Tall, dark and handsome is nice, but today’s singles are also looking for a mate with a solid credit score.

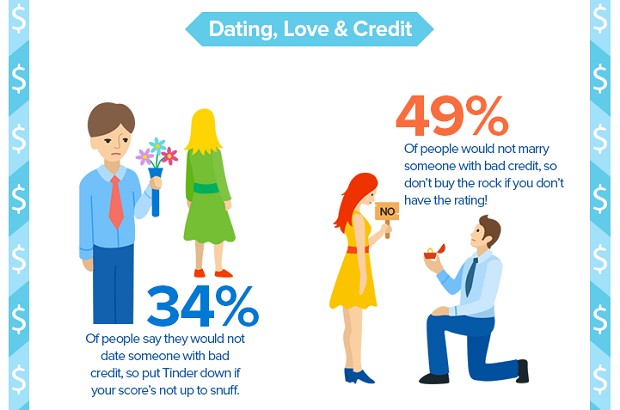

More than a third of Americans wouldn’t date someone who has a bad credit score, and nearly half say that a poor score is a deal-breaker when it comes to marriage, according to a new report from WalletHub.

When it comes to their own credit, a third of consumers said they’d get a tattoo that says “I Love Credit Scores” if it meant they could have good credit for life.

Related: Your Credit Score: What It Is and Why It’s So Important

Of course, it is possible to maintain good credit without permanently disfiguring your body. Start by paying your bills on time (setting reminders of auto payments can help) and putting any extra money — after you’ve established an emergency savings account — toward paying down the debt with the highest interest rates.

Even if you manage to find a partner who loves you in spite of a poor credit score, you should probably still work on fixing it. After all, if you plan to buy (or rent) a house or a car together in the future, it will cost you far more without good credit.

At today’s rates, for example, the total interest owed on a $300,000 mortgage would cost an extra $13,200 over 30 years for an individual with a credit score of 759 rather than 760, according to myFICO.com. If you have an extremely low score, you may not be able to get a loan at all.