You Won’t Believe How Much Diabetes is Costing the U.S.

The budget-busting price of Sovaldi, a drug used to treat hepatitis C has generated wave after wave of media attention, but it’s far from the only drug creating cost problems for patients and insurers.

As Michelle Andrews of Kaiser Health News points out, diabetes affects 29 million Americans, or 10 times as many people as hepatitis C, and the costs of treating it have been rising quickly. And because it’s a chronic condition, people require lifetime care.

Related: Diabetes Detection Up in Pro-Obamacare States

In 2011, the average annual health spending for individuals with diabetes was $14,093. Two years later, it had risen to $14,999, according to the Healthcare Cost Institute. In contrast, a person without diabetes spent about $10,000 less in medical costs in 2013. Pharmacy provider Express Scripts said earlier this year that 2014 marked the fourth year in a row that medication used to treat diabetes were the most expensive of any traditional drug class.

In all, diabetes costs totaled an estimated $245 billion in 2012, including both direct medical expenses and indirect costs from disability and lost work productivity.

While some of the most popular diabetes drugs aren’t particularly expensive, the new brand-name drugs that are continually being introduced offer more effective treatment and fewer side effects — but also come with a higher price tag. Less than half of the diabetes prescription treatments filled in 2014 were generic.

Nearly a century after its discovery in 1921, insulin is still a common form of treatment for the millions of people with type 1 diabetes, yet there is still no generic form available. Patent protection has been extended in some cases due to improvements in existing formulations. Once those patents expire, Andrews notes, biologically similar drugs could replace them and reduce the price by up to 40 percent.

Related: This Disease Hikes Health Care Costs By More than $10,000 a Year

The financial ramifications of diabetes don’t just stem from the cost of drugs or medical treatment — it’s also been proven that people with diabetes have a high-school dropout rate that is six percentage points higher than those without the disease, according to a Health Affairs study. In addition, young adults with diabetes are four to six percentage points less likely to attend college than those without the disease.

Diabetes also contributes to lower employment and wages. On average, a person with diabetes earns $160,000 less over the course of their lives than people who don’t develop the disease. By age 30, a person with diabetes is 10 percent less likely to be employed.

So even if it’s not generating as many headlines as hepatitis C at any given point in time, the costs of diabetes can’t be ignored.

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Two-Thirds of Americans Believe Social Security Is in a Crisis State

- Why McDonald’s Could Suddenly Be Responsible for Millions of New Employees

Fast Cars and Rampaging Dinosaurs Help Universal Shatter Box Office Record

High-speed car chases, dinosaurs run amok and yellow, pill-like creatures helped Universal Pictures bring in more money this year than any other studio in movie history.

Universal announced Wednesday that the studio has grossed $5.53 billion in worldwide box office so far this year, setting an industry record. The Comcast-owned studio has pulled in $3.59 billion internationally and $1.94 billion domestically.

Related: ‘Jurassic World’ set to become fastest film to gross $1 billion

Three global box office hits -- “Furious 7,” “Jurassic World” and “Minions” -- were the most successful films for the studio. “Furious 7” and “Jurassic World” have each brought in over $1 billion already, with “Minions” expected to top $1 billion after its Sept. 13 debut in China. Universal is expected to become the first studio to release three films in one year that each took in over $1 billion.

And there are still some big films slated to be released by Universal before the year is out, including the N.W.A. biopic “Straight Outta Compton,” “Steve Jobs,” and the Tina Fey and Amy Poehler comedy “Sisters.”

20th Century Fox held the previous record for annual box office, grossing $5.52 billion in 2014.

These Women Are Now Earning Almost as Much as Men

That women earn 77 cents for every dollar a man makes has been chronicled and discussed at length, but a new analysis by economists at the Federal Reserve Bank of New York finds a far smaller gap among recent grads.

The country’s youngest (ages 22 to 27) female workers earn roughly 97 cents on the dollar compared to their male peers, when controlling for major and field of employment. For many majors, they actually earn more.

Any early advantage disappears, however, once workers hit mid-career, with men earning 15 percent more than women across the board. Even in majors where women earned more during the early years of their careers, men earn more by age 35.

Related: 10 Worst States for Working Mothers

Researchers point to several potential reasons for the reversal, including possible gender discrimination and women’s tendency to scale back their careers to bear and raise children.

“Because raising a family often requires more flexible schedules, those with family responsibilities who have difficulty satisfying time-sensitive work demands may face lower wages in these types of jobs,” the authors write. “In fact, in jobs where such time demands are largely absent, and more flexibility is possible, the pay gap has been found to be much smaller.”

For some women, that means leaving the workforce entirely. The percentage of women age 25 to 54 who are working has fallen to 69 percent since peaking in 1999 at 74 percent, following a 60-year climb.

Top Reads From The Fiscal Times:

Facebook Patents a Technology That Could Use Your Social Network Against You

All that data Facebook has been gathering on you and your friends could someday be used to approve -- or deny -- your application for a loan.

