College Students Say They’re Good with Money. Do You Believe Them?

A new study confirms it: College students think they know everything, at least when it comes to personal finance.

Nearly 60 percent of college students said that they had good or excellent financial literacy skills, according to a study released today by the American Institute of CPAs.

Despite that confidence, less than half of students say they stick to a monthly budget, nearly 40 percent had borrowed money from friends or family and more than 10 percent had missed a bill payment.

Of those surveyed, 99 percent said that personal financial management skills were important, but only a quarter said they seek out information on personal finance and incorporate it into their spending and saving habits.

“For many students, college is their first time making financial decisions,” Ernie Almonte, chairman of the AICPA’s Financial Literacy Commission said in a statement. “With this opportunity comes serious responsibility, and if they aren’t making informed, intelligent decisions it can have a negative impact on the rest of their financial lives.”

College students without a strong foundation in personal finance are more likely to take on risky debt or make poor saving decisions. But most students aren’t getting the education they need before they get to campus.

Just 17 states require high school students take a personal finance course, and only six require testing of personal finance concepts, according to the Council for Economic Education. Three out of four American teens can’t even make sense of a paystub.

But hey, at least they’re confident.

Top Reads from The Fiscal Times:

- House GOP Scores a Major Win in Obamacare Legal Challenge

- Hillary’s E-Mail Lapse ... Mistake ... Responsibility ... er, 'Apology'

- How Can You Tell There Are Russian Troops in Syria? Just Look for Some Soldier Selfies

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

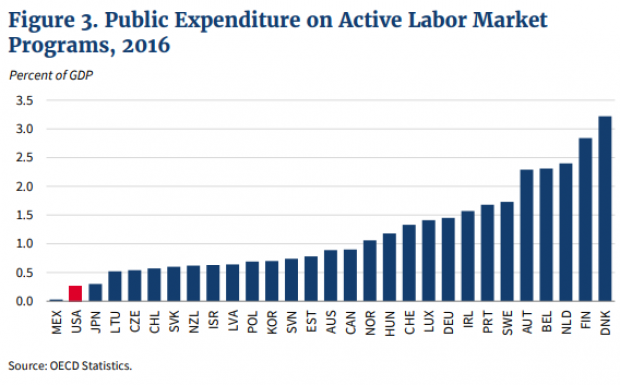

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.