If Republican presidential nominee Donald Trump really believes that his economic policies will be able to boost US economic growth annually to 4 percent, then President Trump will have his work cut out for him if the International Monetary Fund’s latest projections are accurate.

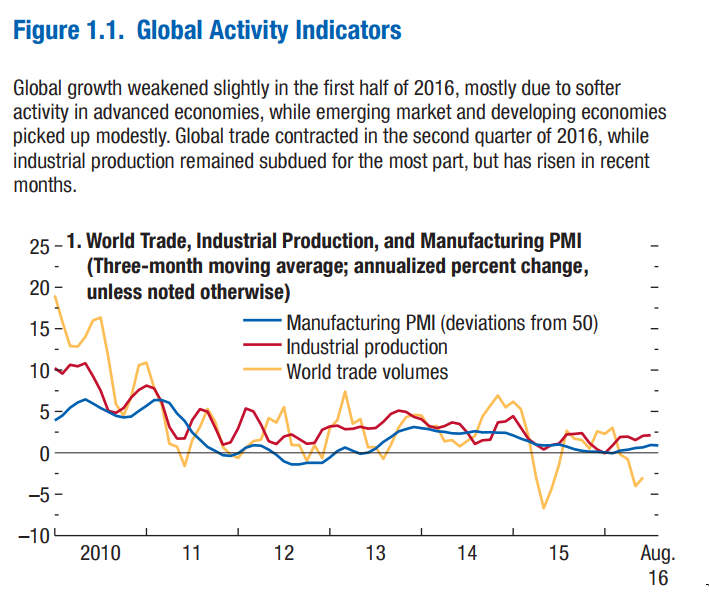

The IMF’s World Economic Outlook, published today, projects a drop in global economic growth to 3.1 percent in 2016, and only a slight improvement, to 3.4 percent, in 2017. The decline is driven, in no small part, by what the IMF’s economists described as weaker-than-expected U.S. activity in the first half of the year as well as materialization of an important downside risk with the Brexit vote.” (The latter refers to the decision by voters in the United Kingdom to leave the European Union and its single market.)

Related: Robots Muscle in on the Gig Economy

The US economy will growth at a sluggish 1.6 percent annual rate through 2016, and while it is expected to jump to 2.2 percent in 2017, will begin trending downward again after that.

IMF chief economist Maurice Obstfeld stated, “Global growth remains weak, even though it shows no noticeable deceleration over the last quarter. The new World Economic Outlook sees a slowdown for the group of advanced economies in 2016 and an offsetting pickup for emerging and developing economies.

“Taken as a whole, the world economy has moved sideways. Without determined policy action to support economic activity over the short and longer terms, sub-par growth at recent levels risks perpetuating itself—through the negative economic and political forces it is unleashing.”

In fact, it is the risk arising from “political discord and inward-looking politics” that IMF economists see as the main threat to further worsening in the global economic outlook, and it points to the US elections and the Brexit vote as related phenomena.

Related: Dodging Taxes? Trump’s Got Nothing on Apple, Citigroup and Nike

“The Brexit vote and the ongoing U.S. presidential election campaign have highlighted a fraying consensus about the benefits of cross-border economic integration,” they wrote. “Concerns about the impact of foreign competition on jobs and wages in a context of weak growth have enhanced the appeal of protectionist policy approaches, with potential ramifications for global trade flows and integration more broadly.”

In combination with increasing concern about income inequality and persistently low productivity growth uncertainty may “lead firms to defer investment and hiring decisions, thus slowing near-term activity, while an inward-looking policy shift could also stoke further cross-border political discord,” they add.

Within the United States, IMF economists said that the lowered growth rate appears to be a combination of reduced business investment as well as three consecutive quarters of declining non-farm labor productivity.

“The U.S. economy has lost momentum over the past few quarters, and the expectation of a pickup in the second quarter of 2016 has not been realized, with growth estimated at 1.1 percent at a seasonally adjusted annual rate.”

Related: How Reduced Middle Class Wages Are Stagnating the US Economy

While consumption growth is still strong, and the job market has largely bounced back from the declines that followed the Great Recession, business spending on fixed investments is still weak. It “appears to reflect the continued (albeit moderating) decline in capital spending in the energy sector, the impact of recent dollar strength on investment in export-oriented industries, and possibly also the financial market volatility and recession fears of late 2015 and early 2016.”

The combination of stalled growth in countries like the US, and a mixed bag of strength and weakness in emerging markets raise “worrisome prospects” for future global growth, IMF economists concluded. And “make the need for a broad-based policy response to raise growth and manage vulnerabilities more urgent than ever.”