The 15 Most Valuable NFL Teams

The New England Patriots may be reigning Super Bowl champs and have the most successful quarterback-coach pair in NFL history -- Tom Brady and Bill Belichick each have four championship rings with the Pats -- but they’re missing something nevertheless.

As they kick off the season tonight against the Pittsburgh Steelers, the Pats aren’t at the top of the NFL in terms of team value. That title still goes to the Dallas Cowboys, according to an analysis at Forbes.

Related: 10 Big Money NFL Draft Busts

Dallas must be feeling pretty good about beating New England at something. They had the same regular season record as the Patriots last year, with 12 wins and 4 losses, but ended the season with a loss to the Green Bay Packers in the divisional playoffs, while the Pats went on to win Super Bowl XLIX (that’s 49 for all you non-Romans out there).

Even though the Washington Redskins have been playing pretty pathetically for the past decade, they still come in third. Washington’s NFC East rival, the New York Giants, rank fourth at $2.1 billion.

Here are the 15 most valuable NFL teams:

- Dallas Cowboys - $3.2 billion

- New England Patriots - $2.6 billion

- Washington Redskins - $2.4 billion

- New York Giants - $2.1 billion

- Houston Texans - $1.85 billion

- New York Jets - $1.8 billion

- Philadelphia Eagles - $1.75 billion

- Chicago Bears - $1.7 billion

- San Francisco 49ers - $1.6 billion

- Baltimore Ravens - $1.5 billion

- Denver Broncos - $1.45 billion

- Indianapolis Colts - $1.4 billion

- Green Bay Packers - $1.38 billion

- Pittsburgh Steelers - $1.35 billion

- Seattle Seahawks - $1.33 billion

Top Reads from the Fiscal Times:

- After the Fiorina Fiasco, What Insult Will Trump Fling Next?

- $42 Million for 54 Recruits? U.S. Program to Train Syrian Rebels Is a Disaster

- A Military Coup in the U.S.? A Surprising Number of Americans Might Support One

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

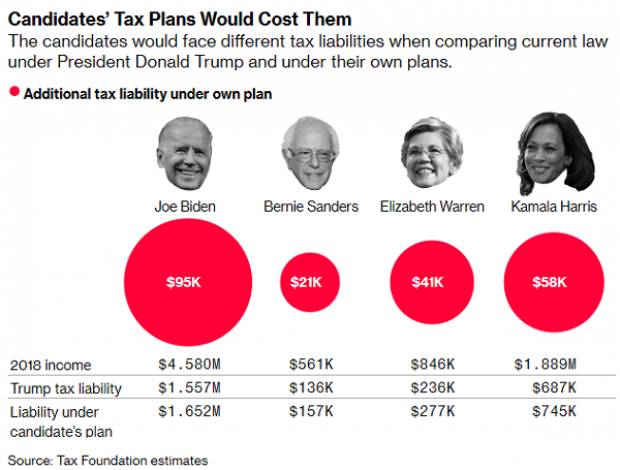

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.