Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

The 15 Most Valuable NFL Teams

The New England Patriots may be reigning Super Bowl champs and have the most successful quarterback-coach pair in NFL history -- Tom Brady and Bill Belichick each have four championship rings with the Pats -- but they’re missing something nevertheless.

As they kick off the season tonight against the Pittsburgh Steelers, the Pats aren’t at the top of the NFL in terms of team value. That title still goes to the Dallas Cowboys, according to an analysis at Forbes.

Related: 10 Big Money NFL Draft Busts

Dallas must be feeling pretty good about beating New England at something. They had the same regular season record as the Patriots last year, with 12 wins and 4 losses, but ended the season with a loss to the Green Bay Packers in the divisional playoffs, while the Pats went on to win Super Bowl XLIX (that’s 49 for all you non-Romans out there).

Even though the Washington Redskins have been playing pretty pathetically for the past decade, they still come in third. Washington’s NFC East rival, the New York Giants, rank fourth at $2.1 billion.

Here are the 15 most valuable NFL teams:

- Dallas Cowboys - $3.2 billion

- New England Patriots - $2.6 billion

- Washington Redskins - $2.4 billion

- New York Giants - $2.1 billion

- Houston Texans - $1.85 billion

- New York Jets - $1.8 billion

- Philadelphia Eagles - $1.75 billion

- Chicago Bears - $1.7 billion

- San Francisco 49ers - $1.6 billion

- Baltimore Ravens - $1.5 billion

- Denver Broncos - $1.45 billion

- Indianapolis Colts - $1.4 billion

- Green Bay Packers - $1.38 billion

- Pittsburgh Steelers - $1.35 billion

- Seattle Seahawks - $1.33 billion

Top Reads from the Fiscal Times:

- After the Fiorina Fiasco, What Insult Will Trump Fling Next?

- $42 Million for 54 Recruits? U.S. Program to Train Syrian Rebels Is a Disaster

- A Military Coup in the U.S.? A Surprising Number of Americans Might Support One

A Military Coup in the U.S.? A Surprising Number of Americans Might Support One

Imagine you’re watching the evening news, kicking back after a long day in the cubicle. Suddenly a breaking news alert flashes across the screen: “Military Coup Overthrows the Government.” What would be your reaction?

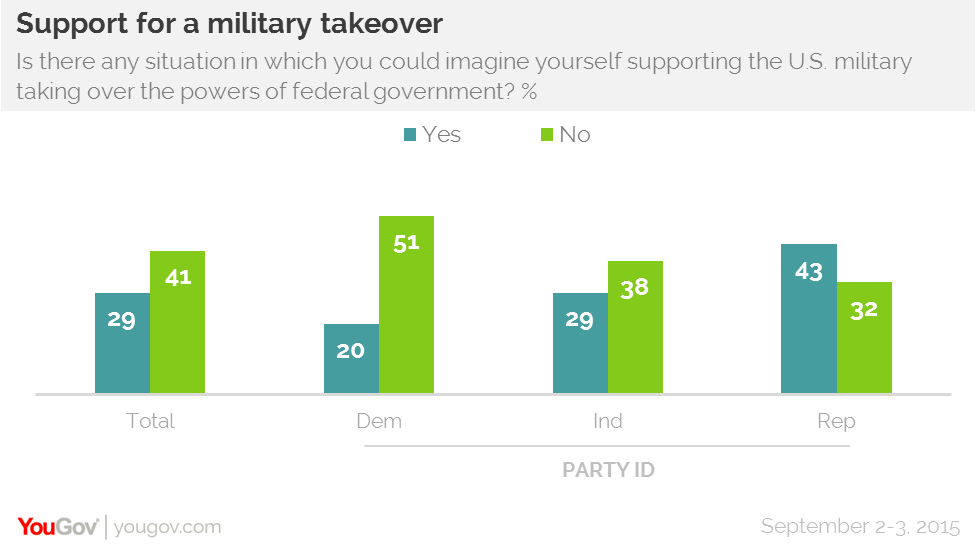

While most Americans say they can’t imagine supporting a takeover of the government by the armed forces, or least aren’t sure about it, a substantial number of people say they can imagine supporting the military in such a scenario.

