Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

The Best and Worst States for Student Debt

Where you go to college and what major you pick can have huge financial consequences, but where you live after graduating can also have a big impact on how much your diploma is worth — and how well you can handle your student debt.

How likely are you to land a good paying job? How high will your living expenses be? The answers to those questions and others like them go a long way to determining how burdensome those monthly student loans payments are.

Related: The Best Investment the U.S. Could Make—Affordable Higher Education

To ensure your loan doesn’t break you, experts suggest that your payment should not exceed 8 to 10 percent of your monthly income.

Unsurprisingly, the personal finance website WalletHub says, “Student-loan borrowers will fare better in states that produce a combination of lower college-related debt levels, stronger economies and higher incomes.”

To find those states, WalletHub looked at seven metrics, with special emphasis given to student debt as a percentage of average income, the local unemployment rate for people aged 25 to 34 and the percentage of borrowers aged 50 or older. Here are the 10 best and worst states for student debt. You can click on your state on the map below to see where it ranks.

Related: Private Student Loans: Everything You Need to Know

10 Best States for Student Debt

- Utah

- Wyoming

- North Dakota

- Washington

- Nebraska

- Virginia

- Wisconsin

- Minnesota

- Colorado

- South Dakota

10 Worst States for Student Debt

- Mississippi

- Rhode Island

- Connecticut

- Maine

- Georgia

- South Carolina

- New York

- Alabama

- West Virginia

- Oregon

Top Reads from The Fiscal Times:

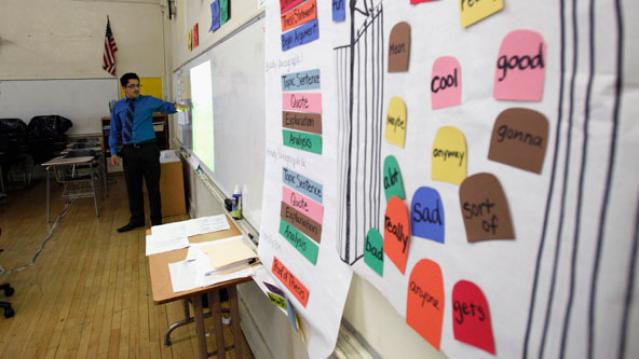

Why We’re Wasting Billions on Teacher Development

School districts spend an average $18,000 per year on teacher development, and teachers devote about 10 percent of their time to professional learning, but a new report finds that such programs may not be producing any measurable results.

The report, released today by TNTP, a nonprofit aimed at addressing educational equality, finds even with development programs, teachers do not show much improvement year over year, and the performance for the vast majority (70 percent) remained constant or declined over the past two to three years.

The report’s authors believe the lack of improvement stems from low expectations for teacher development and performance, and they suggest that schools need to rethink completely the ways that they measure teacher performance and the way they conduct student development.

Related: The Education Department Is Failing Students Who Got Defrauded

The study evaluated information on more than 10,000 teachers at three large school districts and a charter network covering nearly 400,000 students.

The authors report that teachers who do show improvement do not appear to be the result of deliberate, systemic efforts, and show no clear patterns that could improve development for others. “The absence of common threads challenges us to confront the true nature of the problem,” they write. “That as much as we wish we knew how to help all teachers improve, we do not.”

Rather than offer specific solutions, the authors suggest that schools redefine professional development, re-evaluate professional learning programs, and reinvent the ways they support teachers.

Top Reads from The Fiscal Times:

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- The 2016 Presidential Election Is Already a Dumpster Fire

- You’re Richer Than You Think. Really.

Happy Watermelon Day! 16 Sweet, Juicy Facts You Didn’t Know

Frida Kahlo painted them and poets have celebrated them. In his “Ode to the Watermelon,” Pablo Neruda described it as “a fruit from the thirst-tree” and “the green whale of the summer.” He wrote: “its hemispheres open/showing a flag/green, white, red,/ that dissolves into/wild rivers, sugar, delight!” Abundant in summer, watermelons are by their very nature sweet and heavy, plus they’re full of vitamins: A, B6, and C. Aug. 3 is National Watermelon Day. We celebrate it here with 16 fun facts.

Related: Born in the USA: 24 Iconic American Foods

- Watermelons are 92 percent water.

- The word “watermelon” first appeared in English dictionaries in 1615, according to John Mariani’s The Dictionary of American Food and Drink.

- Watermelons are related to pumpkins, as well as cucumbers and squash.

- The world’s largest watermelon was grown by Lloyd Bright of Arkadelphia, Arkansas in 2005 and weighed 268.8 pounds, according to the Guinness Book of World Records.

- Watermelons originated in southern Africa.

- They appear in Egyptian hieroglyphics nearly 5,000 years ago. Watermelon seeds were found in the tomb of King Tut.

- Early explorers carried watermelons on long trips as a source of water, like canteens.

- Watermelons are both fruits and vegetables.

- China is the largest producer of watermelons in the world today, followed by Turkey and Iran.

- The U.S. currently ranks fifth in watermelon production worldwide. Georgia, Florida, Texas, California and Arizona are the states that grow the most watermelon.

