Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

Watch Lindsey Graham Destroy His Phone, Get a Bit of Revenge on Donald Trump

What do you do when Donald Trump gives out your cellphone number in a televised campaign rally? South Carolina Sen. Lindsey Graham, a Trump rival for the GOP presidential nomination, made the most of The Donald’s rude move by releasing a video in which he demolishes his phone (more than one, actually) by doing everything short of blowing it up.

Related: 7 Revelations from Donald Trump’s Financial Disclosure

The YouTube video, posted by IJ Review and titled “How to Destroy Your Phone With Sen. Lindsey Graham,” shows the senator smashing a Samsung flip phone in various ways — a golf club, a wooden sword, a cinder block — and also chopping it with a meat cleaver, putting it in a toaster oven with pizza bagels, dropping it in a blender with some Red Bull, lighting it on fire and dropping it from a rooftop.

“Or if all else fails, you can always give your number to The Donald,” Graham says toward the end of the 1:04 clip.

Related: The 2016 Presidential Election Is Already a Dumpster Fire

Graham isn’t exactly a technophile, so maybe he didn’t know he didn’t need to destroy his phone to get a new number (and there are much better ways to get rid of an old phone). More likely, though, the senator found a clever way to take advantage of the attention Trump provided for him and his campaign while also finally upgrading from his flip phone to a smartphone.

Probably getting a new phone. iPhone or Android?

— Lindsey Graham (@LindseyGrahamSC) July 21, 2015

Graham has struggled to make headway in a crowded Republican presidential field, drawing the support of less than 1 percent of registered GOP voters in recent polls. That would leave him off the stage in the Aug. 6 Fox News debate, which is limited to 10 of the 16 candidates. Trump, by the way, is almost assured of a spot. So the senator and his campaign need all the attention they can get — and the new video sure is getting attention. Since it was published to YouTube yesterday, it’s already been viewed more than 1 million times.

McDonald’s McTricks Aren’t Working

Turns out warm buns aren’t the solution to McDonald’s financial woes.

The burger giant announced Thursday that its sales slide continued in the second quarter, with same store sales falling 0.7 percent globally and by 2 percent in the U.S. Quarterly revenues dropped 10 percent to $6.5 billion, though without currency effects from a strong dollar they would have climbed 1 percent.

The results were good enough to top Wall Street’s expectations, but they showed again just how far McDonald’s has to go to win back customers.

Related: The 11 Worst Fast Food Restaurants in America

The fast food chain blamed the admittedly “disappointing” results on the failure of its products and promotions to draw customers to its stores as anticipated.

New CEO Steve Easterbrook, who took over in March, has promised to revamp the restaurant chain and improve sales by catering to consumers who prefer fresh, high quality food.

McDonald’s continues to try a variety of promotions and menu changes to win back diners. It recently started offering a double cheeseburger and fries for $2.50 as a summer deal and rolled out an “artisan grilled chicken sandwich.” It has also, among other things, enlarged its quarter pounder, tested a new breakfast bowl full of kale, rolled out flavored hot coffee in some locations and even tested a lobster roll in New England restaurants. And it upped the toasting time for its hamburger buns by 5 seconds.

So far, though, the new deals and menu options have failed to entice diners.

Related: 9 Ways McDonald’s Wants to Get You Excited About Its Food Again

Easterbrook did acknowledge that changing McDonalds’ image would take time, but he said Thursday that the company is “seeing early signs of momentum.”

The company will begin to offer all-day breakfast, which already accounts for 25 percent of the company’s sales. And it is continuing to simplify its menu options to lower costs.

Analysts wonder if such changes will be enough to boost consumer appetites for McDonald’s and how the company is going to reposition its brand. As Thursday earnings report made clear, introducing a younger, hip hamburglar isn’t going to cut it.

Why Shark Attacks Have a Silver Lining

While recent headlines about the above average number of shark attacks in the U.S. this year may have rethinking your summer vacation, the incidents could be good news for the ocean’s ecosystem.

Conservation measures implemented to prevent the decline of great white sharks are paying off, scientists have found. The global population of great whites has been in recovery since 1990.

One of the key components in this environmental success story is the passage of the Marine Mammal Protection Act in 1972. With the legislation, seal and sea lion populations began to rebound along the West Coast. Great white sharks eat both seals and sea lions and having more food available most likely boosted their comeback.

A healthy shark population makes for a more balanced ecosystem, leading to healthier oceans that support all lives, both human and non-human. Oceans produce over half of the oxygen in the atmosphere and absorb the majority of carbon in it.

The increase in the number of sharks suggests that some of the damage humans have caused in the oceans has been reversed. However, it will take a while for sharks to rebuild their populations completely. It takes sharks at least eight years to reach a reproductive age and gestation periods can last 18 months.

Even though “Sharknado: Oh Hell No!” is getting awful reviews this week, everyone should applaud this other bit of shark-related news.

