Americans Are Happier with This Car Brand Than Any Other

Americans may love their cars, but these days they love them a little less.

Consumer satisfaction with their cars has fallen for the third consecutive year, reflecting unhappiness with increasing recalls and rising prices, according to new data from the American Customer Satisfaction Index.

Car reliability has improved overall in the past decade but the number of recalls is at an all-time high. “This should not happen with modern manufacturing technology and has negative consequences for driver safety, costs, and customer satisfaction,” ACSI Chairman and founder Claes Fornell said in a statement.

Car owners in the second quarter of 2015 reported a 40 percent increase in recalls year over year. The most high profile recalls involve Takata airbags, affecting more than 17 million older-model vehicles built by 11 different auto makers.

Related: Senators Urge Recall of All Vehicles with Takata Airbags

Looking at individual brands, the index shows that Americans prefer Japanese and luxury brand cars, with Lexus displacing Mercedes Benz as the brand with the highest overall satisfaction (84 out of 100). Mercedes tied for second place with Acura and Lincoln.

The average for all autos fell 3.7 points to 79. The only American automaker to rank above average was Ford with a score of 81. General Motors and Chrysler saw their scores fall modestly to 79 and 75 respectively.

Despite a growing decline in satisfaction, Americans are holding onto their vehicles longer than ever. The average age of cars and light trucks is now 11.5 years old, according to a report issued last month by IHS Automotive.

Top Reads from the Fiscal Times:

- Big Surprise: Hispanic Voters Can’t Stand Donald Trump

- How a Biden-Warren Ticket Could Transform the Campaign

- Air Force Brushes Off $27 Billion Accounting Error

Trump and Schumer Will Try to Scrap the Debt Ceiling

The president and the Senate Democratic leader agreed to seek out a more permanent debt ceiling solution that would end the perpetual cycle of fiscal standoffs. “There are a lot of good reasons to do that, so certainly that’s something that will be discussed," Trump said Thursday. It might not be easy, though, as conservatives see the borrowing limit as a way to keep government spending in check. Paul Ryan said Thursday he opposes doing away with the debt ceiling.

Is a Fix for Obamacare Taking Shape?

Senators on the Committee on Health, Education, Labor and Pensions heard from governors Thursday in the second of four scheduled hearings on stabilizing Obamacare. The common theme emerging from the testimony was flexibility: "Returning control to the states is prudent policy but also prudent politics," said Utah Gov. Gary Herbert, a Republican. He was joined by Democrat John Hickenlooper of Colorado, who said that states need room to innovate and learn from their mistakes. Much of what the governors said was in line with what the Senate panel is already considering, including the continuation of cost-sharing subsidies to insurance companies. (CBS News, Axios)

Senate Approves Trump's Deal with Dems. Will the House Go Along?

The Senate on Thursday voted to fund the government and increase the federal borrowing limit through December 8 as part of a deal that also included $15.25 billion in hurricane disaster relief funding and a short-term extension of the National Flood Insurance Program. The bill passed by a vote of 80-to-17, with only Republicans voting against the bill.

The package now goes back to the House, where it likely faces more strenuous resistance. The Republican Study Committee, a conservative caucus with more than 155 members, on Thursday announced it opposed the deal because it does not include spending cuts. Rep. Mark Walker, the group's chairman, sent a letter to House Speaker Paul Ryan listing 19 policy changes to "address the growing debt burden" or "begin draining the swamp" that could win conservative support for raising the debt ceiling. Some Democrats may also vote against the deal to signal their frustration with an agreement that they say weakened their hand in trying to protect undocumented immigrants who were brought into the country as children.

White House Backs Off Shutdown Threat…for Now

“Believe me, if we have to close down our government, we’re building that wall,” President Trump said of his planned border wall with Mexico 10 days ago. Just two days later, though, White House officials told Congress that a short-term spending bill to fund the government into December wouldn’t have to include $1.6 billion for the wall, The Washington Post reports.

Trump still wants money for the wall to be included in a December budget bill, and he could follow through on his shutdown threat at that point. For now, though, an agreement on a “continuing resolution” to keep the government running after September 30 seems likelier, allowing Congress to deal with some of the other pressing issues it faces this month.

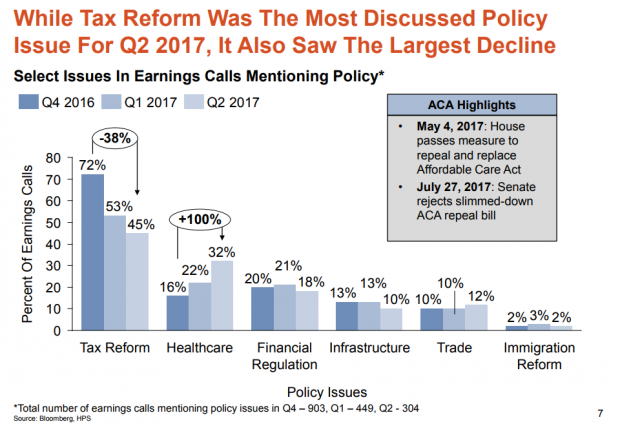

Which Trump Agenda Items Are Companies Talking About With Wall Street?

Hamilton Place Strategies, a public affairs consulting firm, analyzed transcripts of earnings calls by publicly traded U.S. companies over the last three quarters. They found that tax reform was the policy issue companies discussed most on those calls with Wall Street analysts — but that mentions of the subject dropped by 38 percent from the fourth quarter of 2016 to the second quarter of 2017. Overall, the percentage of earnings calls mentioning government or policy issues fell from 41 percent to 16 percent. Health-care reform saw the largest increase.

Does this mean that businesses have given up on tax reform this year? Perhaps. More likely, it's simply the result of a lack of action on the tax overhaul. Hamilton Place notes that mentions of tax policy peaked in February just after the Senate Finance Committee advanced Treasury Secretary Steven Mnuchin's nomination and have spiked after other tax-related announcements. So mentions of tax reform on earnings calls could surge again the fall.

One other note about what businesses have been discussing: Calls mentioning President Trump fell by 84 percent from January to late August.

08312017_HPS_Chart_of_the_day.PNG