This May Be the Best Frequent Flier Perk Ever

Forget about getting bumped up to first class. Delta Airlines is now bumping its best customers off commercial flights entirely -- and onto private jets.

The program got off the ground last week, according to Bloomberg, with its first flight traveling from Cincinnati to Atlanta.

To be eligible for the upgrade, fliers must have at least 125,000 miles in travel and $15,000 in annual spending with the airline. The bump costs an extra $300 to $800.

In addition to improving the loyalty among some of Delta’s best customers, the program has a side benefit for Delta, allowing it to get some value from positioning flights, known as “empty legs,” which make up about 30 percent of industry flying.

Delta and other airlines have been shifting their loyalty programs in ways that make it easier for elite flyers to earn rewards and more difficult for more irregular customers.

Related: Rethinking airline points strategy with the Points Guy

Starting in June 2016, Delta will issue rewards based on the amount of money spent rather than miles traveled, and the airline may change the number of miles necessary to book a flight based on demand and other factors.

Analysts say that other airlines may follow suit. Airline reward programs have been unsuccessful in fostering loyalty among patrons, many of whom book flights based on cost and convenience rather than brand preference. Only 44 percent of travelers and 40 percent of business travelers fly at least three-quarters of their miles on their preferred airline, reports Deloitte.

Delta’s reward program ranked 9th on U.S. News’ annual ranking of the best airline rewards programs, released this week, receiving 3.1 stars out of 5. Alaska Airlines was ranked first.

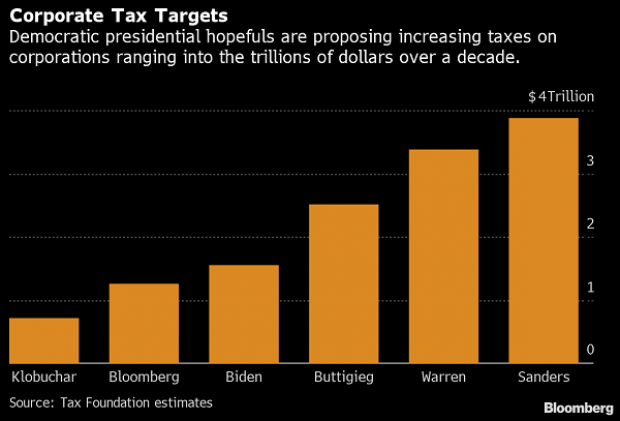

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

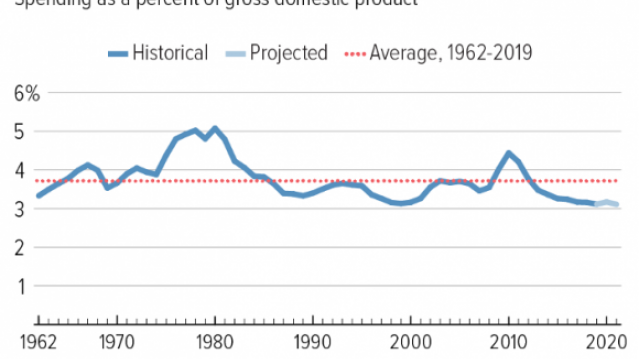

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

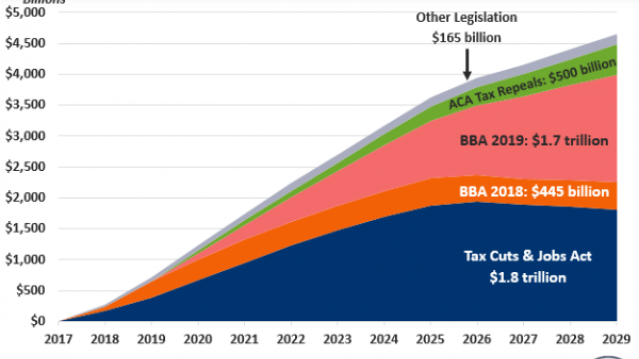

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

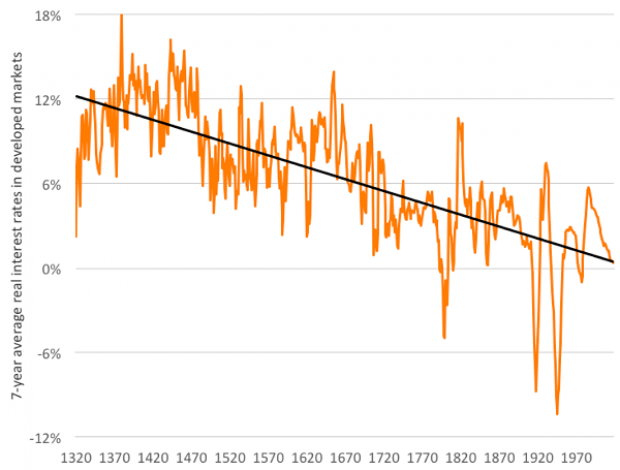

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

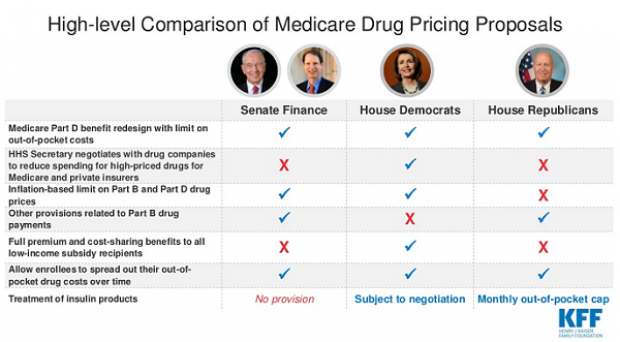

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.