College Students Say They’re Good with Money. Do You Believe Them?

A new study confirms it: College students think they know everything, at least when it comes to personal finance.

Nearly 60 percent of college students said that they had good or excellent financial literacy skills, according to a study released today by the American Institute of CPAs.

Despite that confidence, less than half of students say they stick to a monthly budget, nearly 40 percent had borrowed money from friends or family and more than 10 percent had missed a bill payment.

Of those surveyed, 99 percent said that personal financial management skills were important, but only a quarter said they seek out information on personal finance and incorporate it into their spending and saving habits.

“For many students, college is their first time making financial decisions,” Ernie Almonte, chairman of the AICPA’s Financial Literacy Commission said in a statement. “With this opportunity comes serious responsibility, and if they aren’t making informed, intelligent decisions it can have a negative impact on the rest of their financial lives.”

College students without a strong foundation in personal finance are more likely to take on risky debt or make poor saving decisions. But most students aren’t getting the education they need before they get to campus.

Just 17 states require high school students take a personal finance course, and only six require testing of personal finance concepts, according to the Council for Economic Education. Three out of four American teens can’t even make sense of a paystub.

But hey, at least they’re confident.

Top Reads from The Fiscal Times:

- House GOP Scores a Major Win in Obamacare Legal Challenge

- Hillary’s E-Mail Lapse ... Mistake ... Responsibility ... er, 'Apology'

- How Can You Tell There Are Russian Troops in Syria? Just Look for Some Soldier Selfies

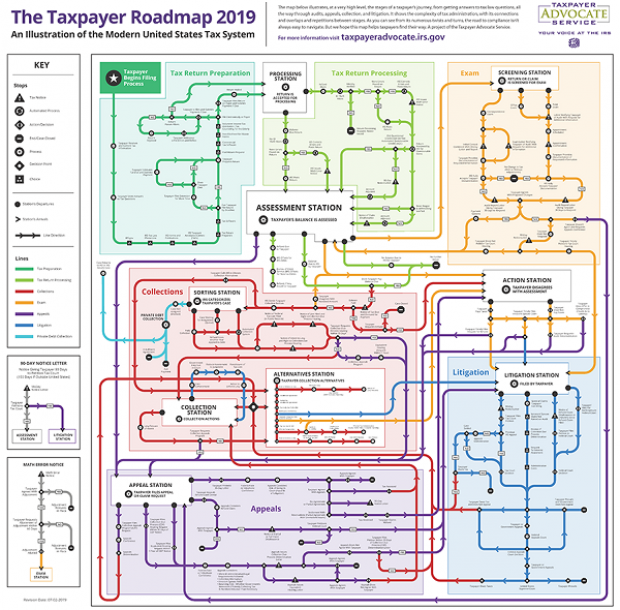

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

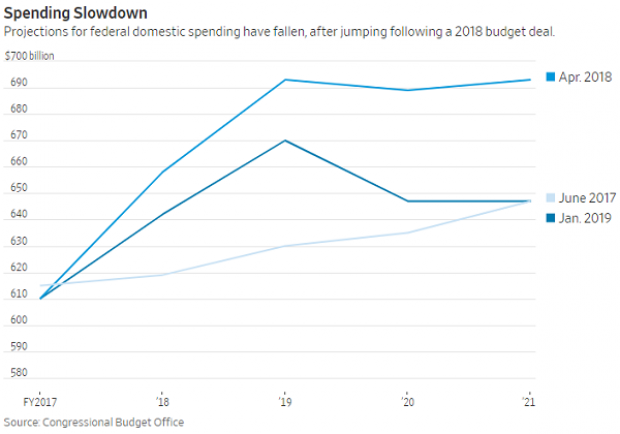

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

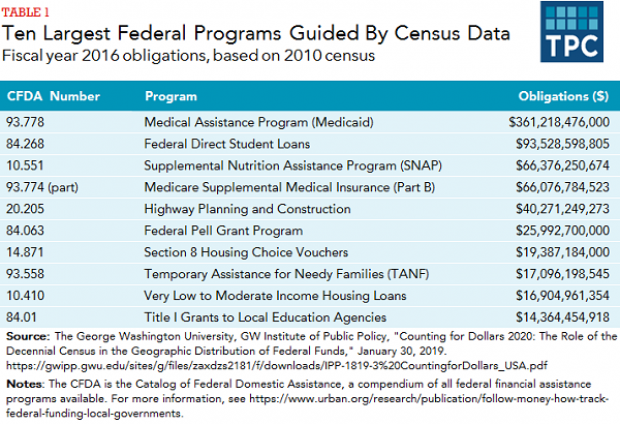

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

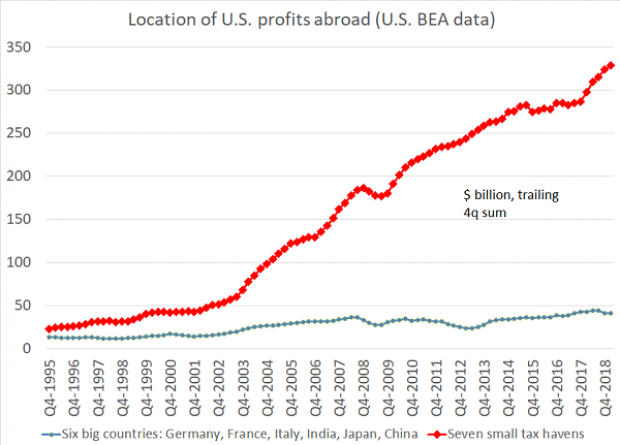

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”