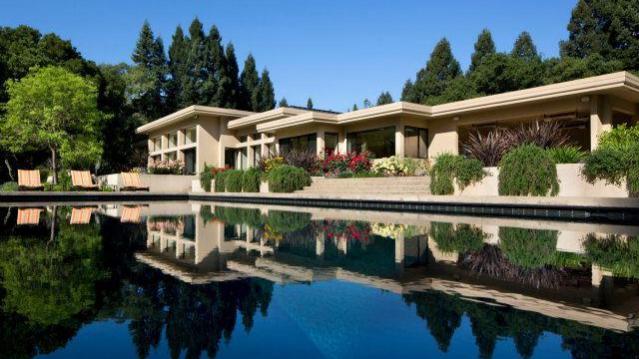

This Is What America’s 'Dream Home' Looks Like

The dream home for today’s American consumer is just over 2,000 square feet and located outside of a major city, according to a report out today by Trulia.

Consumers polled by the real estate Web site said the top features in their dream home were a backyard deck, a gourmet kitchen, and an open floorplan.

Owning a home is still part of the American dream for 70 percent of those polled, down from 77 percent five years ago. The portion of Americans who want to buy a home one day was highest—hitting almost 90 percent—among millennials.

Related: 10 Luxury Home Amenities that Are Trending Up

Those findings echo the results of a Wells Fargo poll in June, which found that nearly two-thirds of consumers say that home ownership is a “dream come true” and an accomplishment to be proud of.

Despite the desire for home ownership, only 14 percent of those surveyed by Trulia said they would buy a home this year. Nearly 70 percent said they planned on waiting at least two years to make a purchase.

The country’s home ownership rate fell to 63.7 percent in the first quarter, the lowest level since 1989. The rate peaked at 69.2 percent in the fourth quarter of 2004, right before the housing bubble burst.

Just 36 percent of millennials who want to buy a home are currently saving to purchase one. As rents in many cities continue to skyrocket, however, homeownership may become more appealing.

- The 10 Fastest-Growing Jobs Right Now

- Teens Are Having Much Less Sex Than Their Parents Did at That Age

- 9 Social Security Tips You Need to Know Right Now

Need a Good Dentist? You Might Want to Head to Mexico

Can you say “dentista?”

Increasingly expensive dental care costs are forcing seniors to bite down hard—and head to Mexico to preserve their pearly whites, the Associated Press reports.

Nearly 70 percent of seniors do not have dental insurance, according to a 2013 Harris Interactive survey commissioned by Oral Health America. Medicare does not cover dental care, and many employers do not offer post-retirement health benefits. You can get dental coverage through the Affordable Care Act, but only if you purchase general health coverage first. (Many seniors already have that coverage.)

Even with coverage, crowns, bridgework, implants and dental surgery can easily exceed the annual limit. As a result, seniors who need extensive dental work may have limited options and could face out-of-pocket costs running into the thousands or tens of thousands of dollars; 23 percent of seniors in the Oral Health America survey said they have not seen a dental provider in five years.

Related: The Hidden Costs of Dental Neglect

Just as people traveled to Canada to buy their prescription drugs at lower cost or traveling the world for other medical services and procedures, more Americans are now flocking to places like Los Algodones, Mexico for dental care. Dental care in Mexico is much cheaper, thanks to lower labor costs and fewer regulatory requirements — factors that you should keep in mind before heading south of the border. The dentists in Mexico maintain that they may not have as much education as their American counterparts, but they spend more time practicing clinical work.

It’s not just people who live in border cities like El Paso, Texas crossing the border to take care of their teeth. The Associated Press reports that shuttle services exist to take dental patients from the Phoenix area to Los Algodones, a 200-mile trip.

Before you book a trip, though, remember that should something go wrong you may not have the same legal recourse as in the U.S., and the dentists may use different types of equipment--so do your research first.

Top Reads from The Fiscal Times:

- America’s 10 Top Selling Medications

- Medicare’s Bold New Move on Knee and Hip Replacements

- 9 Social Security Tips You Need to Know Right Now

Hoping for a Raise? Here’s How Much Most People Are Getting

Nearly all companies plan to give raises to their employees next year, with an average salary bump of 3 percent, the same increase workers received this year, according to a new survey released Monday by Towers Watson.

Raises for executives and management will be 3.1 percent.

“To a large extent, 3 percent pay raises have become the new norm in corporate America,” Sandra McLEllan, North American Practice Leader for Towers Watson said in a statement. “We haven’t seen variation from this level for many years.”

Related: The Real Root of America’s Wage Problem

While the average raise is 3 percent, companies plan to tie the amount of individual raises to worker performance. Employees with the best reviews will receive an average 4.6 percent increase in salary, while workers with below-average ratings will get less than 1 percent.

The survey also found that companies are shifting their compensation packages to include more short-term incentives and bonuses. Eighty-five percent of workers took home a bonus this year, up from 81 percent this year. Nearly 90 percent of exempt employees were eligible for an annual or short-term bonus.

Even as unemployment has finally fallen, wage growth since the Great Recession remains largely stalled. Last month, wages for civilian workers grew just 2.1 percent, according to the Employment Cost Index.

Fed Chair Janet Yellen, who is looking for economic growth before instituting a rate hike, has said that stagnant wages are one factor hampering such growth. After all, consumers can’t increase the amount of goods and services they can purchase if they aren’t increasing their pay.

