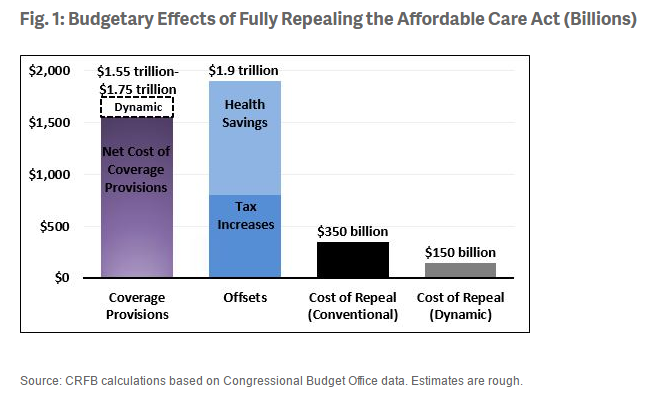

Congressional Republicans have begun the process of repealing the Affordable Care Act, which will not only force them to come up with a plan to replace the program, but as an analysis released by the Committee for a Responsible Federal Budget demonstrates, to fill a hole in the federal budget of as much as $350 billion through 2027.

The massive health care law is a combination of mandates, taxes, regulations and undoing it wholesale would involve not just repealing the things that cost the government money, like premium subsidies, but also measures that save money, like restrictions put in place to slow the growth of health care spending.

Related: Obamacare Repeal Will Test the Definition of ‘Insurance’

The CRFB’s $350 billion figure (potentially only $150 billion under a dynamic scoring model) is most properly seen not as a guaranteed shortfall so much as a baseline. Republicans, as much as they detest Obamacare, have repeatedly said that the plan is not to repeal it and walk away, but to engineer a replacement that delivers health insurance coverage to the same number of people at a lower cost, with fewer requirements on individuals and businesses.

How they will do that remains a large and still unanswered question, and the CRFB analysis provides a useful breakdown of some of the challenges that the GOP will face in both repealing the ACA and keeping their promises about a replacement.

The biggest money-saver would be a full-on repeal of the law’s coverage provisions, CRFB finds. “Of the $1.55 trillion in savings from repealing the ACA’s coverage provisions, $900 billion comes from repealing insurance and cost-sharing subsidies and $1.10 trillion from repealing the Medicaid expansion. These savings are partially offset by $250 billion of cost from repealing the legislation’s insurance mandate penalties and another $200 billion from interactions and various other provisions.”

However, that would also result in about 23 million people losing their insurance -- something Republicans have repeatedly promised not to allow.

Related: Republicans Are Having Second Thoughts About Scrapping Obamacare Taxes

Those savings, though, would be offset by repealing the law’s revenue provisions.

“About half of the $800 billion of revenue loss from repealing ACA’s taxes comes from removing the 0.9 percent Medicare payroll surtax on wages above $200,000 ($150 billion) and the 3.8 percent surtax on investment income above the same threshold ($250 billion). Another quarter of the revenue loss comes from repealing various fees on insurance companies, medical device companies, and drug manufacturers.

“Repealing the “Cadillac tax” on high-cost insurance plans costs $100 billion over a decade; those costs are slated to grow substantially over time, and repealing the Cadillac tax without a replacement would also remove a key tool in helping to slow overall health care cost growth.”

Finally, CRFB notes, total repeal of Obamacare would entail getting rid of numerous measures that have successfully slowed the rate of growth in healthcare spending, and which are expected to save $1.1 trillion between now and 2027.

Related: GOP and Dem Governors Are Closing Ranks Against Obamacare Repeal

Also possible, though, are various versions of a partial repeal of the ACA, leaving in place certain elements of the law and eliminating others. This would, in theory, break the GOP’s promise of total repeal, but under some circumstance would give lawmakers enough financial running room to at least make a credible attempt at a replacement.

For example, CRFB reports, if all the existing coverage provisions were repealed, but the revenue and cost-saving measures were kept in place, there would be $1.55 trillion (or $1.75 trillion on a dynamic scoring basis) available to fund a replacement to cover the 23 million people expected to lose coverage under the original legislation.

In the end, none of these things will happen in a vacuum. The GOP can’t simply flip a switch and turn off programs that have been baked into the nation’s healthcare infrastructure over the course of years, and many of these programs will likely be phased out over time. But the report offers a good bird’s-eye view of the scope of the challenge Republican lawmakers have set for themselves.