Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

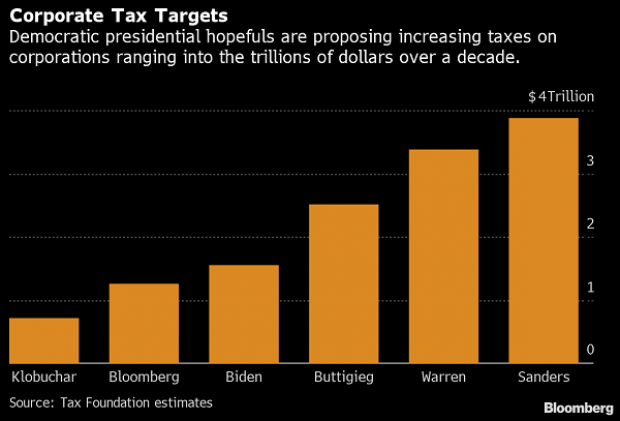

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

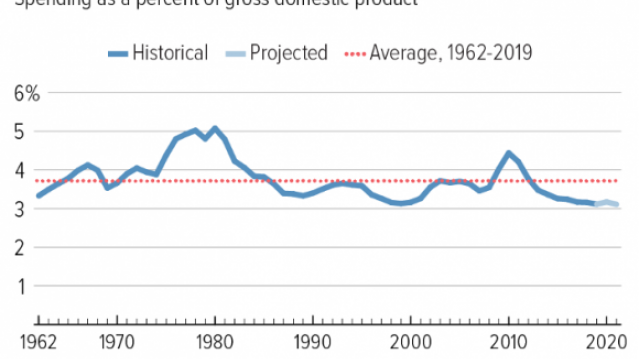

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

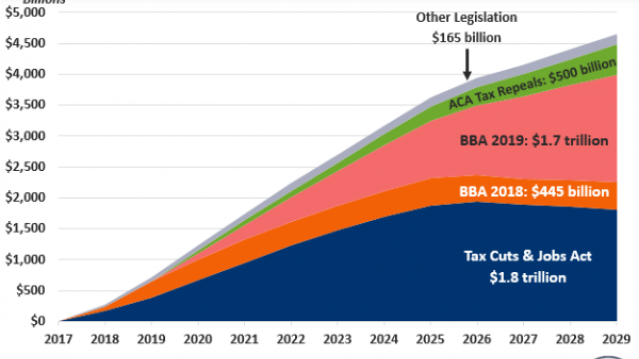

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

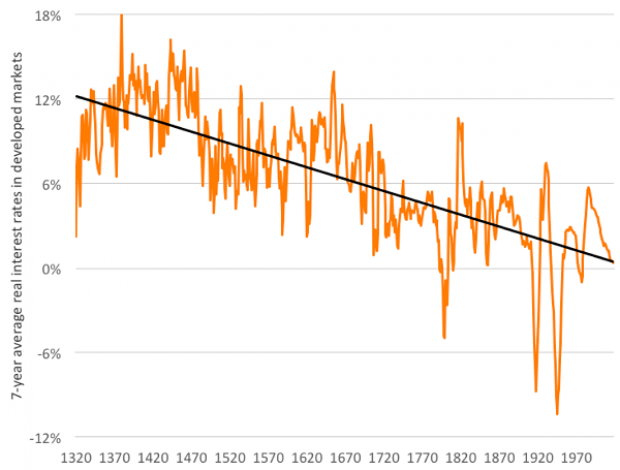

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

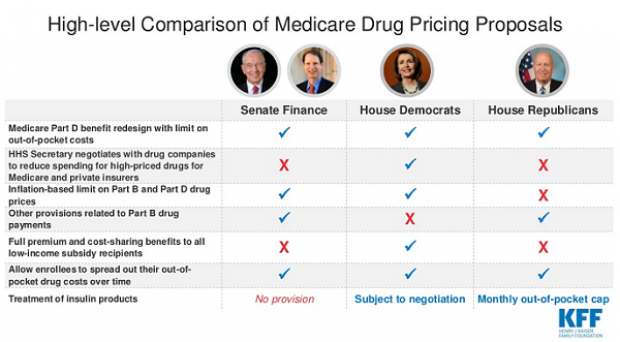

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.