You Won’t Believe How Much Diabetes is Costing the U.S.

The budget-busting price of Sovaldi, a drug used to treat hepatitis C has generated wave after wave of media attention, but it’s far from the only drug creating cost problems for patients and insurers.

As Michelle Andrews of Kaiser Health News points out, diabetes affects 29 million Americans, or 10 times as many people as hepatitis C, and the costs of treating it have been rising quickly. And because it’s a chronic condition, people require lifetime care.

Related: Diabetes Detection Up in Pro-Obamacare States

In 2011, the average annual health spending for individuals with diabetes was $14,093. Two years later, it had risen to $14,999, according to the Healthcare Cost Institute. In contrast, a person without diabetes spent about $10,000 less in medical costs in 2013. Pharmacy provider Express Scripts said earlier this year that 2014 marked the fourth year in a row that medication used to treat diabetes were the most expensive of any traditional drug class.

In all, diabetes costs totaled an estimated $245 billion in 2012, including both direct medical expenses and indirect costs from disability and lost work productivity.

While some of the most popular diabetes drugs aren’t particularly expensive, the new brand-name drugs that are continually being introduced offer more effective treatment and fewer side effects — but also come with a higher price tag. Less than half of the diabetes prescription treatments filled in 2014 were generic.

Nearly a century after its discovery in 1921, insulin is still a common form of treatment for the millions of people with type 1 diabetes, yet there is still no generic form available. Patent protection has been extended in some cases due to improvements in existing formulations. Once those patents expire, Andrews notes, biologically similar drugs could replace them and reduce the price by up to 40 percent.

Related: This Disease Hikes Health Care Costs By More than $10,000 a Year

The financial ramifications of diabetes don’t just stem from the cost of drugs or medical treatment — it’s also been proven that people with diabetes have a high-school dropout rate that is six percentage points higher than those without the disease, according to a Health Affairs study. In addition, young adults with diabetes are four to six percentage points less likely to attend college than those without the disease.

Diabetes also contributes to lower employment and wages. On average, a person with diabetes earns $160,000 less over the course of their lives than people who don’t develop the disease. By age 30, a person with diabetes is 10 percent less likely to be employed.

So even if it’s not generating as many headlines as hepatitis C at any given point in time, the costs of diabetes can’t be ignored.

Top Reads From The Fiscal Times

- The 10 Worst States for Property Taxes

- Two-Thirds of Americans Believe Social Security Is in a Crisis State

- Why McDonald’s Could Suddenly Be Responsible for Millions of New Employees

Trump’s Cabinet Would Benefit from Tax Plan Too

“Eliminating the estate tax would save the Trump Cabinet over a billion dollars," Oliver Willis writes. "Like Mnuchin, Trump’s secretaries would make out like bandits. Commerce Secretary Wilbur Ross would get an extra $545 million. The family of Education Secretary Betsy DeVos would rake in $900 million. Linda McMahon, head of the Small Business Administration, and her husband, WWE founder Vince McMahon, would take in $250 million. Trump’s own net worth is in dispute, thanks to his failure to reveal his tax returns, but based on his estimated net worth of $3 billion, the estate tax scheme would net him $564 million.” (Shareblue Media, Bloomberg)

A Liberal Economist Shoots Down the GOP’s Fiscal Chicken Hawks

Republicans want a tax cut, but they don’t want to fully pay for it and may be willing to increase the deficit by $1.5 trillion over 10 years. This would continue a troubling cycle, economist Jared Bernstein writes, in which supposed fiscal conservatives “use the deficit argument to block spending, promote fiscal austerity, and small government, conveniently tossing deficit concerns aside when it comes to tax cuts.”

You’ll hear arguments about how increased economic growth will make up for the budgetary effects of the tax cuts, but don’t believe them. “Our fiscal history on this point is clear: Cutting taxes loses revenues, which, unless offset by higher taxes elsewhere or spending cuts, increases the budget deficit, which in turn raises the debt.” When this happens again, and the promised growth effects don’t materialize, the tax cutters will go back to pushing for spending cuts.