In a new survey by YouGov, 29 percent of respondents said they can imagine a situation in which they would support the military taking control of the federal government – that translates into over 70 million American adults. Forty-one percent of respondents said could not imagine supporting the military taking over the country.

Related: With $8.5 Trillion Unaccounted for, Why should Congress Increase the Defense Budget?

Republicans (43 percent) were more likely to say they can envision a scenario in which they could support a military coup than Democrats (20 percent). Perhaps that difference is related to having a Democratic president who some critics on the right see as overstepping his power.

Regardless of political ideology, one reason people might support a military coup is because they respect officers in the military far more than they do people in Congress. According to the same YouGov survey, almost three-quarters (70 percent) of respondents believe that military officers want what is best for the country, while only 29 percent think the same of members of Congress.

Lawmakers better shape up or they might be shipped out -- literally.

Top Reads From The Fiscal Times

- A Conservative Rebellion is Brewing on Capitol Hill

- 9 ISIS Weapons That Will Shock You

- There’s Only One Candidate People Actually Like – and It’s Not Trump or Clinton

Sanders Pulls Ahead in Iowa, but a Tougher Clinton Aims to Even the Score

A new poll unveiled Thursday finds populist Bernie Sanders squeezing past Hillary Clinton for the first time as the preferred choice among likely Iowa caucus-goers.

The survey by Quinnipiac University shows the Vermont lawmaker receiving 41 percent, while Clinton garnered 40 percent. The figures put Sanders’ lead well within the poll’s 3.4 percent margin of error, but the numbers serve as another indication of how tight the Democratic primary has become, especially in Iowa where Clinton has long maintained an advantage.

Related: With Trump and Sanders Riding High, How Low Will Bush and Clinton Go?

The poll found another 12 percent of voters would support Vice President Joe Biden, who has yet to decide if he will enter the 2016 race. Former Maryland Governor Martin O’Malley received 3 percent, and the same number were undecided.

While many could view the survey as the latest sign Clinton’s campaign is flailing, the timing of the poll could prove crucial.

The study was conducted between August 27 and September 8. That was the same day the former secretary of State told ABC News that using a personal email account while in office was a mistake and that she is sorry for it.

Related: Hillary’s E-Mail Lapse ... Mistake ... Responsibility ... er, 'Apology'

“I do think I could have and should have done a better job answering questions earlier. I really didn’t perhaps appreciate the need to do that,” Clinton said. “What I had done was allowed, it was above board. But in retrospect, as I look back at it now, even though it was allowed, I should have used two accounts. One for personal, one for work-related emails. That was a mistake. I’m sorry about that. I take responsibility.”

The interview marked the first time she apologized for her unique email arrangement. Questions over Clinton’s use of a private server have dogged her candidacy since she entered the White House race earlier this year.

Republicans have used the controversy surrounding the server to paint Clinton as untrustworthy and unfit to serve in the White House.

Related: Clinton: Trump Is Bad for American Politics

Indeed, Thursday’s poll found that while Clinton is still liked among Democratic voters who believe she would make a good leader, Sanders fares better on the question of trustworthiness.

The Quinnipiac poll also closed before Clinton gave a muscular foreign policy speech at the Brookings Institution on, among other things, the Iran nuclear deal.

“We should anticipate that Iran will test the next president,” she said. “They'll want to see how far they can bend the rules.”

“That won't work if I'm in the White House. I'll hold the line against Iranian noncompliance,” Clinton added.

On the softer side of things, Clinton’s interview on “The Ellen DeGeneres Show” will air Thursday afternoon. The appearance will give her a chance to connect with female voters who are the backbone of her support.

Taken together, the various actions could put Clinton back atop the polls, at least in Iowa, and help her gain back ground she lost to Sanders in New Hampshire as well.

Top Reads From The Fiscal Times:

- House GOP Scores a Major Win in Obamacare Legal Challenge

- Hillary’s E-Mail Lapse ... Mistake ... Responsibility ... er, 'Apology'

- How Can You Tell There Are Russian Troops in Syria? Just Look for Some Soldier Selfies

College Students Say They’re Good with Money. Do You Believe Them?