Top Reads from the Fiscal Times:

- Fiorina Takes on Trump in a Brave Battle of the Sexes

- When Buying Car Insurance, Young Drivers Should Stick with Mom and Dad

- Trump’s Campaign, Leaking Oil, Rumbles Onward

When Buying Car Insurance, Young Drivers Should Stick with Mom and Dad

The parents of young drivers have enough to worry about, but a new study from insuranceQuotes.com finds that those who add coverage for an 18-to-24-year-old can expect to see an average annual premium increase of 80 percent on their existing car insurance. The good news: That’s still cheaper than if the young drivers bought insurance on their own. If those young drivers were to buy individual plans of their own, they’d pay 8 percent more on average — and in some cases, over 50 percent more — than their coverage costs on a parental plan.

Related: The Shocking Secret About How Your Car Insurance Rate Gets Set

Premiums can vary widely depending on the driver’s age and state. An 18-year-old can expect to pay an average of 18 percent more for an individual policy than he or she would if added to an existing policy. But in Rhode Island, an 18-year-old will pay an average of 53 percent more for an individual policy. In Connecticut and Oregon, the difference is 47 percent.

In states such as Arizona, Hawaii, and Illinois, it actually becomes cheaper, on average, for a young driver to get his or her own policy after turning 19. When it comes to determining premiums, Hawaii is the only state that doesn’t allow insurance providers to consider age, gender, or length of driving experience.

These are the five states with the greatest difference in premiums for young drivers buying their own coverage.

1. Rhode Island: 19 percent

2. Connecticut: 16 percent

3. North Carolina: 14 percent

4. Vermont: 14 percent

5. Maine: 14 percent

Related: Now 16-Year-Olds Can Double Your Car Insurance

And these five states have the smallest difference:

1. Hawaii: No difference

2. Illinois: No difference

3. Arizona: 2 percent

4. Mississippi: 5 percent

5. South Carolina: 5 percent.

Top Reads from The Fiscal Times:

- As Politicians Bicker Over Funding, Military Families Cut Back on Vacations

- Why We’re Wasting Billions on Teacher Development

- The Future of War Belongs to the Bots

Vladimir Putin’s Cheesy Act of Defiance

The United States and European Union have been squeezing Russia with sanctions since it annexed Crimea, a territory that previously belonged to Ukraine, in March 2014. In response, Russian President Vladimir Putin established a ban on U.S. and EU foodstuffs a few months later as a snub to the West.

On Thursday, Russia commemorated a tightening of that year-old ban on Western agricultural products by bulldozing bright yellow blocks of cheese. The country also streamrolled fruit and set piles of bacon ablaze. By midday, 28 metric tons of apples and tomatoes from Poland had been demolished, as well as 40 tons of apricots from an unknown country, according to The Wall Street Journal.

Related: Move Over, Santa: Putin Claims the North Pole

The Western sanctions and a plunging ruble have caused Russian food prices to spike this year. Some politicians, religious leaders and other Russian citizens denounced the destruction of the food, noting that millions of Russians are living in poverty. More than 285,000 people signed an online petition that asked Putin to distribute the food rather than destroy it.

The Kremlin has promised to help develop Russia’s own agricultural industries and to promote domestic food products that the middle-class generally ignore in supermarkets in favor of status symbols like French cheese and Italian meat. In addition, the Kremlin announced that any contraband foodstuffs found would be destroyed. Russia’s Agricultural Minister Alexander Tkachyov said on state TV that the quality of Western food products could no longer be guaranteed.

Top Reads from The Fiscal Times:

- Vladimir Putin’s Spokesman Wears a Golden Skull Watch Worth $620K

- The Pentagon’s Next-Generation Budget Busting Bomber

- Born in the USA: 24 Iconic American Foods

This May Be the Best Frequent Flier Perk Ever

Forget about getting bumped up to first class. Delta Airlines is now bumping its best customers off commercial flights entirely -- and onto private jets.

The program got off the ground last week, according to Bloomberg, with its first flight traveling from Cincinnati to Atlanta.

To be eligible for the upgrade, fliers must have at least 125,000 miles in travel and $15,000 in annual spending with the airline. The bump costs an extra $300 to $800.

In addition to improving the loyalty among some of Delta’s best customers, the program has a side benefit for Delta, allowing it to get some value from positioning flights, known as “empty legs,” which make up about 30 percent of industry flying.

Delta and other airlines have been shifting their loyalty programs in ways that make it easier for elite flyers to earn rewards and more difficult for more irregular customers.

Related: Rethinking airline points strategy with the Points Guy

Starting in June 2016, Delta will issue rewards based on the amount of money spent rather than miles traveled, and the airline may change the number of miles necessary to book a flight based on demand and other factors.

Analysts say that other airlines may follow suit. Airline reward programs have been unsuccessful in fostering loyalty among patrons, many of whom book flights based on cost and convenience rather than brand preference. Only 44 percent of travelers and 40 percent of business travelers fly at least three-quarters of their miles on their preferred airline, reports Deloitte.

Delta’s reward program ranked 9th on U.S. News’ annual ranking of the best airline rewards programs, released this week, receiving 3.1 stars out of 5. Alaska Airlines was ranked first.