The country faces a number of serious challenges, including an aging population that by itself will require increased government spending, and we need a tax policy that does more than drive up the deficit. “The problem with structural deficits — ones that go up even in good times — is that they reveal that we’re unwilling to raise the necessary revenues to support the government we want and need. This enables those who whose goal is to shrink government to point to deficits and debt as their proof that we can’t afford it, whatever ‘it’ is, except when ‘it’ is tax cuts.” (New York Times)

Health Secretary Tom Price Under Fire for Use of Private Jets

Back in 2009, Tom Price spoke out against House Democrats who wanted to spend $550 million on private jets for lawmakers to use. A Republican representative from Georgia at the time, Price told CNBC that the purchase of the jets was “another example of fiscal irresponsibility run amok.” Now Secretary of Health and Human Services, Price seems to have changed his mind about the virtue of government officials using private jets at taxpayer expense. Just last week, Price used a chartered private jet to travel to three HHS events — including one at a resort in Maine — at an estimated cost of $60,000, Politico reports.

While previous HHS secretaries typically flew commercial, reports indicate that Price has been traveling by private jet for months. “Official travel by the secretary is done in complete accordance with Federal Travel Regulations,” an HHS spokesperson told Politico.

Critics on Twitter have been harsh:

More in-your-face kleptocracy from Tom Price.Take food stamps from poor, hungry kids- spend $25k from taxpayers to charter plane to Philly

— Norman Ornstein (@NormOrnstein) September 20, 2017

1️⃣ Attack Medicaid while trading health stocks.

— Harry Stein (@HarrySteinDC) September 20, 2017

2️⃣ Spend funds that could give someone 4 years of Medicaid coverage to fly a private jet. https://t.co/GO5cfJgWgO

First Mnuchin, now Tom Price. The @realDonaldTrump Cabinet has a big problem charging taxpayers for private flights. https://t.co/th1QbGdfT7

— Ben White (@morningmoneyben) September 20, 2017

Social Security Benefits Due for a Bigger Bump in 2018

In a few weeks the Social Security Administration will announce its cost-of-living adjustment, or COLA, for 2018. Inflation data for the month of August suggests that the adjustment could be the highest in five years, possibly over 2 percent, according to the Washington Examiner. Adjustments for the past five years have been relatively small: The cost of living adjustment for 2017 (announced last October) came in at a modest 0.3 percent, and the adjustment for 2016 was zero. Some retirees have complained in the past about small COLAs, but it’s worth remembering that higher adjustments are driven by higher inflation, which is bad news for people living on fixed incomes.

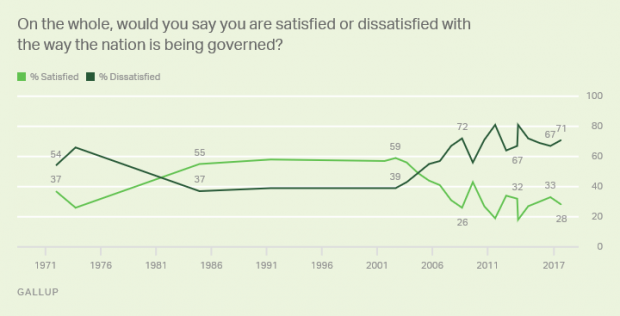

Americans Are Less Satisfied with Government Now Than a Year Ago

Gallup finds that just 28 percent of Americans are satisfied with the way the nation is being governed, down from 33 percent a year ago. And as we approach some potential fiscal battles, it's worth noting that the lowest satisfaction levels since Gallup started updating the measure annually in 2001 came in 2011 (19 percent) after a debt ceiling showdown that led to the U.S. credit rating being downgraded by S&P analysts and in 2013 (18 percent) during a federal government shutdown.