A new study confirms it: College students think they know everything, at least when it comes to personal finance.

Nearly 60 percent of college students said that they had good or excellent financial literacy skills, according to a study released today by the American Institute of CPAs.

Despite that confidence, less than half of students say they stick to a monthly budget, nearly 40 percent had borrowed money from friends or family and more than 10 percent had missed a bill payment.

Of those surveyed, 99 percent said that personal financial management skills were important, but only a quarter said they seek out information on personal finance and incorporate it into their spending and saving habits.

“For many students, college is their first time making financial decisions,” Ernie Almonte, chairman of the AICPA’s Financial Literacy Commission said in a statement. “With this opportunity comes serious responsibility, and if they aren’t making informed, intelligent decisions it can have a negative impact on the rest of their financial lives.”

College students without a strong foundation in personal finance are more likely to take on risky debt or make poor saving decisions. But most students aren’t getting the education they need before they get to campus.

Just 17 states require high school students take a personal finance course, and only six require testing of personal finance concepts, according to the Council for Economic Education. Three out of four American teens can’t even make sense of a paystub.

But hey, at least they’re confident.

Top Reads from The Fiscal Times:

- House GOP Scores a Major Win in Obamacare Legal Challenge

- Hillary’s E-Mail Lapse ... Mistake ... Responsibility ... er, 'Apology'

- How Can You Tell There Are Russian Troops in Syria? Just Look for Some Soldier Selfies

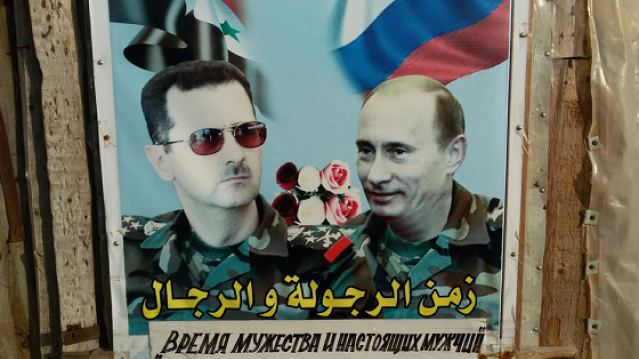

How Can You Tell There Are Russian Troops in Syria? Just Look for Some Soldier Selfies

Although Russian President Vladimir Putin has denied that he is sending troops to Syria, selfies taken by Russian soldiers and posted on social media are telling a different story.

Russian investigative journalist Ruslan Leviev reports that an increasing number of experienced Russian troops have been deployed to a naval maintenance facility in Tartus, along Syria’s Mediterranean coast. His source? Status updates and photos posted on Russia’s two biggest social networking sites by members of the 810th marine brigade, an infantry force in the Russian navy.

Related: As Putin Targets Dissent, U.S. Democracy Group Banned in Russia

One photo Leviev found is of a career soldier named Mazhnikov, who appears to be at the naval facility in Syria. Another soldier, Anatoly Golota, also a member of the 810th brigade, updated his status on the Russian version of Facebook with the words, “Off to Syria :)).”

Russia has not denied that it’s been supplying weapons to the Syrian government and helping train the Syrian military. But Putin knows that combat troops are a different story.

The naval maintenance facility at Tartus is small, and in the past has been manned by just a handful of personnel. Leviev reports that the number of troops stationed at the facility is growing, and the troops are experienced contract soldiers, not draftees.

Videos uploaded to social media sites have raised concerns that Russian troops might be involved in combat inside Syria, according to an article in Foreign Policy. However, beyond the footage, which shows a Russian-made BTR-82A armored vehicle firing its gun in Syria, no other substantial evidence of active combat involving Russian troops has been found.

While the marines may or may not be directly involved in the fighting, the presence of Russian troops in Syria shows how hard Putin is pressing for a victory by the Assad regime. Now if he can just teach his soldiers how to avoid giving themselves away on social media.

Top Reads From The Fiscal Times

- Putin’s Economy May Be in Even Worse Shape Than It Looks

- China Sends a Message with Its New ‘Carrier Killer Missile

- In Showing Off Physical Strength, Putin Tries to Hide Political Weaknesses