Undeterred by a rocky stock market in the first quarter, a record number of Americans upped their contributions to their 401(k) retirement plans. The figures follow other data showing that consumers are increasing their savings.

Fidelity reported on Friday that 13.6 percent of 401(k) investors increased their savings rate in the first quarter, topping the previous high of 12.9 percent set in the first quarter of 2015. The total savings rate for 401(k) savers, which includes individual and employer contributions, also reached a record 12.7 percent in the period, surpassing the prior record of 12.5 percent in first quarter of 2008.

Americans boosted their retirement savings even as they watched their account balances fall. The average 401(k) balance was $87,300 in the first quarter, down by less than a percent from the fourth quarter and down 5 percent from a year ago. The average IRA balance of $89,300 also decreased by similar amounts.

Related: What Your Retirement Should Look Like at Age 50

"Investors were once again exposed to market volatility in the first quarter of this year, but an increasing number of people remained steadfast when it came to savings," said Doug Fisher, senior vice president of workplace investing at Fidelity Investments, in a statement. "In order to reach their goals, retirement investors should resist reacting to short-term market events and maintain a consistent savings rate and diversified asset allocation during both market upswings and downturns."

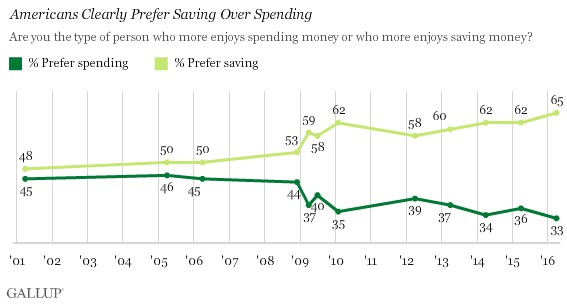

Fidelity’s numbers echo findings from two other reports this week. On Monday, a Gallup survey found that almost two-thirds of Americans prefer saving money than spending it, continuing a pro-savings trend that took root in the wake of the Great Recession. Only a third said they prefer spending. The gap between the pro-savers and pro-spenders is at its widest point since Gallup first asked the survey question in 2001.

On Friday, the Commerce Department reported that Americans barely increased their spending in March. Total spending rose 0.1 percent during the month. But income was up 0.4 percent and the savings rate increased from 5.1 percent to 5.4 percent, the highest level in the last three years.