Home prices have finally returned to levels seen before the housing bust nearly a decade ago, but slow wage growth over the same period is making it harder for many people to afford houses.

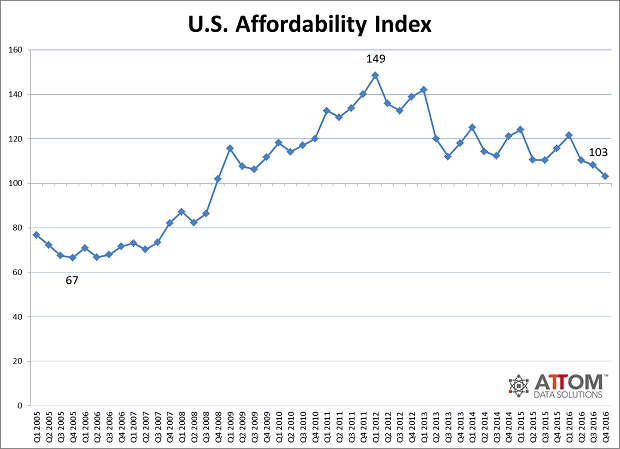

The affordability index tracked by Attom Data Solutions hit its lowest level in the past eight years, with home prices growing faster than wages in eight of 10 markets. Home prices have shot up 60 percent since bottoming out in 2012, compared to a wage increase during that time of just 1 percent.

Related: 9 States With the Hottest Housing Markets for 2017

“Rapid home prices appreciation and tepid wage growth have combined to erode home affordability during this housing recovery and the recent uptick in mortgage rates only accelerated that trend in the fourth quarter,” ATTOM Data Solutions senior vice president Daren Blomquist said in a statement.

Across the country, the average wage earner needs to spend 36.9 percent of his income to buy a median-priced home.

At the same time that homes are getting less affordable, it’s also getting more difficult to get a mortgage. A separate study from CoreLogic finds that the average credit score for homebuyers in the third quarter increased to 739. Borrowers also have slightly less debt and are putting down slightly higher down payments than borrowers were a year ago.

Higher prices and tighter credit are among the factors that are keeping more young American adults in their parents’ home. A new report from Trulia and The Wall Street Journal finds that nearly 40 percent of adults under age 34 were living with either their parents, siblings or other relatives -- the highest percentage since 1940.