Teens Are Having Much Less Sex Than Their Parents Did at That Age

Adolescents may be thinking about sex all the time, but fewer teens are actually doing the deed. Since 1988, sex has dropped by 14 percent among teenage females (ages 15 to 19) and 22 percent among teenage males (ages 15 to 19). The latest study from the U.S. Centers for Disease Control and Prevention’s National Center for Health Statistics shows that 44 percent of female teenagers and 47 percent of male teenagers had experienced sexual intercourse at least once.

Related: The App-Selling Power of Kate Upton’s Cleavage

The good news? The majority of them used contraception. From 2011 to 2013, 79 percent of female teenagers and 84 percent of male teenagers used contraception the first time they had sexual intercourse. Condoms were the most widely used method of contraception among teenage girls, followed by withdrawal (60 percent) and the pill (54 percent). Use of the emergency “Plan B” or “morning after pill” came in fourth, reaching 22 percent in 2013, and up from 8 percent in 2002.

About 70 percent of 15- to 19-year-old females said their first sexual intercourse happened with a steady dating partner, compared to about 50 percent of 15- to 19-year-old males.

Could all that sex education be working? Are teenagers watching more porn? Do teens have more access to contraception because of Obamacare? Then again, it could be all those episodes of reality TV they’re watching. Last year CNN reported a study from the National Bureau of Economic Research that linked watching MTV’s 16 and Pregnant and Teen Mom to a 5.7 percent reduction in teen births in the U.S. The study found a correlation between higher rates of viewership in certain areas with a bigger decrease in teen births.

Related: Schools Gamble on Gut-Punch Anti-Drug Programs for Teens

Despite teen births being at an all-time low, the U.S. still leads other developed countries in teen pregnancy. (New Zealand comes in second, followed by England and Wales.) And if parents are worried their teens won’t ever get off their iPhones long enough to have sex, they can relax. Most teens, or two-thirds of adolescents, will have sex by the time they’re 19.

Here’s a Good Sign for the Economy: Americans Are Hitting the Road

Driving is as American as apple pie, but the Great Recession took a big bite out of the nation’s driving habits. Total miles driven in the U.S. hit a peak in the fall of 2007 just before the recession hit and fell for several years after. Total miles driven bottomed out in 2011, moving slowly higher since then.

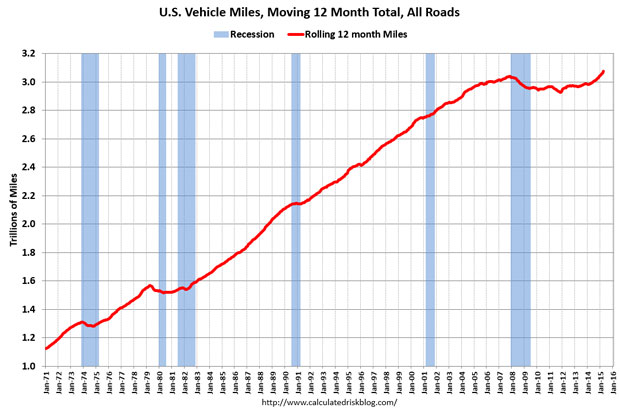

The Department of Transportation reported this week that total miles driven has hit a new, all-time high. Vehicles drove 7.3 billion miles in May, up 2.7 percent from May, 2014. The annual number is even more impressive: Using a moving 12-month figure, total miles traveled in the past year registers at 3.08 trillion miles. This graph from Calculated Risk paints the picture:

This sure seems like good news for the U.S. economy. The data for miles driven reflects booms and busts in the economy, and seeing the numbers climb suggests the economy is still gaining strength.

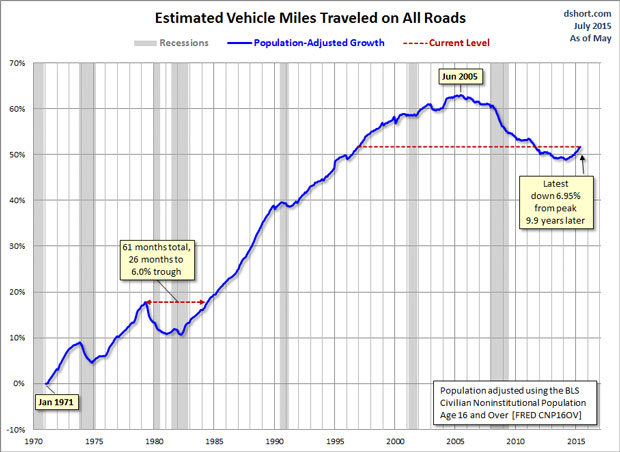

However, the raw numbers may not be quite as good as they first appear. Even though miles driven are up, so is the U.S. population. Once the data is adjusted for population growth, a less robust picture emerges. Doug Short at Advisor Perspectives ran the numbers, concluding that on a per capita basis, miles driven is still well below its pre-recession peak. Here’s his chart:

It looks like the U.S. economy still has a long way to go to get back to its pre-recession strength, at least as measured by by the rough proxy of total miles driven.