Facebook was just granted an updated technology patent for “authorization and authentication based on an individual's social network.” This innocent-sounding technology can no doubt be applied in a multitude of ways, many of them benign. But one troubling use of the technology consists of assisting lenders in discriminating against a borrower based on his or her social network connections.

The patent application explains that a lender can use the technology to examine the credit ratings of members of the social network of the individual who is applying for a loan. If the average credit rating of the social network reaches a minimum, pre-defined level, the lender moves forward with the loan process. If the average credit score is too low, the loan application is rejected.

Related: Now Facebook Wants to Know Where You Buy Your Toothpaste

The new technology raises concerns about potential unjust bias, but banks would most likely use it as an additional factor in the loan approval process, not as an end-all metric. The Equal Credit Opportunity Act imposes strict guidelines as to what factors creditors can use when determining whether to approve a loan. It’s unclear if Facebook’s new technology falls under the criteria the federal law defines – things like income, expenses, debt and credit history.

Another fear involves predatory lenders. People rejected for loans through this process would make a nice customer list for unscrupulous financial operators.

Some of the less worrisome uses of the technology include preventing spam email and inappropriate content and improving the accuracy of searches. At this point, it’s not clear how Facebook plans to implement the new technology. Let’s hope the social networking giant stays on the sunny side of the street on this one.

Top Reads from the Fiscal Times:

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

Facebook Patents a Technology That Could Use Your Social Network Against You

All that data Facebook has been gathering on you and your friends could someday be used to approve -- or deny -- your application for a loan.

Facebook was just granted an updated technology patent for “authorization and authentication based on an individual's social network.” This innocent-sounding technology can no doubt be applied in a multitude of ways, many of them benign. But one troubling use of the technology consists of assisting lenders in discriminating against a borrower based on his or her social network connections.

The patent application explains that a lender can use the technology to examine the credit ratings of members of the social network of the individual who is applying for a loan. If the average credit rating of the social network reaches a minimum, pre-defined level, the lender moves forward with the loan process. If the average credit score is too low, the loan application is rejected.

Related: Now Facebook Wants to Know Where You Buy Your Toothpaste

The new technology raises concerns about potential unjust bias, but banks would most likely use it as an additional factor in the loan approval process, not as an end-all metric. The Equal Credit Opportunity Act imposes strict guidelines as to what factors creditors can use when determining whether to approve a loan. It’s unclear if Facebook’s new technology falls under the criteria the federal law defines – things like income, expenses, debt and credit history.

Another fear involves predatory lenders. People rejected for loans through this process would make a nice customer list for unscrupulous financial operators.

Some of the less worrisome uses of the technology include preventing spam email and inappropriate content and improving the accuracy of searches. At this point, it’s not clear how Facebook plans to implement the new technology. Let’s hope the social networking giant stays on the sunny side of the street on this one.

Top Reads from the Fiscal Times:

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

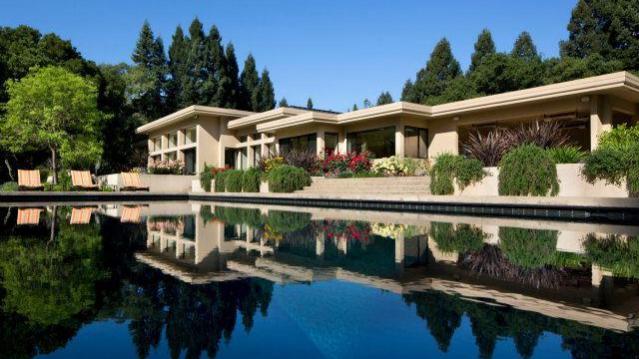

This Is What America’s 'Dream Home' Looks Like

The dream home for today’s American consumer is just over 2,000 square feet and located outside of a major city, according to a report out today by Trulia.

Consumers polled by the real estate Web site said the top features in their dream home were a backyard deck, a gourmet kitchen, and an open floorplan.

Owning a home is still part of the American dream for 70 percent of those polled, down from 77 percent five years ago. The portion of Americans who want to buy a home one day was highest—hitting almost 90 percent—among millennials.

Related: 10 Luxury Home Amenities that Are Trending Up

Those findings echo the results of a Wells Fargo poll in June, which found that nearly two-thirds of consumers say that home ownership is a “dream come true” and an accomplishment to be proud of.

Despite the desire for home ownership, only 14 percent of those surveyed by Trulia said they would buy a home this year. Nearly 70 percent said they planned on waiting at least two years to make a purchase.

The country’s home ownership rate fell to 63.7 percent in the first quarter, the lowest level since 1989. The rate peaked at 69.2 percent in the fourth quarter of 2004, right before the housing bubble burst.

Just 36 percent of millennials who want to buy a home are currently saving to purchase one. As rents in many cities continue to skyrocket, however, homeownership may become more appealing.

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now