The flurry of deals in the last few weeks — including AT&T’s eye-popping $85 billion bid for Time Warner announced last weekend — means that 2016 will be another big year for mergers and acquisitions.

Slideshow: The 15 Biggest Corporate Mergers and Acquisitions

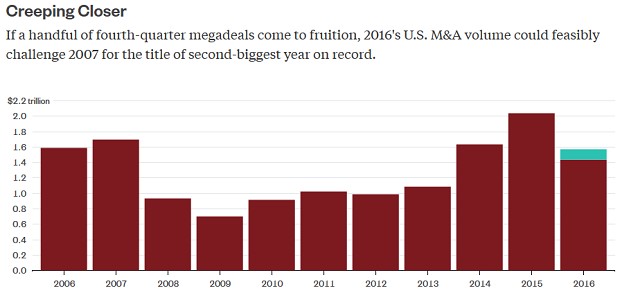

The annual record for M&A activity was set in 2015, when $2 trillion worth of deals was recorded. The fourth quarter of 2016 would need several super-deals for this year to outdo 2007, currently the No. 2 year for M&A activity, with $1.7 trillion in deals. So far, $1.4 trillion in M&A transactions have been recorded in 2016, so the second place ribbon is within reach.

Besides the possible AT&T-Time Warner deal, the big deals this month include British American Tobacco’s $47 billion offer for a stake in Reynolds American. Then there’s Qualcomm’s bid for NXP Semiconductors, worth $46 billion, and the CBS-Viacom merger, valued at over $30 billion.

Before this month, M&A activity in the U.S. was declining in terms of the number of deals but the dollar volume was up, according to a report from FactSet. The number of deals slipped 5.4 percent to 1,005, compared to 1,062 in August. But September’s spending was up 28.3 percent.

Source: Bloomberg

The sectors that saw the biggest year-over-year gains in M&A deal activity in the third quarter were process manufacturing (132 in 3Q 2016 vs. 118 in 3Q 2015), government services (13 vs. 3), non-energy minerals (71 vs. 63), energy minerals (46 vs. 38) and communications (46 vs. 41).

AT&T-Time Warner falls in the latter category, and would be the 15th largest M&A deal of all time by some measures. (The complexity of M&A deals can make apples-to-apples comparisons difficult.)

The size of the deal doesn’t guarantee success, of course — just look at the disaster that followed the AOL-Time Warner deal in 2000, the second-biggest ever.

Past studies also show that mergers are risky. The failure rate falls between 70 percent and 90 percent, depending on the study. Failures are often driven by poor integration planning, a lack of synergy evaluation and due diligence, business culture conflicts, controversial management team selection and inadequate communication with employees, shareholders and vendors.

Aside from their success or failure, which merger takes the cake in terms of size? Click here to see the biggest M&A deals ever.