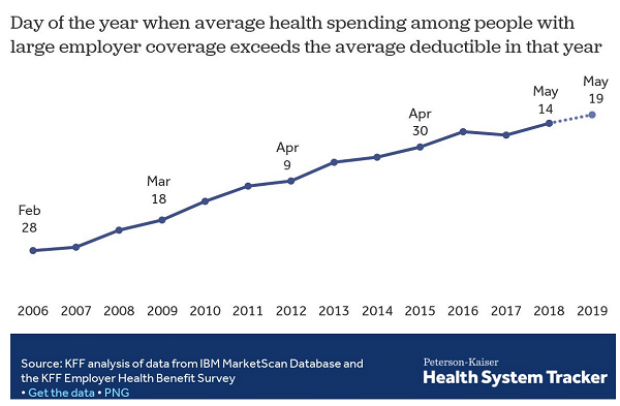

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

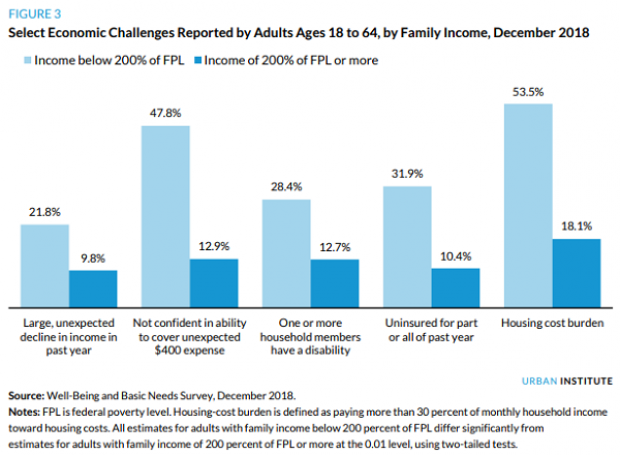

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

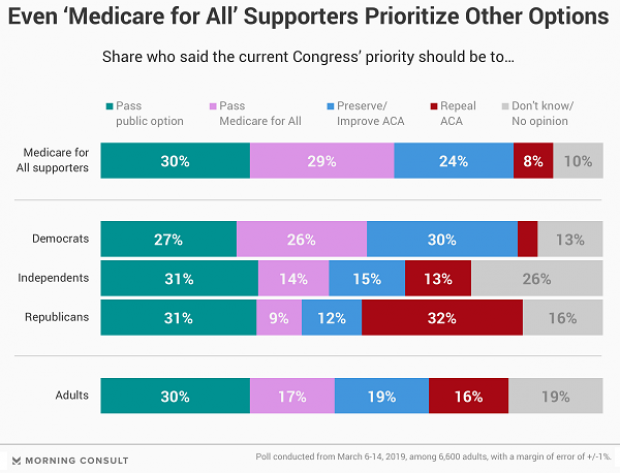

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

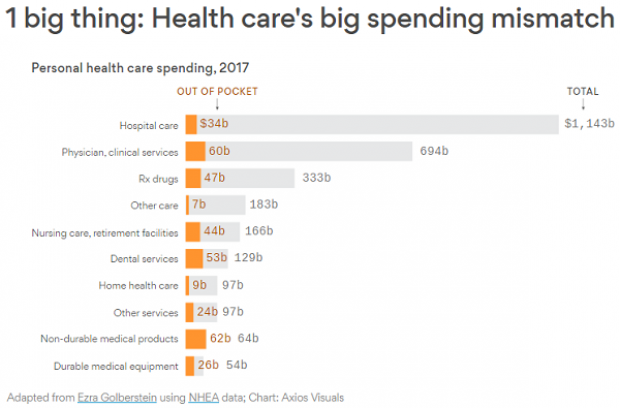

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.