Did you notice? The past four weeks have been the most boring market period in 21 years, according to LPL Financial. After the historic post-Brexit rebound, U.S. large-caps have been relegated to a super-tight trading range, with the S&P 500 hovering in a mere 20-point zone between 2,160 and 2,180.

Don’t get lulled into thinking this will keep going. Beneath the surface, volatility is percolating. The source: Crude oil. West Texas Intermediate traded below the $40-a-barrel benchmark on Monday for the first time since April. While it’s now ticked back above that mark, it’s still down more than 20 percent from its high. Energy is in a new bear market, driven by a return of supply/demand headwinds and worries about bloated inventories.

Related: Home Prices Hit an All-Time High: Is This Another Bubble?

Oil and gas stocks are suffering as a result, and as concerns reemerge over the financial health of high-cost U.S. shale producers, the next shoe to drop will be high-yield energy bonds, which were at the epicenter of the oil selloff last August.

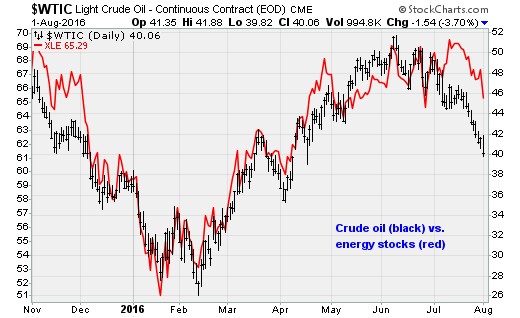

The selling is just getting started, as both energy stocks and energy bonds have disconnected from the multi-week selloff in crude oil. The chart above shows the extent of the disconnect. As energy stocks catch up to the reality of crude oil prices, the market will feel the pressure. In a sign of the times, the post-earnings decline in Exxon Mobil (XOM) has pushed its market cap below Amazon (AMZN) for the first time ever.

XOM Market Cap data by YCharts

Investors can't ignore the trend. Optimism that the February low was "The Bottom" for crude oil pushed energy sector stock valuations to eye-watering levels. Consider that Exxon Mobil's current trailing 12-month price-to-earnings ratio is nearly double what is considered fair value. There's a lot of optimistic sentiment justifying these share price levels.

Related: Throwing Shade on the Dow's Record High

Bank of America Merrill Lynch Chief Investment Strategist Michael Hartnett notes that while energy stocks have started to price reality back in, high-yield junk bonds are still trying to ignore it.

Bond prices are too high relative to where oil is trading, as shown in the chart above. Once weakness materializes, the focus will then turn to higher loan write-downs in the sector and rising credit offsets at banks such as Wells Fargo (WFC), perpetuating the cycle, as investors figure out that the industry is rapidly burning through cash. Share buybacks and dividends will soon be curtailed if current trends continue.

Hartnett wrote in a note to clients that this could all play out as a repeat of last summer's oil-driven market selloff — which saw the S&P 500 lose more than 12 percent.

I covered the supply-demand problems facing crude oil and the threat this created for financial markets in recent articles here and here, focusing on the acute oversupply in gasoline as the summer driving season prepares to wind down. The inventory backlog in refined products has pinched refinery margins, slowed cracking activity, and is pushing the backlog up the supply chain into crude.

The oversupply is only going to get worse.

Related: The US Now Has More Oil Reserves Than Saudi Arabia or Russia

Libya announced this week that oil ports closed due to civil unrest are to resume exports within two weeks. Iran is aggressively ramping up production, with a goal of pushing output to an eight-year high of 4 million barrels per day by the end of the year.

And in a sign that Saudi Arabia isn't interested in relenting in its two-year-old price war with U.S., Russian and Iranian suppliers, state-owned Saudi Aramco just announced that it would cut the price of Arab light sweet exported to Asian markets by the most in 10 months, to $1.30 below the regional benchmark.

On top of tall that, on July 20, Russia's energy minister said he did not see a coordinated action on curtailing oil output with OPEC. It'll be hard for rumors of another supply freeze to squeeze the shorts and force oil higher like they did back in February.

The wildcard, as it's been for the last eight years, is the Federal Reserve. A strong jobs report on Friday will increase the odds of an interest rate hike in September, which in turn will further lift the U.S. dollar and put exchange-rate pressure on crude oil.

This "boring" market calm cannot last much longer.