A scathing new report by a budget watchdog group warns that neither Donald Trump nor Hillary Rodham Clinton, the presumptive Republican and Democratic presidential nominees, is serious about addressing the long-term debt now on target to reach historic levels in the coming decade.

To the contrary, the study by the non-partisan Committee for a Responsible Federal Budget warns both Trump’s and Clinton’s tax and spending initiatives would greatly exacerbate the problem.

Trump’s plan would more than double the growth of the national debt between now and 2026 because of deep across the board tax cuts the study claims.

Related: Experts Weigh Donald Trump’s Tax Plan, and Find It Wanting

At present, publicly held debt totals $14 trillion – or 75 percent of the Gross Domestic Product and nearly twice the historic average. Absent any change in policy to contain entitlement and health care spending and interest on government borrowing, the debt will increase by an additional $10 trillion over the coming decade, according to Congressional Budget Office projections.

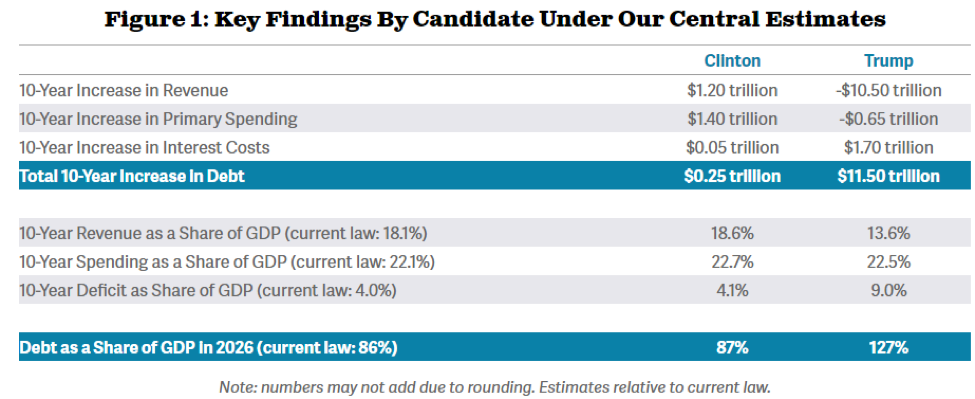

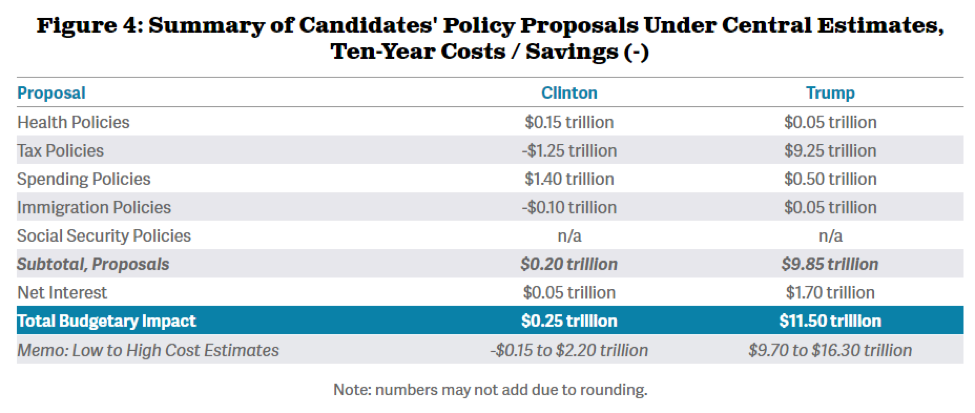

However, Clinton’s proposals for major domestic spending increases and relatively modest tax hikes would add $250 billion more to the debt over the coming decade, according to the new CRFB analysis. Meanwhile, Trump’s across the board tax cuts and his opposition to curtailing Social Security, Medicare and other entitlements would add an astounding $11.5 trillion to the long term debt during that same period.

Viewed another way, Clinton’s budget and tax policies would boost the publicly held debt to 87 percent of the overall economy by 2026, while Trump’s approach would cause the debt to skyrocket to 127 percent of GDP over that same period, an unprecedented post-World War II level.

“What we find is that both candidates, at a time when our debt is already at record levels, would not put forth a plan that would put the debt on a sustainable path,” Maya MacGuineas, president of the CRFB, said Sunday on the CBS News “Face the Nation” program. “But that said, the plan of Donald Trump would add much, much more to the debt than Hillary Clinton’s.”

Related: Trump Retreats on Comments on Raising Taxes on the Wealthy

The group’s report – the latest in a series of analyses of the fiscal policies of Republican and Democratic presidential candidates – warns that unrestrained rising debt will eventually “slow wage growth, raise interest rates, leave the country less equipped to deal with a national crisis, and set the stage for abrupt and painful adjustments in the future.”

MacGuineas said that the global economic uproar over last week’s “Brexit” vote in Great Britain “is a great reminder of why we need to have a debt that’s under control, because emergencies will happen, because downturns will happen, and you want to have a strong fiscal house to get started.”

(Debt as a share of GDP in 2026)

MacGuineas was reflecting the view of many budget hawks who lament the long term growth of the national debt – which now actually exceeds $19.2 trillion when factoring in intergovernmental borrowing for Social Security and other programs.

However, many conservative Republicans contend that Trump’s tax cuts would help grow the economy and end up costing the Treasury far less than the CFRFB and other group’s “static” economic models would suggest. Democrats, meanwhile, argue that the annual budget deficit is at the lowest point since the 2008 financial crisis and that additional domestic spending is essential to spurring the economy.

Related: Clinton’s Plan: New Taxes, New Investment, Same Challenges

For Clinton, the increase in the debt would result from her proposed increase in spending on health care, education, infrastructure investment and other domestic initiatives that would not be fully offset by her proposed increases in revenue. On a net basis, she would increase domestic spending by $1.45 trillion over the coming decade, while raising only $1.2 trillion of offsetting tax revenue.

Trump, by contrast, would seek massive tax relief for Americans that would reduce tax revenue by $10.5 trillion over the next ten years while only approving $650 billion of program cuts.

The report says that if Trump and Clinton were serious about putting the long-term debt on a “sustainable” path, there are things they could do – although most of them are totally impractical or at odds with the two candidate’s platforms.

Trump, for example, would have to slash government spending by as much as 37 percent, raise tax rates by as much as 20.5 percent, somehow accelerate GDP growth by 160 percent to 390 percent, or do some combination of all three. Trump insists his tax cuts would help raise revenue when viewed through the prism of “dynamic scoring,” and he has vowed to protect Social Security, Medicare and other entitlement programs from cuts.

He insisted at one point that he could balance the budget simply by cracking down on government “waste, fraud and abuse.”

Clinton, for her part, would have to reduce spending by as much as 15 percent, raise tax rates by 3.5 percent to 8.5 percentage points or somehow boost economic growth by 35 percent to 125 percent, according to the report – or some combination of the three. That is all, of course, out of the realm of possibility.

Related: Clinton’s Tax Hikes on the Rich Could Raise $1.1 Trillion Over 10 Years

Clinton has been under pressure from Democratic liberals to greatly expand spending on health care, Social Security benefits, debt relief for college students and scores of other domestic programs. Moreover, she pledged that she wouldn’t raise taxes on any Americans making less than $250,000 a year.