- On April 17, 2007, the Oklahoma State Senate passed a bill declaring watermelon as the official state vegetable.

- Over 1,200 varieties of watermelon are grown in 100 countries across the world.

- Watermelons were introduced to the New World by European colonists and African slaves. Spanish settlers started growing watermelon in Florida in 1576.

- One cup of watermelon has more lycopene, a pigment with antioxidant effects, than a large fresh tomato.

- You can eat the seeds. And the rind. Here’s a recipe for pickled watermelon rind.

- Are your muscles feeling sore? Have some watermelon before your next workout. The juice contains L-citrulline, which the body converts to L-arginine, an amino acid that helps relax blood vessels and improves circulation.

Top Reads from The Fiscal Times:

- 16 Companies Taking Some ‘Junk’ Out of Their Food

- Here’s Why Americans Are Keeping Their Cars Longer than Ever

- Amazon’s Prime Concern—A New Online Blitz by Walmart

Why Believing Donald Trump Will Be the GOP Nominee Is Delusional

Despite his commanding lead at this early stage among GOP candidates, the 2016 nomination is anyone’s game.

It is risky to put too much stock in the latest findings, including the NBC/Wall Street Journal poll released Sunday. That’s because the national telephone survey of 1,000 adults included only 252 registered voters who said they would vote for a Republican, and the poll has a margin of error of plus or minus 6.17 points.

Related: Why Jeb Bush’s Pragmatic Immigration Plan Has No Chance of Passing in the House

There are plenty of downsides to Trump’s candidacy – including his threat to mount a third-party campaign if he is denied the Republican nomination -- which has alarmed GOP leaders who are looking down the road to the general election.

Trump has the highest negatives of any of the top tier candidates, and a majority of Americans in the survey said they think Trump is hurting the Republican Party. Not surprisingly, the vast majority of Democrats interviewed said Trump was harming his party’s image, but nearly half the Republicans interviewed said the same thing.

Political analyst Nate Silver notes that Trump ranks just 13th in overall favorability among Republicans in a series of national polls. “If you’re going to imply that a candidate is popular based on their receiving 20 percent of the vote, you ought to consider what the other 80 percent thinks about him,” Silver wrote recently in his FiveThirtyEight blog. “Most Republicans who don’t plan to vote for Trump are skeptical of him instead.”

Related: Donald Trump Just Showed Why His Campaign Is Doomed

What’s more, about three in four Latinos said they have a negative view of Trump – and that more than half consider his comments about lawless Mexican immigrants to be racist or highly inappropriate, according to a separate NBC News/Wall Street Journal Telemundo poll released today.

The survey of 250 Hispanic-American voters revealed widespread hostility towards Trump, with only 13 percent saying they have a positive view of him.

The Republican presidential frontrunner has said repeatedly that many Latino voters “love” and support him, and that he would win the majority of that vote if he ends up as his party’s nominee. There is little evidence in this poll to suggest Trump is dealing with reality.

Top Reads from The Fiscal Times:

- Clinton Tries to Change the Narrative with First Two Campaign Ads

- Super PAC or Not-so-Super PAC? The Difference Between Jeb and Bernie

- States Are Finally Overcoming the Fiscal Headwinds

Cruz Won’t be Trumped—Watch Him Cook Bacon on a Machine Gun

Sen. Ted Cruz (TX) has shown an affinity for breakfast foods he did, after all, famously read "Green Eggs and Ham" on the Senate floor. Now, the Texas senator is the latest Republican presidential contender to ham it up in a stunt video released Monday—this time, he separates himself from the pack by cooking bacon with a machine gun.

“Few things I enjoy more than on weekends cooking breakfast with the family. Of course in Texas, we cook bacon a little differently than most folks," Cruz says in a video. Cruz walks the viewer through the rather unique cooking process, including wrapping strips of bacon around the gun’s nozzle and encasing it in aluminum foil to keep in the heat.

Cruz himself fires off several rounds at a gun range. After he’s finished, and gotten grease all over the cement floor, he uses a fork to pick a piece of still sizzling meat off the barrel and eats it.

“Mmm. Machine gun bacon,” the senator says with a smile before chuckling.

The 66-second clip comes roughly two weeks after Sen. Lindsey Graham (R-SC), another White House hopeful, shot his own video where he used a variety of methods to destroy cellphones after he had his phone number given out by GOP frontrunner Donald Trump.

The video is sure to bounce around the web and get people talking about Cruz’s candidacy just as the Republican field gets ready to take the stage for its inaugural debate.

An NBC/Wall Street Journal poll released on Sunday showed the Texas lawmaker taking fifth in the GOP primary race, with 9 percent support. That put him 10 points behind current polling leader Donald Trump. Cruz also trails Wisconsin Gov. Scott Walker, former Florida Gov. Jeb Bush and neurosurgeon Ben Carson, according to the survey, meaning that the bacon stunt can't hurt: His campaign could definitely use more sizzle.

Top Reads from The Fiscal Times:

- Joe Biden: The Looming Threat to a Republican Presidency

- Trump’s Net Worth Isn’t His Only Claim That’s Fake

- Why the Six Candidates Left Out of the GOP Debate Might Be Winners After All