When it comes to tax policy, Hillary Clinton would like the U.S. economy to eat its vegetables and grow stronger over the long run, while Donald Trump and Republicans in the House of Representatives are pushing an eat-dessert-first plan that would deliver a short-term sugar high followed by sluggishness later on.

That, in summary, is the finding of a detailed analysis of the tax plans put forward by both major party presidential candidates yesterday by the Penn Wharton budget model, a program at the University of Pennsylvania’s Wharton School.

Related: Here’s Why Goldman Paid Clinton a Bundle for That Speech

The Penn Wharton model, built in collaboration with the Washington-based Tax Policy Center, delivers both static and dynamic analysis of the impact the candidates’ tax plans would have on economic growth, the federal deficit and more. It also offers the opportunity to compare both plans with a third option, the tax plan put forward by Republicans in the House of Representatives.

The official summary of the findings is fairly straightforward:

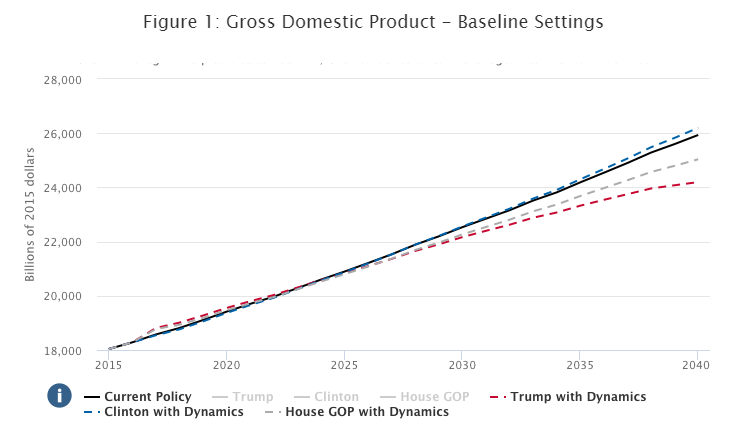

- “In the short run, Hillary Clinton’s tax plan dampens economic growth. However, in the long run her tax plan increases economic growth relative to current policy because her tax plan reduces federal debt relative to current policy.”

- “In the short run, Donald Trump’s tax plan boosts economic growth. However, in the long run, his tax plan reduces economic growth compared to current policy because his tax plan increases federal debt relative to current policy.”

However, the Penn Wharton model is more than just a fixed set of findings. The program built an interactive online simulator that allows users to adjust the assumptions implicit in any analysis of this sort, with immediate feedback that shows how the results are affected.

Related: A Trump Television Network? It Sure Would Explain a Lot

Do you believe the labor supply is highly sensitive to tax rates? The model lets you change labor supply elasticity assumptions. Want to see what would happen to the economy if federal spending was slashed by 10 percent? Go for it. (Hint: It doesn’t do as much as you might think.)

Under Trump’s proposal, the economy would grow slightly faster than the baseline estimate following implementation, adding about 1.12 percent to GDP in the first few years. Clinton’s, by contrast, would throttle growth back by a small amount -- about 0.19 percent below the baseline.

However, after the first few years, the effects begin to reverse. At the five-year mark, projected GDP under both plans is virtually identical. At the ten-year mark and beyond, it’s the Trump plan that produces growth below the baseline, while the Clinton plan generates growth moderately above the current policy projection.

(The model finds that the Trump plan could consistently produce economic growth above the baseline, but only if it is accompanied by a huge infusion of foreign investment into the U.S. economy.)

Related: The Value of Donald Trump’s Brand Is Taking a Beating

The reason, in large part, is the relative impact the two plans have on the federal deficit and debt. While neither of the candidates is proposing a way to actually balance the budget in the long term, the Trump plan adds far more to the federal debt than the Clinton plan in order to offset a massive revenue loss from proposed tax cuts.

While the Clinton plan would keep the deficit below $500 billion in 2015 dollars for the length of the simulation (the model extends to 2040), Trump starts with a $588 billion deficit in 2017 and increases it every year, adding more than $1 trillion to the federal debt every year after 2026.

In conclusion, the Penn Wharton model finds, “Donald Trump’s tax plan reduces taxes on business and higher income Americans, boosting investment and work, which results in more economic growth. However, in the long run, the Trump tax plan increases federal debt more than current policy, resulting in less economic growth. The Trump tax plan can increase economic growth in the long run, but only if foreign investment flows are high enough to offset the impact of his tax plan’s higher federal debt.”

Clinton’s plan, it finds, “slightly reduces taxes on wage income while increasing taxes on businesses and, in the short run, dampens investment and work, which results in less economic growth. However, in the long run, the Clinton tax plan reduces federal debt relative to current policy resulting in more economic growth. The Clinton tax plan does not need foreign capital to fund domestic investment to boost economic growth in the long run because her tax plan reduces federal debt relative to current policy.”