Diamond Prices Are Falling, but Don’t Rush to Buy an Engagement Ring

Diamond prices are getting slashed, but that doesn’t mean you should run out to the jewelry store right now.

De Beers, the world’s largest producer and distributor of diamonds by value, is cutting diamond prices by as much as 9 percent, according to Bloomberg.

Diamond prices have already slumped over the past year as demand has fallen, partly as a result of the economic slowdown in China, the second-biggest market for the precious stones.

Related: Can Gold Regain Its Shine?

De Beers, which is a unit of mining giant Anglo American and controls one-third of the global diamond market, initially tried to stabilize prices by ramping down its production. It had started the year with a production goal of 34 million carats, but has twice slashed the goal to a current 29 million to 31 million carats.

That hasn’t been enough to counterbalance sagging demand, so De Beers says it will invest in a holiday marketing campaign in an attempt to boost consumer interest. The campaign will be focused in the U.S. and China, the world’s two leading diamond markets, and will primarily target men buying diamond jewelry gifts for their partners.

In other words, you can expect to see a whole lot of diamond commercials soon — and in an interview with The Fiscal Times, one diamond industry expert predicted that the industry’s struggles will lead at least some retailers to cut prices this holiday season.

Related: Putin’s Spokesman Wears a Golden Skull Watch Worth $620K

The De Beers price cuts probably won’t have much effect on prices at high-end jewelry retailers such as Tiffany’s, though. These stores only purchase gems from a limited number of producers and since the diamonds they use are higher in value, their prices aren’t as vulnerable to market pressures as less valuable stones.

But it never hurts to look, right?

Top Reads from The Fiscal Times:

- Why You Should Ignore the Stock Market Sell-Off

- The 10 Worst States for Property Taxes

- The Best Things to Charge on Your Credit Card

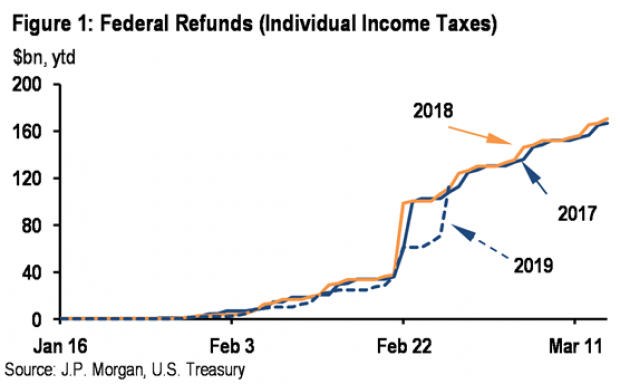

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

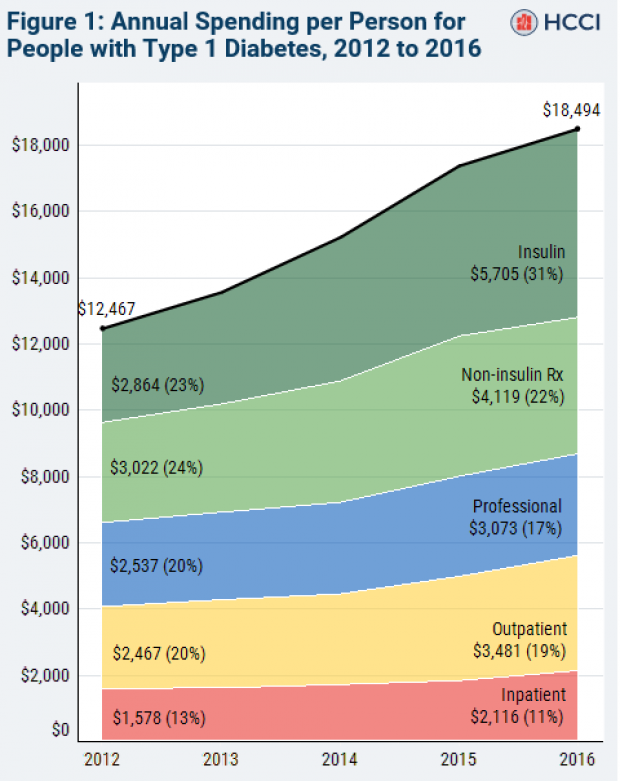

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

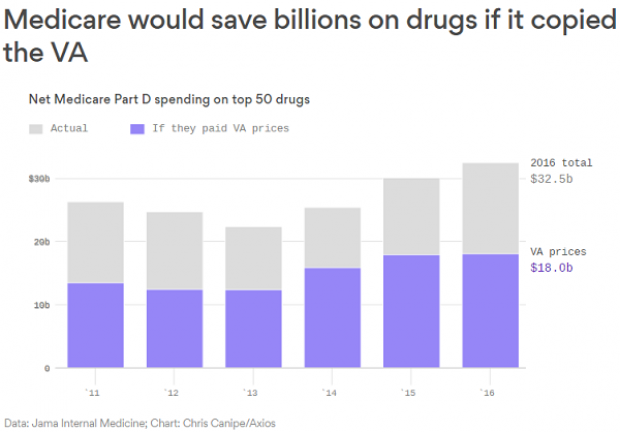

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.