SAT Scores Drop to Lowest Levels in a Decade

Student scores on the SAT have slipped to the lowest level in 10 years, according to new statistics from the College Board, again raising questions about education-reform efforts meant to improve student performance in high schools.

Just under 1.7 million students took the test this year, more than ever before. Only 41.9 percent of them reached the “SAT Benchmark” score of 1550, which indicates whether an individual is prepared for college or a career. Based on the SAT’s measure, more than 1 million students are not ready for college or for work.

Related: 10 Public Universities with the Worst Graduation Rates

The average score for high-schoolers in the class of 2015 was 1490 out of a possible 2400, down 7 points from last year. The three sections of the test — reading, writing, and math — all saw declines of at least two points.

As has been the pattern for years, certain demographic groups performed better than others. Whites and Asians, on average, received higher scores than blacks and Latinos. Students from higher-earning families received higher scores than those from families with lower income. But scores among all demographic groups except for Asians went down.

Related: The Lucrative Business of SAT Test Prep is About to Get Disrupted

The low scores are an indication that improved testing scores for elementary school students aren’t translating to gains by high-schoolers. The stark contrast in scores among racial and ethnic groups may also be a sign of systemic problems that remain a barrier to educational success. Since 2006, the scores among white students have fallen six points, pulling the average down to 1,576. The average scores for black students have dropped 14 points to 1,277.

The College Board plans to introduce a new SAT exam next year. Changes will include more of a focus on math, fewer questions on vocabulary words and an elimination of the penalty for guessing. The idea, the College Board has said, is to make the test more about what students learn in high school and the skills that college will require.

Top Reads From The Fiscal Times

- Average Family Has Saved Enough to Send One Kid to College for Half a Year

- The 5 Best and Worst Jobs for New Grads

- This College Choice Could Make You $3 Million Richer

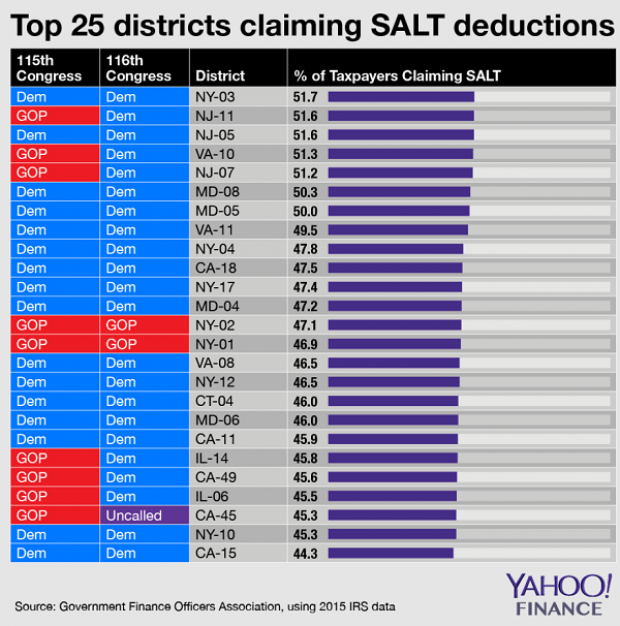

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

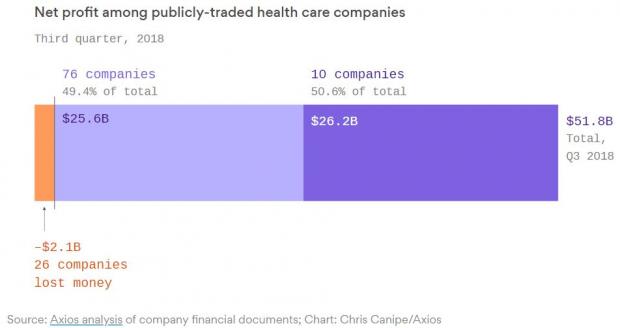

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

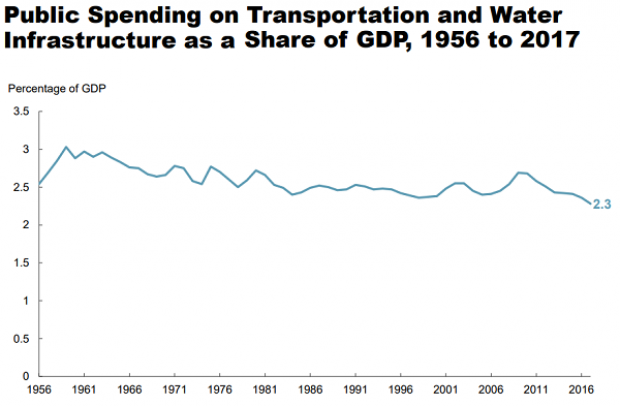

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.