The Republican tax cuts are paying off bigtime for Apple shareholders.

The iPhone maker on Tuesday reported stronger-than-expected earnings for the first three months of the year — but its operating results were overshadowed by the bonanza it announced for shareholders: Apple said it would buy back an additional $100 billion worth of stock from its investors and increase its dividend payout by 16 percent.

Apple’s new plans for its huge $252 billion overseas cash hoard are bound to fuel the debate over who benefits from the GOP’s tax overhaul. Here’s what you need to know:

Apple’s new buyback plan is absolutely huge: The $100 billion program is reportedly the largest ever. It’s about the size of Ecuador’s GDP, or enough cash to buy companies like Lockheed Martin, Goldman Sachs or Starbucks. It also dwarfs other buyback plans announced in recent months by U.S. companies. Senate Democrats have been tracking buyback announcements since the Republican tax law was passed, and Apple’s is far and away the largest, accounting for more than a quarter of the $390 billion total so far. (Cisco’s $25 billion increase in its repurchase program, announced in February, is second on the list.) And Reuters’ Noel Randewich reports that U.S. companies announced a combined total of $50.4 billion in new buyback plans last month, up from $38.1 billion worth of planned buybacks announced a year earlier, according to TrimTabs Investment Research. Over the first quarter, U.S. companies announced a record $242.1 billion worth of buybacks, according to TrimTabs.

And it’s absolutely the result of the new tax law: Apple CEO said as much on an earnings call with analysts: “Tax reform makes it possible for us to execute our program more efficiently, both through share repurchases and payment of dividend to the tens of millions of investors who own Apple stock either directly or indirectly from large pension funds to individuals with retirement accounts.” Apple is a prime beneficiary of the new law that dropped the corporate tax rate from 35 percent to 21 percent and cut the rate on corporate profits repatriated from foreign countries even lower. “Its effective tax rate (the amount it actually pays) has dropped by about 10 percent between this year and last, and it’s saving an estimated $47 billion on taxes on profits earned overseas as well,” Vox reports.

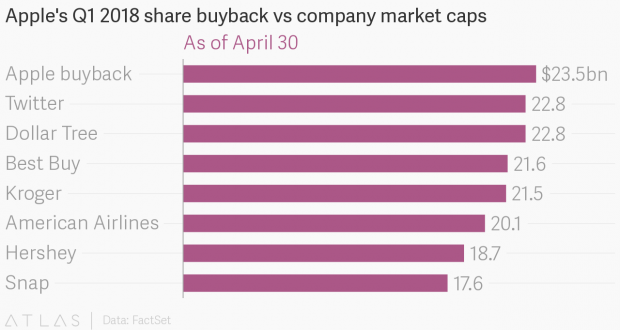

Apple has already been showering huge amounts of cash on its investors. Apple has already paid out some $275 billion to shareholders, including about $200 billion worth of share repurchases through multiple buyback programs dating back to 2012. The company spent $23.5 billion buying its own stock in the most recent quarter — a record for any U.S. company, according to S&P Dow Jones Indices. To put that figure in some context, it’s larger than the stock market value of 275 companies in the S&P 500 index, including some very familiar names, as this chart from Quartz shows:

Apple also paid out $3.2 billion in dividends in the quarter. That’s before its announced 16 percent increase.

Apple says it still has plenty of money to invest: The company has said it will invest more than $350 billion in the U.S. economy over the next five years, including $30 billion in capital expenditures, and says it expects to add 20,00 new jobs. "Our balance sheet and our cash flow generation are strong, and that allows us to invest significantly in our product roadmap and still return a very meaningful amount of capital to our shareholders," Apple CFO Luca Maestri told analysts.

But for now the tax cut winners are clear: “Apple Inc lavished cash on its shareholders like no company in history in the first three months of the year and it intends to keep doing so, making the iPhone maker’s investors the clearest winners yet from last year’s sweeping U.S. corporate tax cuts,” Reuters’ Randewich wrote.